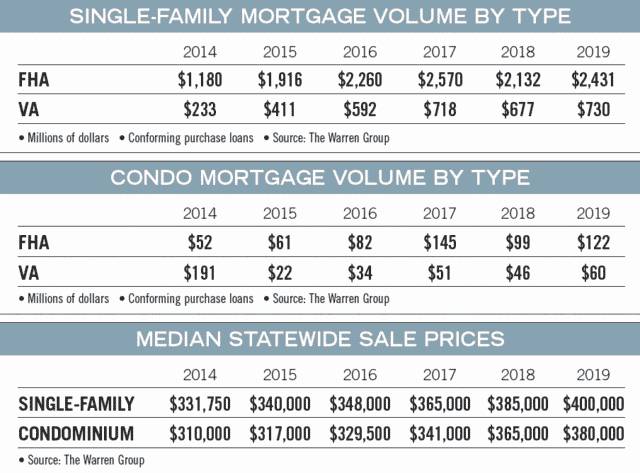

The unexpected drop in interest rates that drove mortgage activity in 2019 could continue in 2020, setting lenders up for a strong purchase market this spring even as the state’s median single-family home sale price hit $400,000 and the median condominium sale price hit $380,000 at the end of last year according to The Warren Group, publisher of Banker & Tradesman.

Despite rising home prices and lagging wage growth, lenders can count on Millennials to be among the borrowers, with more and more becoming first-time homebuyers.

“They had a different view of the American dream – When do you buy a house? Do you buy a house?” said David Lazowski, senior vice president for the New England region at Fairway Independent Mortgage Corp. “Now we’re seeing that generation decide they want to own homes.”

In the face of challenging economic conditions, many Massachusetts Millennials have been able to afford homeownership in part because of down payment assistance. Not only has the conventional expectation of 20 percent down been reduced to as low as 5 percent or less for first-time homebuyers, borrowers can now receive down payment assistance, including from numerous municipal programs and through a loan program offered by MassHousing, that could see someone purchase a home with no money down beyond the closing costs.

Nationally, 38 percent of buyers with FHA mortgages now receive down payment assistance, according to figures from the federal Department of Housing and Urban Development, up from less than 30 percent in 2011.

“What we’re saying is if you have the job stability, if you have the good credit, if you have a little money out of your own pocket, we can get you sustainable homeownership through a MassHousing mortgage product.”

— Mounzer Aylouche, vice president of homeownership programs, MassHousing

Lending a Hand – Not a Handout

A quasi–state agency funded through bonds and securities, MassHousing in March 2018 introduced a down payment assistance program that can be paired with 30-year mortgages that require only a 5 percent down payment.

Partnering with about 150 mortgage companies, community banks and credit unions to originate mortgages, MassHousing provides funding, mortgage insurance and services loans throughout Massachusetts.

MassHousing has provided 2,055 down payment assistance loans totaling $15.8 million in less than two years. This past fall, the program expanded to cover up to 5 percent of the purchase price or $15,000, whichever is less. The loan lasts for 15 years at 2 percent interest.

Mounzer Aylouche, MassHousing’s vice president of homeownership programs, said down payment assistance has removed an obstacle for prospective homebuyers who could not afford to save up 20 percent of a home’s purchase price.

“We took that stigma out. We really eliminated the fact that you need 20 percent down,” Aylouche said. “What we’re saying is if you have the job stability, if you have the good credit, if you have a little money out of your own pocket, we can get you sustainable homeownership through a MassHousing mortgage product.”

Down payment assistance for first-time homebuyers, military veterans and others are helping Massachusetts residents access home ownership even as home prices keep rising.

Delinquency Rate on Par with Industry

As with MassHousing mortgages, borrowers must meet certain income limits, which could differ depending on the county, and credit standards. Homebuyer education courses are also required for MassHousing borrowers.

“We’re not giving money away,” Aylouche said. “Someone has to qualify for it; someone has to basically be able to handle it.”

The delinquency rate on MassHousing’s loans is 3.92 percent, on par with the Mortgage Bankers Association’s most recent national average of 3.96 percent, according to MassHousing. The agency’s foreclosure rate is 0.33 compared to the national rate of 0.87 percent.

The down payment assistance is not just for single-family homes and condominiums. When the program expanded last fall, the purchase of multifamily homes up to four units in Boston and the state’s gateway cities became eligible for down payment assistance.

Aylouche said opening up homeownership to people who thought they would not be able to afford it, especially in an expensive and competitive real estate market, adds value to communities.

“Homeownership builds wealth, stabilizes neighborhoods, establishes good citizens,” Aylouche said. “There’s a tremendous intrinsic value of homeownership that we provide through these mortgage products.”

Easier Process

Fairway Independent Mortgage’s Lazowski, the company’s regional leader, has seen down payment assistance programs, as well as initiatives for veterans, bring Millennials into the marketplace.

“We’re expecting 2020 to be as good if not better than 2019 for first-time homebuyers,” said Lasowski, whose company is a top lender for MassHousing.

He said the market for first-time homebuyers could improve even more in 2020 as the state’s low inventory starts to loosen, including through new developments that have added more condominiums to the market.

Diane McLauglin

Also helping first-time homebuyers is the option to obtain a property inspection waiver through Fannie Mae and Freddie Mac. Lazowski said eliminating the need for an appraisal has saved money for first-time homebuyers and time, since the process can take up to a month.

And 2020’s first-time homebuyers will have a benefit that past borrowers did not experience. Technology has made the process easier for customers, loan originators and operations to retrieve financial, tax and other information need for the loan.

In some cases, the process to originate a loan has been reduced to 18 business days, down from 45 to 60 days in the past, Lazowski said.

“We’re going through a revolution in technology on the operational side,” Lazowski said. “The pieces have been there for many years, and now we’re implementing things that are going to make then process easier for first-time homebuyers.”

|

|