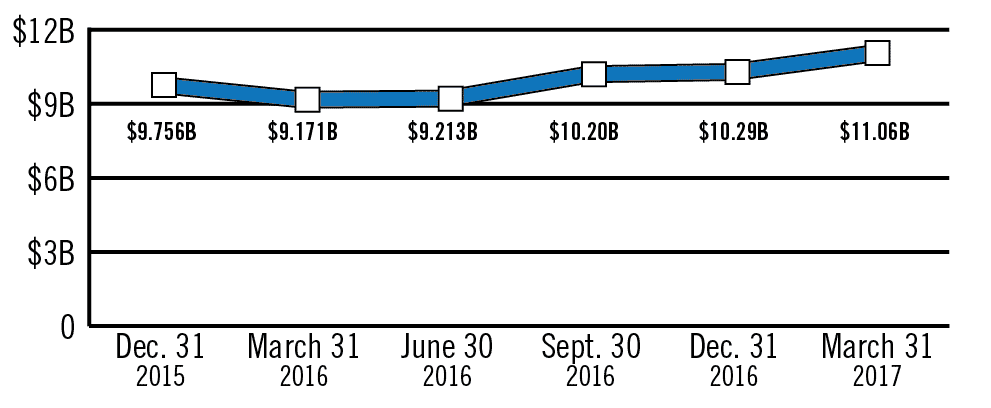

The nation’s biggest banks’ first quarter 2017 results have contained positive results in the net interest income sphere – a continuation of a trend that started in 2016. Bank of America reported a 20.6 percent increase in net interest income over that of fourth-quarter 2016.

With the Federal Reserve’s establishment of a definitive path toward continued interest rate increases, the Massachusetts Division of Banks (DOB) will be assessing its member banks’ interest rate sensitivity as their assets and liabilities mature, requiring decisions on asset and liability strategies going forward.

The DOB “continues to monitor Massachusetts bank’s exposure to rising interest rates through on-site exams as well as off-site surveillance through the review and analysis of quarterly financial data,” said DOB spokesman Chris Goetcheus.

He notes banks do their part through the performance of interest rate risk analysis, whether internally, through a third party, or a combination of the two.

“It is the division’s expectation that institutions measure their exposure to rising rates over short- and long-term time horizons, which affect both their assets (such as loans) and liabilities (deposits),” Goetcheus said.

Reading the economic indicators in this first-quarter 2017 season, one can see a mixed bag indeed. On one side is the play-it-safe with short-term investments camp; on the other is the seeking-safety-in-longer-term investments camp.

While interest rates have moved up since the election, five- and 10-year bond yields have “gone sideways,” said Robert Segal, principal of Bedford-based Atlantic Capital Strategies Inc. The 10-year Treasury bill has hit a record low. And the up-and-down news on the health of consumer loan activity – credit card, auto loans and student loans – indicates that growth in these areas may be selective, impacting the future purchasing power on the consumer side. It’s more likely that sustained growth will come from mortgages and commercial real estate portfolios.

A dramatic portrayal of the move toward long-term assets is portrayed in an FDIC report showing the growth in the number of community banks with 30 percent or more of their assets in long-term instruments. Only two states – Maine and Massachusetts – held this position in 2006. In 2015, nine states did.

Banks that concentrated most of their assets in short-term products in the last eight to 10 years lagged behind their long-term asset peers in income – and income is capital, says Segal.

The Best Rate In Town

Christopher Cole, executive vice president and senior regulatory counsel for the Independent Community Bankers Association, noted that the economic picture will be dependent on forces only beginning to become known as this issue went to press. The advent of a federal fiscal stimulus, he indicates, could change the picture significantly.

Christopher Cole, executive vice president and senior regulatory counsel for the Independent Community Bankers Association, noted that the economic picture will be dependent on forces only beginning to become known as this issue went to press. The advent of a federal fiscal stimulus, he indicates, could change the picture significantly.

Cole said commercial banks have kept their investment portfolios as short as possible and by pricing loans not to go out too far into the future. As for the Northeast, our region wouldn’t be as much at risk from interest rate rise as more commercially volatile regions of the country. Additionally, there’s far less exposure to brokerage deposits, as there was in the 2008 recession.

Cautioning that the prognosis is based on current conditions, Cole said that the comfort level for ICBA members is a 25 basis point increase per quarter this year, with possibly another two such hikes in 2018.

As rates go up, will customers start rate-shopping? Cole thinks that will occur more in the non-bank financial tech sector, which uses wholesale funding and which may face pressure to consolidate as rates rise, hampering their ability to offer competitively lower rates. “Banks don’t have brokeraged deposits that would dry up like that,” he said. “More are in pretty good shape.”

“No one size fits all for consumers,” said Greg McBride, chief financial analyst for Bankrate.com. “Those that rate shop would do so in any [economic] environment.”

A possible risk is that CD deposits could migrate to other investments. However, he notes greater risk aversion on the part of consumers with a high loyalty to their current bank, who may be predisposed to letting deposits sit, despite opportunities for better return elsewhere.

Not only pricing, but flexibility, will be a key attraction in bringing in new deposits and retaining existing customers, said Segal, who has worked with 20 banks located throughout New England and Metro New York.

“Special rates are attractive in bringing in deposits,” he said. “Banks must have products to roll out to protect against deposits leaving.”

Banks seeking ways to look more attractive to regulators have implemented higher-rate CDs already, in the 2 to 2 ¼ percent range, he said, but noted that today’s growth is coming from residential and commercial loans.

Commercial and regional banks are best positioned to take advantage of rising rates to invigorate their income, as opposed to larger banks that draw more on fee income, McBride said: “The best rate in town is at commercial banks, not the big ones.”

|

|