Lenders across Massachusetts saw an uptick in mortgage activity this spring, despite ever-higher home prices, thanks to interest rates that dropped dozens of basis points.

When mortgage lenders began preparing for the spring 2019 season, many did not expect the activity they would end up seeing.

“All the forecasts going into last year were expecting higher mortgage rates,” said Shant Banosian, a senior vice president at Guaranteed Rate. “Lower rates were unexpected, and that fueled the fire a bit.”

Lower interest rates helped drive the Massachusetts spring mortgage season. The volume of mortgages for single-family homes increased by almost $1 billion in the first six months of 2019 compared to the same time period last year. First-time homebuyers and people looking to refinance were among those stepping into the 2019 market.

The average interest rate on a 30-year, fixed-rate mortgage started the year at 4.51 percent, according to Freddie Mac, and finished June at 3.75 percent. The average rate for a 15-year, fixed-rate loan slid from 3.99 percent to 3.18 percent over the same period.

$18 Billion in Mortgages

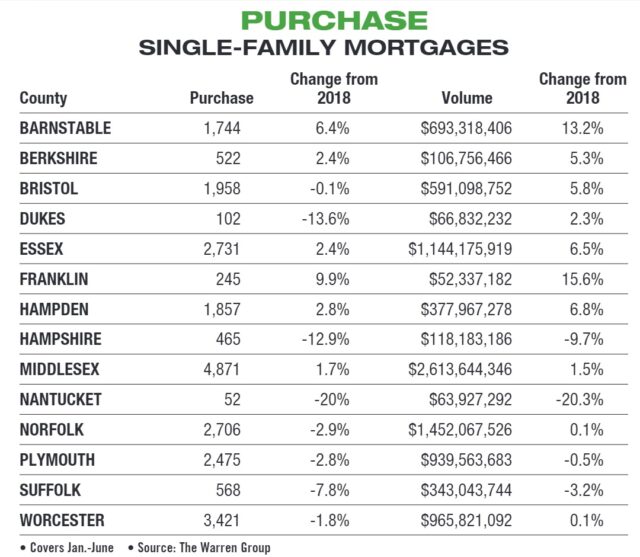

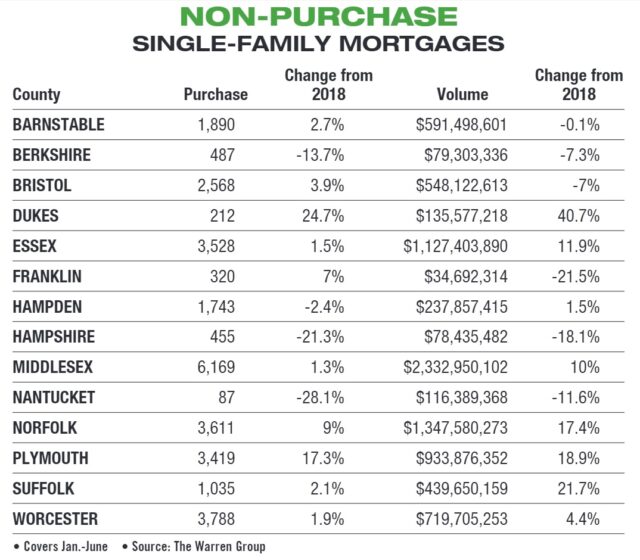

For single-family homes, Massachusetts had $18.25 billion in mortgage activity from January through June 2019, about 5.6 percent more compared to the same time period last year, according to The Warren Group, publisher of Banker & Tradesman. There were about 53,000 single-family mortgages in the first six months of 2019, almost 1,000 more than the same time last year.

Diane McLauglin

Over half the single-family home mortgages involved non-purchase activity, with 29,300 for a total of $8.7 billion. Purchase activity accounted for about 23,700 mortgages and $9.5 billion.

The condominium market also saw increased activity in the first half of 2019, with $4.86 billion in mortgages, about 2 percent more than the first six months of 2018. Roughly two-thirds of this went toward purchase activity. There were about 13,600 condominium mortgages between January and June, including 8,600 purchase mortgages.

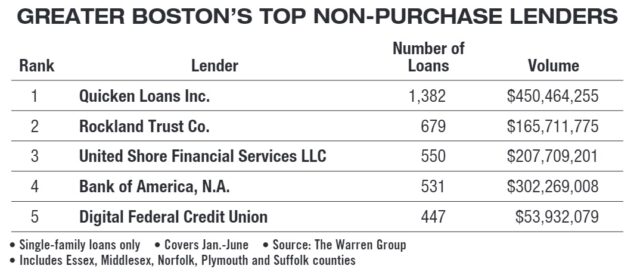

The top lender for single-family homes during the first six months of 2018 and 2019 was Quicken Loans. About three-quarters of Quicken’s 3,000 single-family loans from January through June 2019 were for non-purchase activity.

Lower Rates ‘Leveled the Field’

While Massachusetts has an ongoing housing shortage, Guaranteed Rate’s Banosian saw buyers take advantage of the lower interest rates.

“Homes were more affordable for buyers because of the lower costs,” he said. “It levels the field for buyers.”

With home prices continuing to rise across the Boston area homeowners took the opportunity to cash out equity they had built up in their homes by refinancing.

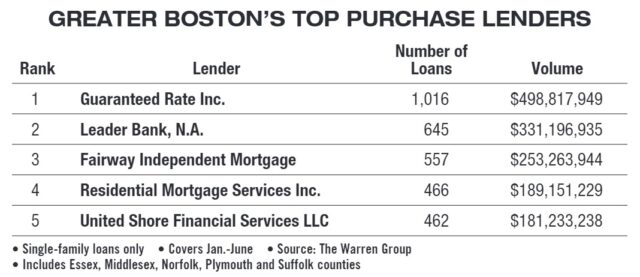

Guaranteed Rate was the top lender for single–family purchase mortgages and second overall for the first six months of 2019. The lender originated about $579.5 million and more than 1,200 purchase mortgages. Including non-purchases, Guaranteed Rate had almost $800 million in mortgage activity through June.

Guaranteed Rate had the most activity in condominium mortgages with $403.9 million and 972 loans. About 78 percent of these were for purchase activity.

Among the busiest areas for single-family homes was MetroWest, Banosian said. Buyers included families moving to the area from other states and countries to work in the technology and biotech industries. Demand for condominiums was strong as well, Banosian said, including in Cambridge and Somerville, despite rising prices.

Banosian said he expects the strong market to continue into next year.

“I think the housing mortgage market is on stronger footing than ever,” he said.

Beyond Route 128

Among the banks offering mortgages, Arlington-based Leader Bank had the highest volume of purchase mortgages and the second highest behind Bank of America for single-family lending, overall. For single-family homes, Leader Bank had $379.87 million in purchase mortgages and $583.86 million in total single-family mortgages.

Leader Bank Executive Vice President Jay Tuli, who oversees retail banking and residential lending, said the bank saw more mortgage lending volume than projected, close to or better than the volume in 2016.

First-time home buyers were well represented among the mortgage-seekers served by Leader Bank this spring. He said anyone looking for a home below $600,000 has to go to areas like Billerica, Reading and Lynnfield. First-time home buyers often don’t fall into the income bracket needed to afford communities within Route 128.

Bob Driscoll, head of mortgage lending division at Rockland Trust, also saw many first-time home buyers. He said this was a good sign for Massachusetts.

“Any vibrant economy, any vibrant housing market, you need a strong first-time home market,” Driscoll said. “We’re excited they’ve made the choice to get into home ownership and use this as part of the wealth-building process.”

Cash-out Refinancing

In the midst of the spring mortgage market, Rockland Trust completed its acquisition of Blue Hills Bank. Driscoll said the bank doubled the number of loan officers compared to 2019 and expanded the mortgage products available to customers.

Among banks, Rockland Trust had the highest number of single-family mortgages with more than 1,200, including 900 non–purchase mortgages, also the highest number in the first six months of 2019.

High home prices and low inventory led some existing homeowners to decide against looking for a new home, Driscoll said. Instead, they did cash-out refinances. People used the extra funds to build additions and make other improvements to their existing homes.

Driscoll said he was excited to see what 2020 would bring to the mortgage industry, adding that the upcoming election could bring volatility to the market.

“It’s strong, it’s vibrant, it’s a fun challenging market right now,” Driscoll said. “We’re fortunate to be part of it.”

|

|