The value of Boston’s taxable real estate rose 78 percent to $164.5 billion between 2013 and 2019, spurred by new growth that accounted for 60 percent of new property tax revenues collected in fiscal 2019.

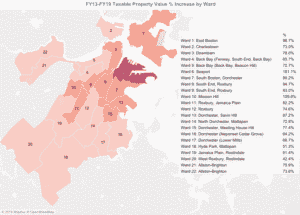

The Seaport District and Mission Hill led all neighborhoods in taxable property value increases over the same period, rising 181 percent and 110 percent respectively, according to a report released today by the Boston Municipal Research Bureau.

Tax revenues from new growth have exceeded increases from existing properties for four consecutive years. In fiscal 2019, new growth accounted for 60 percent of the $134.2 million in additional property tax revenues. The new growth category includes new construction, renovations, exempt properties moving back onto the tax rolls and expiration of tax agreements.

The development boom reflects recent job and wage growth that exceed national averages, as well as a resurgence in urban living that attracted nearly 40,000 new city residents between 2013 and 2017.

With property taxes accounting for 70 percent of the city’s budget, the report warns that Boston shouldn’t become reliant on new growth to pay for services.

“Strong new growth, particularly over the last six years, is not a new normal, but rather a sign of Boston’s recent economic boom,” the report stated. “Boston should keep a close eye on spending to ensure it has the ability to sustain quality city services and infrastructure, including commitments to address challenges around housing, transportation, education and equity, when the current pace of economic development slows.”