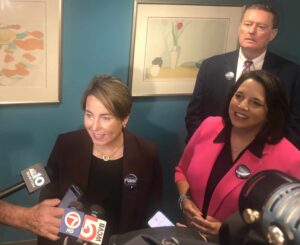

Gov. Maura Healey, Lt. Gov. Kim Driscoll and Secretary of Housing and Livable Communities Secretary Ed Augustus during a press scrum following Healey's signing of the Affordable Homes Act on Aug. 6, 2024. Photo by Steve Adams | Banker & Tradesman Staff

How much new and rehabilitated housing can $5.16 billion buy? We will find out over the next five years, when the results of the new Massachusetts Affordable Homes Act (AHA) become evident.

Enacted in August, the AHA offers a smorgasbord of spending and housing production policies. About $2.5 billion will be made available to the Executive Office of Housing and Livable Communities (EOHLC) for a wide range of initiatives related to housing, including programs supporting disabled individuals, capitalization of the Affordable Housing Trust Fund, climate change mitigation and funding for low-income housing and innovative developments.

The AHA will provide $2 billion to upgrade thousands of state-aided public housing units across the Commonwealth. Another $426 million will be distributed among local housing authorities to promote, create, and renovate affordable housing. The state treasurer is authorized to issue up to $5.16 billion in bonds to pay for these programs.

New tax credits will encourage construction of affordable dwelling units for first-time homebuyers with moderate incomes, and conversions of commercial properties into mixed-use projects. Existing tax credits for community investment corporations and for historic rehabilitation projects are expanded.

The AHA requires EOHLC to use resources wisely. EOHLC may not spend more than 2 percent of authorized funding on administrative costs. It must promulgate guidance and regulations for its programs, and then report its progress to the legislature within 18 months. EOHLC is also charged with delivering comprehensive housing plans every five years, covering supply and demand data, affordability challenges and needs by region and local zoning responses to housing needs. The Legislature and the governor’s office will have the ability to hold EOHLC accountable under the AHA.

A Roadmap for Regulatory Reform

The AHA makes noteworthy changes to the Massachusetts Zoning Act, which governs local zoning laws in every municipality except Boston.

At least one accessory dwelling unit (ADU) will be allowed as of right in single-family zoning districts throughout Massachusetts (but not in Boston), subject to reasonable regulations for site plan review and building dimensions, and restrictions on short-term rentals. Municipalities cannot require owner occupancy of either ADUs or principal dwellings. They can require one additional parking space for each ADU, but not for ADUs located near MBTA stations.

In addition, the AHA amends the Zoning Act to restrict the merger doctrine applicable to undersized lots. Massachusetts courts invoked this doctrine to “merge” contiguous nonconforming lots that would otherwise be buildable lots if separately owned, when such lots come under common ownership.

The merger doctrine rendered such lots non-buildable. Now adjacent lots under common ownership cannot be treated as a single lot under local zoning, if the lots met existing dimensional requirements when established under a subdivision plan, have at least 10,000 square feet of area and 75 feet of frontage, and are located in a zoning district that allows single-family residences.

This amendment will enable home construction on these nonconforming lots. However, single-family homes built on such lots cannot exceed 1,850 square feet of heated living area, must contain at least three bedrooms, and cannot be used as seasonal homes or short-term rentals.

Christopher R. Vaccaro

Abutters Discouraged

Other changes to the Zoning Act are intended to discourage abutters from filing court appeals against developers to delay or block projects.

Those appeals create significant and unpredictable financial problems for developers, and often prevent worthy projects from coming to fruition. Such abutters now must sufficiently allege and plausibly demonstrate, using credible evidence, that specific measurable injury to a private legal interest will likely flow from the zoning decision. This requirement is likely to result in more dismissals of abutters’ appeals.

Also, the maximum amount of appeal bonds that courts may require from abutters was increased from $50,000 to $250,000. Appeal bonds are intended to indemnify and reimburse developers for damages and increased expenses, if the court finds that the harm to the developer or the public interest caused by the appeal, outweighs the financial burden on the abutter.

Courts may require a bond without determining that abutters are acting in bad faith or with malice. Courts may also assess a developer’s reasonable attorneys’ fees against abutters, if they find that abutters acted in bad faith or with malice in making the appeal.

The AHA approaches the Massachusetts housing shortage from many different directions. But in the end, there is only one metric that matters when determining whether the AHA is successful – how many dwelling units are created or rehabilitated in Massachusetts over the next five years. That metric should be easy to determine.

Christopher R. Vaccaro, Esq. is a partner at Dalton & Finegold, LLP in Andover. His email address is cvaccaro@dfllp.com.