Powell: Elevated Inflation Will Likely Delay Rate Cuts

“If higher inflation does persist,” he said, “we can maintain the current level of [interest rates] for as long as needed.”

“If higher inflation does persist,” he said, “we can maintain the current level of [interest rates] for as long as needed.”

Consumer inflation remained persistently high last month, boosted by gas, rents, auto insurance and other items, the government said Wednesday in a report that will likely give pause to the Federal Reserve as it weighs when and by how much to cut interest rates this year

From Wall Street traders to car dealers to home buyers, Americans are eager for the Federal Reserve to start cutting interest rates and lightening the heavy burden on borrowers.

A top Federal Reserve official said this week that he is increasingly confident that inflation will continue falling, but provided few hints of the likely timetable for Fed rate cuts.

In a year full of big numbers, with strong gains for stocks and even more fantastic flights for crypto, it was one shrinking number that superseded all.

“No one statistic can adequately characterize the labor market, since aggregate numbers do not show the wide range of experiences across people, sectors and places,” Susan Collins said.

Federal Reserve Chair Jerome Powell suggested Thursday that the Fed is in no hurry to further raise its benchmark interest rate, given evidence that inflation pressures are continuing to ease at a gradual pace.

The president of the Federal Reserve Bank of Boston believes that inflation still remains too high and that policymakers are keeping an eye on price stability as it plays out over time.

The Federal Reserve left its benchmark interest rate unchanged Wednesday for the second time in its past three meetings, a sign that it’s moderating its fight against inflation as price pressures have eased.

Boston Federal Reserve President and CEO Susan M. Collins is expecting interest rates to remain at restrictive levels, hinting that the Fed may have to further increase key rates, depending on economic data to come.

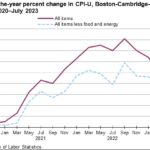

Consumer prices were up 3.2 percent nationally and 2.8 percent locally for the 12-month period ending with July.

The stickiness of inflation could endanger the possibility that the Fed will achieve a rare “soft landing” for the economy.

Gus Faucher, chief economist at PNC Financial Services Group, has thoughts on whether the economy will remain resilient, and whether the Fed can achieve a notoriously difficult “soft landing.”

The Federal Reserve raised its key interest rate Wednesday for the 11th time in 17 months, a streak of hikes that are intended to curb inflation but that also carry the risk of going too far and triggering a recession.

After two years of painfully high prices and over a year of steady interest rate hikes, inflation in the United States has reached its lowest point in more than two years in a sign the Fed’s rate-hike campaign is working.

An inflation index that is closely monitored by the Federal Reserve tumbled last month to its lowest level since April 2021, pulled down by lower gas prices and slower-rising food costs.

Inflation remains “stubbornly high” and is no longer making much progress toward the Federal Reserve’s 2 percent target, a top Fed official said Wednesday, hours after price data for April were released.

The Federal Reserve is getting some unwanted help in its drive to slow the U.S. economy and defeat the worst bout of inflation in four decades: a cutback in bank lending.

Federal Reserve Chairman Jerome Powell appeared to be trying to quell any assumption that the Fed has already decided to raise rates more aggressively based on a recent string of data that pointed to strong economic growth and still-high inflation.

The Federal Reserve could increase the size of its interest rate hikes and raise borrowing costs to higher levels than previously projected if evidence continues to point to a robust economy and persistently high inflation, Chair Jerome Powell said Tuesday in prepared testimony to a Senate panel.