From Boston to Great Barrington, homebuyers looked to the suburbs for more space as the pandemic changed what they wanted in a property.

A year ago, homes were selling well in Massachusetts. On the Cape, the market was “strong and vibrant.” In the Berkshires, 2020 began “exceptionally well.” The Worcester area enjoyed a “robust” market.

Within a few weeks, of course, the commonwealth shut down in response to the coronavirus pandemic. When it did, Lee Joseph, a real estate agent with Coldwell Banker in Worcester, worried.

“I thought the market as I knew it was going to cease to exist, and I’ve been doing this for 36 years,” she recently told Banker & Tradesman.

It did, very briefly, before Gov. Charlie Baker deemed real estate an essential service, and new ways to buy and sell homes emerged. By June, when Clay Realty Group in Falmouth held an open house, 61 parties visited the home, which got 31 offers. In pre-pandemic times, receiving two offers was considered good.

“That’s really the first time we had something like that happen with us,” said Steve Clay, team leader of the Keller Williams-affiliated group. “But then it continued May, June, July, August – frankly, up until now.”

![]() Three Weeks’ Supply

Three Weeks’ Supply

The residential real estate market’s strong start last year ultimately became a preamble to dramatic increases in single-family sales and prices, and incredibly low inventory nearly throughout the commonwealth.

Statewide, single-family home sales grew from 59,178 in 2019 to 61,469 in 2020, a 3.97 percent increase year-over-year according to The Warren Group, publisher of Banker & Tradesman. Median prices increased by 11.38 percent over the same period, from $400,000 to $445,000. Condominium sales, by contrast, declined very slightly, from 24,533 in 2019 to 24,193 last year, yet median prices rose by 9.21 percent, from $380,000 to $415,000.

It was “a year like no other,” Joseph said.

“When you look at the month’s supply of inventory, it’s just dropped,” said Massachusetts Association of Realtors President 2021 Steve Medeiros. “If you’re looking across the entire state, a year ago it was 2.2 months’ supply of inventory. Now we’re at 0.8. So that’s just over 3 weeks. A level market is a six-month supply.”

Prices have risen accordingly, encouraged by historically low interest rates which have pulled new buyers into the market. The rates have also allowed many buyers to extend stronger offers by $10,000 or $20,000, “which makes a big difference to the seller,” Medeiros said.

For Joseph, with Coldwell Banker in Worcester, March’s suspended animation now seems like a “blip.”

She heard from city-dwellers wanting more space. Sales have been strong in Worcester – median single family home price is $285,000 and the median condo price is $188,000 – and, despite the suburban trend, other Gateway Cities: New Bedford condo prices, for example, increased 48.64 percent over 2019.

“I’ve seen first-time buyers in droves,” Joseph said, noting that properties in towns just outside of Worcester, such as Shrewsbury, also sold well.

Cash Dominated Second Home Market

Cash buyers edged out many first-time homebuyers on Cape Cod, in a market that pitted Baby Boomers against aspiring Millennial homeowners.

“You actually feel bad,” said Clay, with Keller Williams in Falmouth, when strong, above-asking-price offers don’t cut it.

The bidding wars typical inside Interstate 95 became the norm on the Cape and elsewhere as demand all but outpaced supply. Lot sales are also up, as is new construction, Clay said.

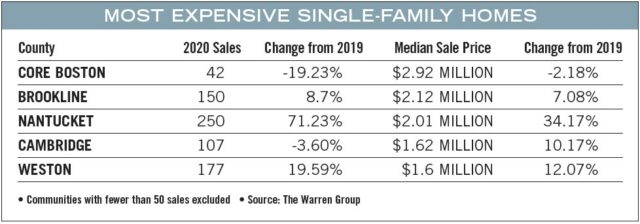

Among this year’s top four median home price increases were Osterville, Nantucket and Cotuit – Nantucket saw the total number single-family home sales increase by 71.23 percent over 2019.

“In March 2020, there were 9,163 houses for sale in Cape Cod,” he added. “As of the end of January 2021, there were 477. That’s crazy.”

Inventory is low in the Berkshires, too, where early in the pandemic, Barnbrook Realty in Great Barrington received about a dozen rental inquiries each day “from people living in the city wanting to flee,” owner/broker Maureen White Kirby said in an email.

“As the rentals went, a rapid increase in local sales activity was not far behind,” she said, with buyers coming from New York City and Greater Boston.

Single-family home sales in Great Barrington were up by 77.46 percent in 2020 over 2019, and by 66.07 percent in Williamstown. White Kirby said every price point sold well: Barnbrook Realty doubled its 2019 sales and sold more homes above $2 million than in the previous four years combined.

Will Some Buyers Regret?

Nonetheless, pockets of Massachusetts’ residential market didn’t see the same runaway price jumps as other communities.

More traditionally middle-class Boston suburbs, including Woburn, Billerica and Burlington, and the area between Routes 3 and 24 to the south didn’t have the extreme price growth typical of the MetroWest last year. And in Boston, supply of condominiums is up, especially at prices at and above $2 million.

David Bates, an associate broker at the William Raveis Back Bay Office, noted that in South Boston last year, 961 condos – the most in the past decade – were listed at a median price of $829,000. In the South End, condominium inventory rose 44 percent, with a median list price of $1 million.

Different priorities currently drive migration out of Massachusetts’ cities than those that shaped real estate patterns during the Great Recession, he added, when interest in luxury suburban homes waned. Then, buyers chose “a safer market if they had to resell” over space, Bates said.

“So instead of buying in [Jamaica Plain], they’d get a little bit less and buy in Brookline,” he said.

“So instead of buying in [Jamaica Plain], they’d get a little bit less and buy in Brookline,” he said.

During the pandemic, buyers prioritized space, and if they couldn’t afford one town, they headed deeper into the suburbs.

“The pandemic has changed what people think of home, and what a home is supposed to do,” he said.

That pandemic-molded ideal will likely keep Massachusetts home sales robust “until the inventory starts to increase, or the [average mortgage] interest rate starts to go up,” Keller Williams’ Clay said.

At some point, current restrictions will hopefully give way to livelier times with bustling urban centers.

“Five years from now, will people be sorry that they bought in some area, like, an hour outside the city, and all of a sudden they have to go downtown?” Bates asked. “I wonder.”