Webster First Federal Credit Union has been helping members with their lending needs since 1928. Even in a housing economy like today’s, their lending portfolio continues to grow. In 2023, they lent over $64.6 million in mortgages and home equities and $143 million in business or commercial real estate loans. Banker & Tradesman even named them among the top ten Massachusetts lenders for commercial purchase loans in several categories. Homebuyers and homeowners can feel secure when they choose to finance or refinance their mortgages with a top credit union lender.

Why choose financing from a credit union lender?

The benefits of choosing a local credit union as your lender start with how they run things. Credit unions operate as not-for-profit institutions, unlike banks. This can result in lower fees, lower rates, more financing options like First Time Homebuyer loans, and personalized service from people just like you. You can take comfort in knowing the credit union you finance with gives back to local organizations in the communities you live in.

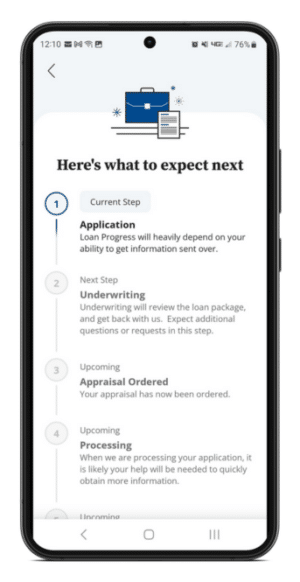

It can be tough to communicate with a big bank about your mortgage. The Webster First Home Loan app makes it easy. You can run payment calculations, e-sign and upload documents, and communicate with your loan officer right from the palm of your hand. Be completely in the know about which part of the loan process you’re in. No need to visit a location in person until it’s time for you to close.

The Home Buying Process Step-by-Step: Tips for First Time Homebuyers

The process of buying a house may seem foreign to someone who is doing it for the first time. Without knowing all the mortgage lingo or documents, it can feel scary signing your name to something. That’s why Webster First has tried to break down the process in a simple way that first time buyers can understand.

- Find out how much house you can afford. You don’t want to look outside your price range and end up with a mortgage you can’t afford to pay. Speak honestly with a mortgage loan officer about your debts and expenses or use a mortgage calculator to determine a budget for yourself.

- Get pre-approved for a mortgage. You want to be pre-approved before you start looking. This way, if you find yourself in a house that you want to place an offer on, the seller will take your offer seriously knowing you already have financing lined up.

- Find a real estate agent. Your real estate agent will be able to show you homes for sale within your price range. They communicate with the seller on your behalf when you want to make an offer. They often have access to details about listings that you may not be able to find on public real estate listing sites. To find one, research trusted real estate agencies in your area or ask around. You probably know someone else who bought a house that would gladly recommend their agent to you.

- Find your house and make an offer. When you’ve found the house for you, let your agent know you’d like to make an offer. When you make an offer, it is customary to provide your pre-approval letter and a deposit of $1,000 or more to let the seller know you’re serious and make your offer stand out among others. This deposit is known as earnest money and will be held in escrow until the sale goes through. Your agent will let you know if the seller accepts your offer or wants to counter.

- Get an inspection. Although an inspection is optional, First Time Home Buyers are highly encouraged to have one. It’s important to know what may be wrong with a house before you buy so you can decide whether it’s worth fixing or if you need to lower your offer. Or if the house is no longer worth buying. You should be there with the inspector to ask questions. You are paying for their expertise, and you won’t have the opportunity to ask after they leave.

- Finish signing your documents and order your appraisal. Once you’ve reviewed your inspection and decided on your final offer, you will need to sign the Purchase & Sale Agreement (P&S) and your Loan Estimate will be issued. This details an estimate of your payments and any fees or closing costs.

- Have a final walkthrough of your home. This will be your last chance to make sure everything in the house is the way you want to move into it, and the last chance to ask anything of the seller. Once you close on your mortgage and the house becomes yours, the seller is freed of all responsibility to the house.

Mortgage Lending in a High-Rate Environment

With rates high and little housing inventory available, many potential homebuyers are discouraged from looking – but not all can afford to wait for rates to drop. If you must take out a loan when rates are high, consider refinancing when the opportunity becomes available. Also consider starting with an adjustable rate loan. Webster First’s current adjustable options have lower annual percentage rates than the 30-year fixed First Time Homebuyer loan. You can save money on payments, and if you plan on refinancing within the first 5-10 years (depending on which term you choose) you can avoid the adjustable period.

Angela Talbot

Home Lending Built on Trust

Part of Webster First’s mission is to help their members make the best possible financial decisions through education. They value being transparent with their members so there are no surprises along their home buying journey. In addition to their knowledgeable staff, they run a blog where they frequently release new articles that cover a wide range of topics related to buying homes, taking out loans, paying off debt, investing, and more financial literacy topics.