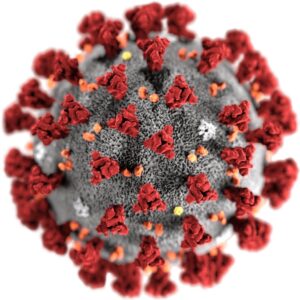

An illustration of the new coronavirus that causes the disease COVID-19. Image courtesy of the Centers for Disease Control.

President Donald Trump announced Wednesday night that, effective immediately, he would have the Small Business Administration start providing low-interest loans for businesses that have been affected by the coronavirus.

In an address from the Oval Office, Trump said these loans would help small businesses overcome the economic disruptions that have been caused by the virus. In addition, he said he would request that Congress boost this loan pool by providing an additional $50 billion in funding for the SBA.

SBA Administrator Jovita Carranza issued a statement Thursday afternoon providing details on the low-interest loans that would be available through the SBA’s Office of Disaster Assistance. State governors will need to work with the SBA on an receiving an economic disaster declaration. Massachusetts is working on the declaration, according to a spokesman for the state’s SBA district office.

Once the disaster is declared, the SBA will make loans available to small businesses as well as private, nonprofit organizations in designated areas of a state to help companies through any pain caused by the COVID-19 outbreak.

Key details include:

- Companies and nonprofits can receive up to $2 million in assistance.

- These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the virus’ impact. The interest rate is 3.75 percent for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for nonprofits is 2.75 percent.

- SBA offers loans with long-term repayment schedules in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

Congress is also working on additional SBA funding. Chairman of the U.S. Senate Committee on Small Business and Entrepreneurship, Sen. Marco Rubio, R-Florida, said in a press release that his committee would immediately work on a bipartisan bill to ramp up the SBA’s 7(a) loan program. Rubio’s proposal would provide near-term relief to small businesses facing payroll challenges and disruptions in supply chains related to the coronavirus, according the statement.

“I look forward to working with President Trump on bipartisan legislation that will give the SBA additional resources and authority to infuse billions of dollars into our nation’s small businesses to help Americans deal with the coronavirus,” Rubio said in the statement. “In support of the president’s request, I will introduce legislation [Thursday] that will provide the authorization for much-needed resources to the SBA’s 7(a) loan program. Together, we will help small businesses that are struggling in the midst of a global pandemic and begin rebuilding our domestic supply chain.”

The Senate committee held a hearing on the coronavirus and the small business supply chain this morning.

Trump also announced Wednesday night that he would also take emergency action to provide financial relief to allow working Americans who have been affected by the virus to stay at home if they are ill, quarantined or taking care of others dealing with the coronavirus.

He said he would ask Congress to provide additional funding for this worker relief.

Trump also said that he will instruct the Treasury Department to allow individuals and businesses negatively affected by the coronavirus to defer their tax payments beyond the April 15 filing deadline.

The Associated Press contributed to this report.