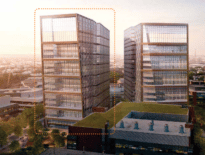

A rezoning plan designed to stimulate real estate investment in downtown Hyannis received immediate positive response from developers, and an emerging push to revisit the changes. iStock photo

Zoning changes designed to revitalize downtown Hyannis got immediate traction from developers proposing multifamily housing to replace neglected commercial sites.

But within months, a change of leadership on the Barnstable Town Council led to fears of a rollback of the new rules that allow fast-track approvals for 4-story apartments and condominiums.

At a Barnstable Town Council meeting this month, residents confronted councilors about the potential about-face.

“Our current town council president has a ‘We’re Full,’ sticker on the back of her car,” said Megan Mort, a Barnstable housing advocate. “What? For people who are struggling for housing right now, where are we supposed to go? What leadership are we supposed to look to? Because it’s not here.”

The new council president, Felicia Penn, is a former Planning Board member and member of a group that opposed developer Quarterra’s recently-abandoned plans to acquire Twin Brooks Golf Course in Hyannis for a 300-unit housing complex.

“It doesn’t represent anti-growth: what it represents is growth that is out of scale,” Penn said in an interview. “It says, ‘We’re full: Keep Cape Cod authentic.’ That doesn’t mean don’t build anymore. The environment is having a hard time handling the year-round residents we have, and to build development after development after development doesn’t help our water and our wastewater.”

The council plans to appoint a subcommittee to revisit the zoning changes, reflecting public reaction to the design and appearance of the newly-approved projects, Penn said. Objections range from insufficient parking requirements and open space to the lack of a ground-floor retail requirement.

“It’s a main street, and you certainly want to have vital streets with activity, not just to have an apartment building without retail which doesn’t make a whole bunch of sense to people,” Penn said.

Blighted Properties Snapped Up by Developers

In downtown Hyannis, multifamily developers have been quick to embrace the new opportunities created by the March 2023 zoning change.

Boston-based WinnCompanies received approval in October for 120 apartments at a vacant former TD Bank building at 307 Main St. And Grander Capital Partners, a Wellesley developer, got the OK to build a 95-unit apartment building at the former Cascade Motor Lodge property.

Such projects illustrate the business case for redeveloping decades-old commercial properties as multifamily projects, said Chuck Carey, a Hyannis commercial real estate broker.

“The poster child is the former Cascade Motel, which is very typical of the buildings in Hyannis,” said Carey, owner of Carey Commercial. “It was a drug haven and a crime haven. The new zoning really tipped the scales, and was the main and only reason the buyer bought it.”

From 2017 to 2023, there were 460 housing units completed in the town of Barnstable, according to a planning department report, representing less than 2 percent of the town’s housing inventory according to U.S. Census Bureau data.

“We have longstanding goals to invest in downtown Hyannis and its revitalization,” Barnstable Director of Planning and Development Elizabeth Jenkins said. “We were not really seeing that happen, so that was one of the reasons we took another look at zoning.”

Taking effect in March 2023, the Downtown Main Street rezoning plan includes a new form-based zoning code that provides more flexible dimensional rules for buildings.

During the COVID pandemic, office-to-housing conversions were constrained by previous regulations limiting housing units per acre and lengthy permitting processes, Jenkins said.

Boston-based WinnCompanies received approval in October for 120 apartments at a vacant former TD Bank building at 307 Main St. in Hyannis. The company is currently assembling project financing. Image courtesy of ICON Architecture

“We were not seeing major reinvestment in blighted properties,” Jenkins said. “On a smaller scale, we were not seeing enough flexibility to have the smaller structures responding to the market.”

As another part of the downtown revitalization effort, consultants Stantec and urban planner Jeff Speck advised the town on a wayfinding and streetscapes study intended to improve walkability and traffic patterns. A key recommendation: turning Main Street back into a two-way traffic pattern for the first time in nearly a half-century.

“It was fascinating to hear so much support from the developers,” said Jason Schreiber, a senior principal at Stantec. “There definitely were skeptics, but from the development community there were almost none. Merchants always have a little bit more hesitation about change.”

Downtown Decline Attributed to ‘Outdated Thinking’

An affordable housing executive said the rezoning was overdue, and lamented a potential rollback of housing-friendly policies.

“It’s an unfortunate turn of events,” said Alisa Magnotta, CEO of nonprofit affordable developer Housing Assistance Corp. of Cape Cod. “There’s a group of people who have this mindset that ‘The Cape is full,’ or more specifically their town is full. It’s this outdated thinking that the way it is, is the way it always should be. Just look at downtown Hyannis: it used to be a thriving Main Street and now it needs revitalization like no other part of the Cape.”

Steve Adams

Lotteries for units in Housing Assistance Corp.’s income-restricted projects typically receive five to 10 applications for each unit available, Magnotta said.

The median single-family home price in Barnstable was just under $800,000 in 2023, according to data compiled by The Warren Group, publisher of Banker & Tradesman.

The Barnstable Town Council was scheduled on Thursday to appoint a subcommittee to review the downtown zoning.

In the meantime, some projects approved under the 2023 rules appear to be moving forward. The WinnCompanies project is in the process of assembling financing for the 307 Main St. project, according to a spokesperson.

Grander Capital did not respond to a request for comment. The approved development site at 201 Main St. is on the market, however, according to a CBRE listing, which touts future residents’ “spectacular” harbor views.

Barnstable’s constrained housing supply has contributed to average rents of $3.20 per square foot at recently completed apartment projects, or roughly $2,560 for an 800-square-foot unit, the offering sheet states.

|

|