Vacant office buildings are emerging as a new source of downtown Boston development activity as hotel developers explore acquisitions for conversion projects. Rhino Capital is preparing to seek approval for a hotel conversion at the former CBT Architects headquarters at 110 Canal St. Photo by James Sanna | Banker & Tradesman Staff

New hotel construction has slowed to a crawl in Boston since COVID but a new source of room supply is emerging in conversions spurred by the city’s struggling office market.

Properties in the Financial District and Bulfinch Triangle are in play for potential adaptive projects adding to Boston’s hotel inventory. Architects say they’re receiving a growing number of inquiries from developers looking at hotels as an option for office conversions, pointing to a potential new source of downtown development activity.

“There are opportunities to find financing,” said Senam Kumahia, director of development at Boston-based Rhino Capital. “You’ve got to get creative and design a project that works.”

Why It’s Tempting

Hotel developers continue to face steep financial hurdles to ground-up construction, so the chance to acquire office properties at steep discounts to pre-COVID prices for conversions is a tempting proposition.

The Financial District and Seaport neighborhoods have approximately 16 million square feet of class B and C office buildings, and vacancy rates in both submarkets topped 20 percent at the end of 2023, according to CBRE research.

As sales of class B office buildings in Boston accelerate in 2024, local architects are fielding inquiries from potential buyers asking them to evaluate the potential for hotel conversions. Boston-based Group One/JCJ has evaluated three such opportunities recently for developers, Principal Harry Wheeler said.

The firm also is completing schematic designs for an approved project converting long-vacant Fidelity Investments offices at 15-19 Congress St. into an 80-room boutique hotel. Construction could begin as soon as 2025, Wheeler said.

Rhino Capital acquired the 63,000-square-foot 110 Canal St. (left) in December for the assumption of $14.6 million in mortgage debt. Photo by James Sanna | Banker & Tradesman Staff

Making the Math Work

Typical costs for conversions exceed $600 per square foot, reflecting the complexities of such projects in aging, historic buildings on irregular building lots, Wheeler said.

But the chance to acquire office buildings at steep discounts to pre-COVID prices can make adaptive reuse projects feasible.

Rhino Capital acquired 110 Canal St., a vacant 63,000-square-foot office building located a block away from The Hub on Causeway, in December for the assumption of $14.6 million in mortgage debt. Architects CambridgeSeven advised the developer that the early-20th-century structure would lay out well as a boutique hotel.

Developers focused on a hotel as the highest and best use for the property because of its high-traffic location, Kumahia said.

“It has great transit access with North Station right there, and you have got the TD Garden that anchors the neighborhood not just with Celtics and Bruins games, but other concerts and other activities,” Kumahia said.

The 7-story building that formerly housed CBT Architects’ headquarters has the modest-sized floor plates necessary to provide guest rooms with exterior windows, along with placement of elevator shafts suitable for a hotel configuration, he said.

And at the border of Roxbury and South End, a development team that’s been trying to restore a historic building at 1767 Washington St. now sees a hotel as a better financial option than a 106-unit condominium tower.

Alexandra Partners LLC said the current capital market conditions favor switching back to earlier approved plans for a 150-room hotel, in a filing recently submitted to the Boston Planning & Development Agency. The project would include a large new construction element while retaining the former Alexandra Hotel’s historic facade.

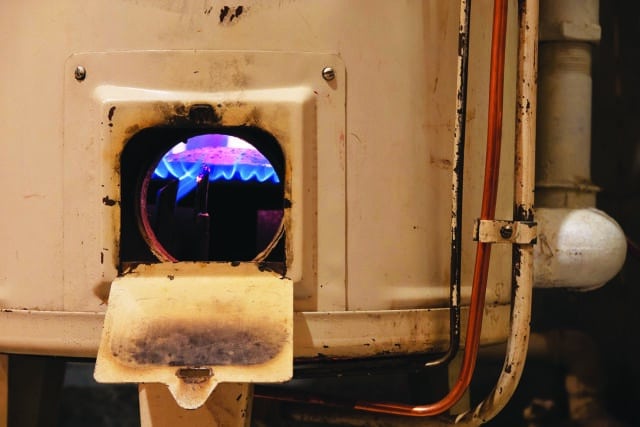

Boston’s decarbonization regulations still mean most office-to-hotel conversions will need to replace building systems. iStock photo

High Barriers to New Construction Linger

Only one major new hotel project is scheduled for completion in Boston this year: Dutch chain citizenM’s second location at 408 Newbury St.

Alan Suzuki, managing director of capital markets for JLL Boston, said interest rate hikes since 2022 and higher project costs since 2020 have stymied ground-up hotel projects.

“Construction costs aren’t getting any cheaper, and construction financing continues to be challenging,” Suzuki said. “The fundamentals are certainly back to 2019 levels in many cases, but costs make it very difficult for new construction to work in today’s market.”

Adaptive reuse projects come with their own set of risks, related to the unpredictability of upgrades to aging buildings. Because of new and pending regulations on decarbonization in the building sector, developers will need to invest heavily in utility replacement, said Michael Liu, senior partner and design principal at The Architectural Team, a Chelsea-based firm.

Steve Adams

“Given where the energy code is and where it’s going, it’s not likely you’re going to be saving building systems in any case,” Liu said.

But Boston’s inventory of office buildings developed in the first half of the 20th century offers ample opportunities for both hotel and residential conversions, Liu said, because of their smaller footprints.

Additional benefits can include speed to market and availability of tax credits for historic properties, said Ellen Anselone, a principal at Boston-based architects Finegold Alexander. The firm designed the 2015 conversion of two vacant commercial buildings at Downtown Crossing into the 242-room Godfrey Hotel for Chicago-based developer Oxford Capital Group.

The project required complete building systems replacement and seismic and building envelope stability upgrades, but was approved as-of-right enabling a fast-track development timetable, Anselone said.

|

|