Apartment rents have blasted past pre-COVID levels in Greater Boston as demand returned to both downtown and suburban markets while the new supply pipeline declined.

“It’s a tough time to be a renter,” said Jeff Tucker, senior economist at Zillow, which reports Greater Boston rents rose nearly 14 percent to over $2,600 a month in 2021. “A lot of folks renewing their leases right now signed a lease last winter at pretty advantageous rates. Tenants are in for a surprise and might be rethinking where they want to live.”

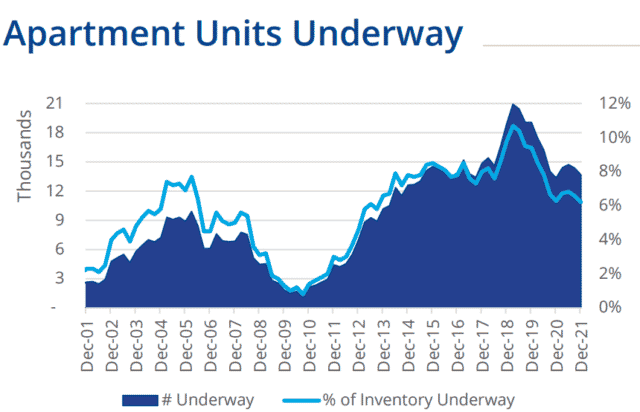

The return of thousands of off-campus college renters last fall sent vacancy rates dropping to pre-pandemic levels. Meanwhile, construction starts have steadily declined since late 2018, according to data compiled by Colliers International and CoStar.

The supply-demand imbalance has shattered all-time records, with asking rents now topping $2.70 per square foot in eastern Massachusetts. CoStar surveyed rents at nearly 220,000 apartments located in market-rate properties with at least 25 units.

A recent report from Apartment List paints a slightly less daunting picture for renters, reporting rents are up 0.2 percent in Boston since March 2020 and currently stand at $1,999 for a one-bedroom apartment, and $2,130 for a two-bedroom unit.

The listing service recently changed its methodology to emphasize actual, rather than listed rents and to control the overrepresentation of luxury properties in its own and competitors’ databases.

After a surge of multifamily construction in Greater Boston prior to the pandemic, apartment inventory expansion has slowed, even as demand rebounds. Image courtesy of Colliers International

Production Held Down Rents Pre-COVID

Rent gains moderated in 2018 when housing construction peaked at around 21,000 units and forced landlords to be more hesitant about raising rents, said Jeffrey Myers, Colliers’ research director in Boston.

“When you have thousands of units under way and you’re a landlord, your biggest concern is the building next door will steal your tenants,” Myers said.

But new supply dipped below 15,000 units in each of the last three years. Life science developers outbid multifamily firms for sites in some areas, and the pandemic briefly caused a pause in development and permitting. Now, supply chain delays and inflation are threatening the timelines and viability of some apartment projects.

“Investors are willing to pay a lot of money for quality assets in Boston, but there are impediments,” Myers said.

Apartment rents in Greater Boston now have surpassed pre-pandemic levels, according to multifamily researchers, driven by rebounding demand and a large cohort of renters moving elsewhere in the face of rent hikes.

The city of Boston has been the largest contributor to the region’s apartment inventory over the past decade, but multifamily development waned in 2021. The Boston Planning & Development Agency approved 6,643 residential units, a 34 percent decrease from 2020.

Demise of the City Exaggerated

Large apartment complexes in core Boston apartment markets – including downtown, the Seaport District and Back Bay – surveyed by The Collaborative Cos. had occupancy rates above 96 percent at year’s end, surpassing the pre-pandemic level. In December, asking rents hit $4.43 per square foot, equal to pre-COVID levels.

“[The pandemic] was supposed to be the demise of the city and everybody going to the suburbs,” said Sue Hawkes, managing director of The Collaborative Cos. “As soon as there was a vaccine, you could see people coming out to see what was renting. There is not a lot of vacancy anywhere, and it’s not going to be a ghost town.”

The downtown market’s revival hasn’t been accompanied by a suburban slump, however. Hybrid work arrangements continue to benefit suburban properties, Zillow’s Tucker said. Equity Residential executives singled out Burlington, where the firm owns the Heritage at Stone Ridge complex, as a submarket that’s seen rent increases as the result of high-income renters moving to the suburbs.

Developers of new luxury complexes report strong lease-up figures – and expectations for double-digit rent gains in 2020.

The 44-story, 470-unit Alcott apartment tower in Boston’s West End opened in fall 2021 and is already 52 percent leased, according to an SEC filing. The $410 million complex currently lists studios starting at $3,775.

Equity Residential predicts rents will rise an average of 10 percent this year at its 27 properties in Greater Boston, totaling 7,170 units with average rents of $3,049. International students have returned to Boston and the region’s life science, financial, health care and education sectors are generating strong demand for apartments, Chief Operating Officer Michael Manelis told analysts in a conference call.

Steve Adams

New England was the strongest market in 2021 for AvalonBay Communities, a Virginia REIT that owns over 9,500 apartments in the region. Average move-in rents rose 30 percent during 2021, the company announced in its fourth-quarter earnings statement, and now sit 10 percent above pre-COVID levels.

AvalonBay projects average rents of $3,315 at its 180-unit Avalon Brighton complex at 139-149 Washington St. which is scheduled for completion in early 2023.

“Improved performance in Boston has been supported by healthy job growth across various industries, most notably biotech, and reduced apartment deliveries in both urban and suburban submarkets,” Chief Operating Officer Sean Breslin told analysts in a recent earnings call.