Among the three votes on the Federal Open Market Committee against Wednesday’s interest rate hike was Federal Reserve Bank of Boston President Eric Rosengren.

The Federal Reserve’s move reduced its key short-term rate – which influences many consumer and business loans – by an additional quarter-point to a range of 1.75 percent to 2 percent.

Rosengren, who has been on a high-profile speaking tour promoting his view that the national economy is actually in pretty good shape despite recession indicators like an inverted yield curve, said he didn’t think the rate cut was necessary.

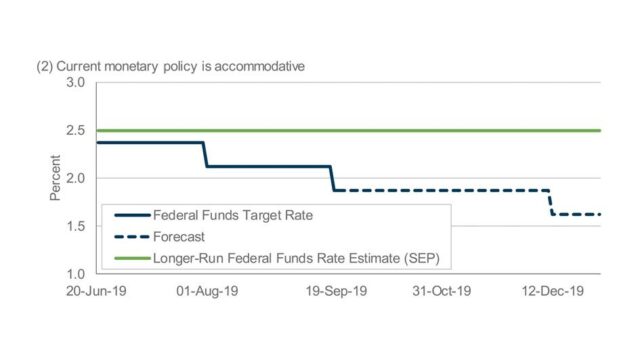

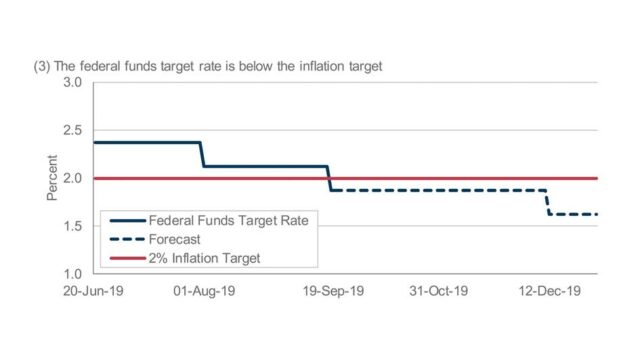

“The stance of monetary policy is accommodative,” or aimed at expanding the money supply, he said in a statement issued by the Boston Fed. “Additional monetary stimulus is not needed for an economy where labor markets are already tight, and risks further inflating the prices of risky assets and encouraging households and firms to take on too much leverage. While risks clearly exist related to trade and geopolitical concerns, lowering rates to address uncertainty is not costless.”

Rosengren released four charts along with his statement noting that the national unemployment rate is closing in on a full percentage point below the “natural rate” of unemployment, that Wednesday’s move marks the second interest rate cut in only a short period of time, that the cut puts the federal funds rate below the Fed’s 2 percent inflation target and that the ratio of American companies’ average total debt to their EBITDA multiple has marched steadily upward since 2015 and is now higher than it was in 2007.

Image courtesy of the Federal Reserve Bank of Boston

Image courtesy of the Federal Reserve Bank of Boston

Image courtesy of the Federal Reserve Bank of Boston

Image courtesy of the Federal Reserve Bank of Boston