Towers rise around downtown Boston’s Winthrop Square. Photo by James Sanna | Banker & Tradesman Staff

Changes designed to attract more developers and commercial tenants to downtown Boston and avoid a looming fiscal chasm tied to declining office occupancy are moving closer to the finish line.

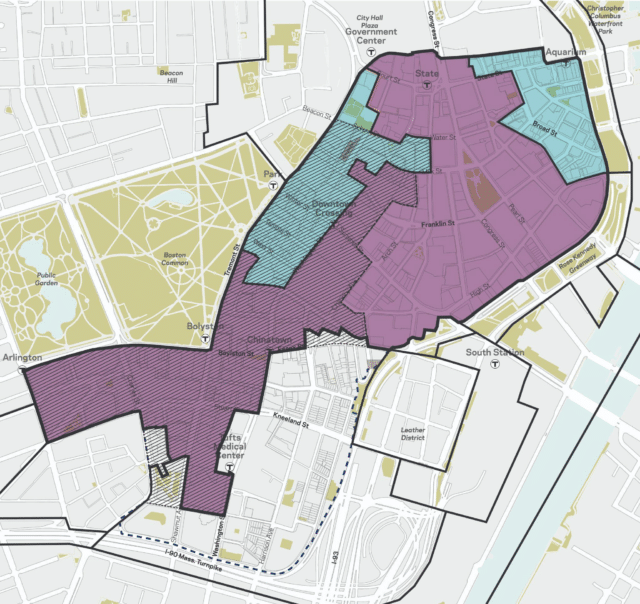

The Boston Planning & Development Agency’s rezoning recipe is designed to make it easier to build taller buildings in parts of the Financial District and Downtown Crossing, with an emphasis on generating multifamily housing, and a more vibrant mix of ground-floor tenants.

The final proposal allows building heights over 700 feet in some areas, while encouraging more retail and recreational uses by-right ranging from nightclubs and distilleries to yoga studios and escape rooms.

“We’re trying to strike a balance between our planning goals and public feedback. The mayor has identified that there are places we need to look at to have height in the downtown,” BPDA Director of Planning Aimee Chambers said during a virtual presentation on the final proposal.

The hoped-for infusion of new residents and destination retail seeks to cushion the fiscal and social repercussions from the post-COVID exodus of office tenants from the urban core.

Boston’s citywide office vacancy rate reached almost 17 percent at the end of March, according to CBRE’s first-quarter Boston office report. Vacancy rates in the Financial District and Downtown Crossing were 26.1 and 22.9 percent respectively.

Gregory Sampson, practice leader of law firm Sullivan & Worcester’s permitting and land use group, said the BPDA’s approach has potential to offer significant benefits to developers.

“They do need to be considered in the context of some of the other headwinds that projects are facing, including affordable housing requirements and the changes to the energy code. But it is great to see efforts focused on creating new growth in downtown districts,” Sampson said in an emailed statement.

A rezoning proposed by Boston officials splits downtown into “Sky” and “Sky-Low” districts, where maximum heights would be set at the FAA limit for the former and 180 feet for the latter. The state Boston Common shadow law would still apply to parcels covered by the striped area. Image courtesy of the BPDA

Filling the Office Fiscal Gap

The outcome of the BPDA’s PLAN: Downtown study took on new urgency when it resumed in 2022 following the COVID shutdown.

With hybrid work emptying millions of square feet of office buildings in the Financial District and Downtown Crossing, planners sought to remove barriers to development and investment. As market data confirmed a continuing decline in office leasing, they sought to encourage development of multifamily housing and more retail and entertainment tenants to ground floors.

The focus on downtown has been intensified by recent forecasts of the implications for Boston’s property tax base from the commercial property slump. A study by the Boston Policy Institute estimates that Boston could lose $500 million in annual tax revenues, representing nearly 12 percent of the city’s current budget, by 2029 due primarily to lower office building valuations.

On the fiscal front, Mayor Michelle Wu is asking the City Council and Beacon Hill legislators for permission to raise commercial-industrial property tax rates beyond the current maximum allowed under state law for five years starting as soon as fiscal year 2025. The shift would increase the commercial tax base’s share of the city’s overall levy from 175 to a maximum of 200 percent.

The Wu administration says it believes a new downtown “skyline” zoning districts will balance historic preservation with attracting multifamily development and destination retail and entertainment venues. Photo by James Sanna | Banker & Tradesman Staff

Removing Obstacles to Occupancy

The downtown rezoning plan, for its part, focuses on new growth by seeking to attract more mixed-use and multifamily development. The “Sky District” allows taller base building heights in the bulk of the Financial District and Downtown Crossing. Some parcels could be approved for buildings of approximately 700 feet, the maximum recommended by the FAA to avoid airport flight paths. Heights would still be regulated by state law limiting new shadows on Boston Common and the Public Garden.

Lower-density development with maximum 180-foot building heights – lower when next to a historic building – would be allowed in the “Sky Low” districts, reflecting historic groups’ objections to effects on properties such as the Old South Meeting House building. The areas include the Washington Street corridor and Broad and India streets, where research labs also would be forbidden.

Kathleen Onufer, the BPDA’s deputy director of zoning, said the proposal modernizes and simplifies decades-old rules that require Zoning Board of Appeal variances and hinder development and leasing. Entertainment venues such as nightclubs with capacity up to 2,000 patrons, for example, would be allowed throughout the study area.

The proposed rezoning makes housing an allowed use throughout both Sky districts and removes inconsistencies in the current zoning that require residential projects to receive Zoning Board of Appeal approvals, BPDA officials said, eliminating a layer of the city’s expensive permitting process.

Acknowledging objections from historic groups, however, the final proposal creates another potential layer of protection: “historic overlays” that apply to the Ladder Blocks and the India and Broad streets section of the Wharf District. New developments in those districts would be limited to maximum floor plates of 20,000 square feet, to prevent bulky towers from overshadowing historic sites.

At last week’s virtual presentation of the final rezoning by BPDA staff, the safeguards didn’t reassure representatives of Revolutionary Spaces, the organization that manages the Old South Meeting House and Old State House, or the Boston Preservation Alliance.

“If the guidelines don’t have teeth, we worry they won’t be effective. That’s the whole point of planning: that we don’t have to fight every battle,” Boston Preservation Alliance Executive Director Alison Frazee said.

Steve Adams

A Green Light for Office Tower?

The final version includes the downtown’s largest development proposal in the higher-density “Sky District,” Midwood Investment & Development’s 23-story office tower at 11-21 Bromfield St.

Downtown business leaders and developers have argued that a new class A office tower would deliver a broad economic stimulus to the district including retail and hospitality properties. The project continues to be opposed by some neighborhood residents and historic groups.

The BPDA’s Onufer noted that the Bromfield Street site’s zoning height also could be used to submit a sizeable residential tower proposal.

“[Opponents] thought that height was inappropriate for commercial development at that site. It would accommodate height for a residential project that includes affordable housing,” Onufer said.

Following a public comment period that expires June 4, the zoning changes are expected to be submitted to the BPDA board at its meeting that month.