Boston Properties CEO Owen Thomas said the office REIT sees “significant opportunities” for acquisitions and development in 2024 as the office sector falls out of favor among institutional investors and values drop.

Thomas compared the real estate market conditions in 2024 to those during the Great Recession, when the office REIT acquired properties including 200 Clarendon St. in Boston.

“We intend to shift to offense on capital deployment, and this has started,” Thomas told analysts today in a conference call to discuss the company’s fourth-quarter earnings.

Boston Properties sees opportunities in office, life science and residential projects and will seek joint venture funding for a development pipeline totaling 2.7 million square feet, Thomas said.

The occupancy rate across Boston Properties’ nationwide portfolio was 88.4 percent at the end of 2023, compared with 88.6 percent in December 2022.

The Greater Boston portfolio ended 2023 with an occupancy rate of 89.9 percent, trailing New York’s 90.1 percent but exceeding the company’s West Coast submarkets in Los Angeles, San Francisco and Seattle.

Because a broad uptick in office leasing demand appears unlikely in 2024, Boston Properties will seek to gain market share by attracting tenants from competitors, President Doug Linde said.

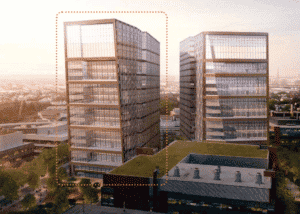

The office REIT will receive $1.66 billion early this year from the partial sale of 290 and 300 Binney St. in Cambridge, after agreeing to sell a 45-percent share to Norges Bank Investment Management in November.

The Kendall Square portfolio includes a new tower preleased to AstraZeneca which is scheduled for completion in 2026, and a 240,000-square-foot office-lab conversion that is preleased to The Broad Institute for occupancy in January 2025.

During the fourth quarter, Boston Properties’ revenues increased 5 percent to $828.9 million while net income totaled $119.9 million compared with $121.8 million in the fourth quarter of 2023.

Funds from operations were $1.82 per share, compared with $1.86 per share in the fourth quarter of 2023.