Tech companies could be the key to future office demand in Boston’s Back Bay neighborhood. Sigfox, a French wireless company that specializes in Internet-of-things applications, recently occupied new offices at 545 Boylston St., an 184,642-square-foot Copley Square building acquired in August by John Hancock Life Insurance for $100.5 million.

Back Bay has some of Boston’s most architecturally distinct landmarks and picturesque streets – and the city’s highest office rents to match. An upcoming exodus of major tenants will force landlords to get creative finding their replacements.

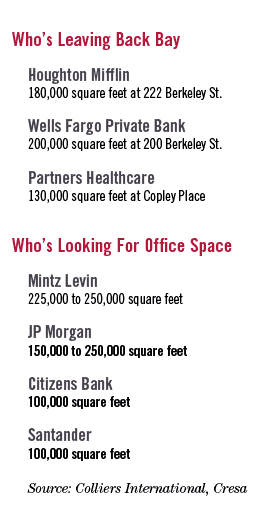

Approximately 800,000 square feet of direct space will become available in the next 12 months as Wells Fargo, Houghton Mifflin Harcourt, Natixis Global Asset Management and Partners Healthcare vacate Back Bay buildings.

“You can go back two decades and we’ve never had a spike in vacancy of any sort in the Back Bay,” said Brendan Carroll, director of intelligence for Boston-based Encompass Real Estate Strategy. “Now all of a sudden, we’re starting to see some options.”

As of Sept. 30, Back Bay had the highest availability rate of any Boston submarket, according to Colliers International’s Market Viewpoint report. Including 434,419 square feet of sublease space, some 14.8 percent of the 13.3 million-square-foot inventory is now available. That includes 135,000 square feet that State Street Corp. is leaving behind at Copley Place for sublease.

The tenant turnover sets the stage for changes in the neighborhood’s corporate DNA. Financial District and Downtown Crossing landlords have landed fast-growing tech startups to replace downsizing law firms and financial companies in recent years. Back Bay property owners are likely to break up and renovate buildings to appeal to tech and creative companies, real estate experts say.

New Competition From The Urban Edges

Back Bay has lost ground to emerging neighborhoods on the urban edge, where developers are repositioning properties in transit-friendly neighborhoods such as Sullivan Square, North Station and Somerville’s Assembly Row.

“Today there’s a lot of other options,” Carroll said. “The Back Bay is seeing more competition from other types of settings than it’s ever had before. It’s good for the tenants. They have a lot of options and they can be deliberate with where they want to be and who their key employee base is.”

That’s played into the decisions by big occupants such as Partners Healthcare to consolidate in an 825,000-square-foot build-to-suit at Assembly Row, while Boston Medical Center leaves three floors at Copley Place in favor of the Schrafft’s City Center in Charlestown.

Other factors include competition from build-to-suit projects such as Boston Properties’ 888 Boylston St. tower, where Natixis will relocate. Wells Fargo and Houghton Mifflin are moving to the Financial District, taking space vacated by tenants that in turn committed to brand-new towers in the sought-after Seaport.

Searching For Demand Generators

The two largest current space requirements – JP Morgan and law firm Mintz Levin – are traditional downtown tenants, and it’s unclear whether they would consider a Back Bay address. Many of the largest lease transactions in the central business district continue to be companies consolidating to slightly smaller spaces, such as ad agencies’ DigitasLBi and SapientNitro’s recent 200,000-square-foot lease at Related Beal’s Congress Square.

“The challenge we’ve faced over the last few years is it’s not net growth,” said Aaron Jodka, director of research for Colliers International in Boston. “It’s relocation or right-sizing of their office space, so it results in backfill space and it takes time to fill that in many cases.”

“The challenge we’ve faced over the last few years is it’s not net growth,” said Aaron Jodka, director of research for Colliers International in Boston. “It’s relocation or right-sizing of their office space, so it results in backfill space and it takes time to fill that in many cases.”

Back Bay was the traditional first choice for Cambridge tenants relocating to Boston, but that pipeline has slowed in recent years, said Duncan Gratton, an executive managing director at Cushman & Wakefield.

“The challenge for Back Bay is the tech tenants that have come into Boston haven’t really looked at the Back Bay much,” Gratton said. “And the big tenants have been staying downtown or in the Seaport, for the most part.”

Among the tech crowd, online home furnishings company Wayfair has been the neighborhood’s major office growth driver, expanding rapidly at Simon Property Group’s 845,000-square-foot Copley Place office tower where it now occupies over 400,000 square feet.

And San Francisco-based cloud computing giant Salesforce has indicated it’s partial to growing in place at 500 Boylston St., where it’s expanded from 23,000 square feet last year to an additional floor.

Migration of suburban office tenants to downtown offers another potential source of absorption. Fleetmatics, an Irish software company which provides GPS-based vehicle tracking services for companies, is looking for 100,000 square feet in Boston, according to brokers. Its current U.S. headquarters are at 1100 Winter St. in Boston Properties’ Bay Colony Park.

Rents Holding Steady

So far, the rising availabilities haven’t translated into savings for tenants. Many of the largest landlords are institutional investors with long investment horizons and conservative debt, unlikely to react to short-term fluctuations in the market.

Average rents for class A office space in Back Bay at the end of the third quarter were $61.69 per square foot, edging the Seaport’s $60.25, according to Encompass research.

But absent a turnaround in recent market trends, a correction could be on the horizon, predicts Matt Harvey, a principal at Boston-based tenant advisers Cresa. Most of the central business district’s leasing activity has been driven by TAMI (technology, advertising, media and information) tenants.

“Those types of tenants like to be on the Red Line, so the Back Bay has not done very well with that group,” Harvey said. “That’s a headwind that the Back Bay has been faced with. We think that’s going to be a submarket due for a correction in pricing.”

|

|