While it’s a fact that there have been double-digit increases in foreclosure petitions in each of the past 23 months, what’s behind the trend and what it means depends on whether you look at it from the bank’s perspective, or the homeowner’s. And there doesn’t seem to be much middle ground.

Methuen attorney Maria Bonanno of Manzi, Bonanno & Bowers studies the foreclosures of properties that she conveys and has determined that most of them are not recently delinquent. She said they’re typically people who have owned their home for 10 to 12 years and have been delinquent since 2008 or so. She said she thinks that it will take another year or two for banks to complete the process of foreclosing on homes stalled in their pipeline.

“The market hasn’t shot up as high as people think,” she said. “We’ll see the market increase 5 percent a year or so, then people can sell their homes and get out from under. I’ve also seen a decrease in short sales. They’ve pretty much been cut in half.”

Bonanno said the new TRID regulations ensure buyers receive more education at the beginning of the process, and knowing what they’re getting into when they take out a mortgage now will mean fewer foreclosures in the future.

“I think the banks are doing a much better job qualifying buyers,” Bonanno said. “After TRID, I think we’re going to see a very big decrease in failure to pay. Give us another five years and I think we might get back to a happy medium. We will go back to normalcy. We should have done TRID in 2010.”

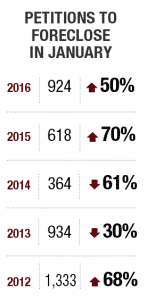

There were 924 foreclosure petitions filed in January 2016, up 49.5 percent over January 2015, according to data from The Warren Group, publisher of Banker & Tradesman. Between 2005 and the end of 2015, there were 74,048 residential foreclosures in the commonwealth. Foreclosure petitions fell dramatically in late 2013 largely in response to several Supreme Judicial Court decisions reversing foreclosures, including the famous U.S. Bank v. Ibañez.

New Laws Heal Old Wounds

In an unusual twist, a law recently passed by the Legislature and signed by Gov. Charlie Baker, SB 2015 (“An Act Clearing Titles to Foreclosed Properties”), is helping heal the market rather than hamstringing it further.

The law gives banks the assurance they need that any title defects that arise as a result of mistakes in the foreclosure process can be cleared if they are discovered, said Linda Kody, a Andover-based real estate agent who specializes in selling foreclosed properties and teaching other Realtors to do the same.

“The new law that Gov. Baker just passed to make things go more smoothly and take some of the gray areas away,” Kody said. “Lenders slowed the process down enough to make sure everything was proper. Now they’re able to move forward and get through the leftover inventory, the homes they couldn’t get to until the title issues were resolved.”

Kody said called the January rate of completed 348 foreclosures “a trickle” compared to 2010, when Massachusetts averaged more than 1,000 per month. She said many of the homes being foreclosed on today have been sitting in the pipeline, vacant, for years.

“Many of these houses have significant issues from being neglected or vandalized,” Kody said. “These are opportunities for an investor – the work is beyond the scope of an average homeowner.”

Whether the foreclosures are old or new is somewhat irrelevant, according to Grace Ross, executive director of the Massachusetts Alliance Against Predatory Lending (MAAPL). Ross says her organization is contacted by people facing foreclosure whose homes have been “in the pipeline” for several years and others who are new to the process. Either way, she said, the bigger issue is that banks are still making the same errors that resulted in the state Supreme Court reversing several foreclosures.

“We don’t see any difference in the process of the banks doing the foreclosing,” Ross said. “They’re violating as many laws now as they did then. In any one foreclosure we look at, we find dozens of violations. We are not seeing an improvement in banking practices at all. None. And we see dozens of cases every month.”

New Law May Help, But Is It Constitutional?

New Law May Help, But Is It Constitutional?

MAAPL is researching ways to challenge the constitutionality of An Act Clearing Titles to Foreclosed Properties, and attorney Glenn F. Russell Jr. thinks they have a strong case.

“Property rights are the most important thing a person has. You don’t take constitutional rights away just to keep the machine rolling, so people can make more money. The right case will expose these issues in court,” he said, adding that he thinks the law is “very susceptible” to constitutional challenges.

While property rights are nothing new, Russell said there isn’t enough case law yet to settle some of the tricky questions that arise during the complicated foreclosure process.

“Don’t get me wrong, I think the judiciary is doing a great job, Russell said. “I think isn’t enough known about these issues. Not a lot of people sufficiently oppose foreclosures. Securitized mortgages and how they intersect with property law is a fairly recently development and it hasn’t been challenged in court enough.”

Moreover, Ross alleges the legislation has “disparate impact on people of color and women heads of households who were targeted for subprime mortgages,” she said. “People need the ability to fight their foreclosures. The bill unintentionally harms people of color and women heads of households much more extremely. You had 20 years to challenge a foreclosure until this bill came along.”

Russell, who has represented people challenging foreclosures since 2006, thinks the trend of increases in foreclosures will continue.

“I think it will be around for a long time; it looks like it’s starting up again,” he said. “I think it’s going to get worse. From what I’ve seen, they’re starting it all over again. This whole thing is all predicated on selling securities. The financial markets have been moribund – that’s what this whole thing was about from the beginning. Foreclosing entities are just looking to move on.”