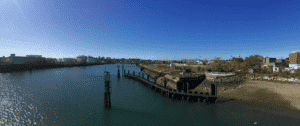

Chelsea officials are seeking to lure light industrial development to the Eastern Avenue corridor in their newly approved municipal harbor plan, as demand for marine-dependent uses declines. Photo courtesy of Chelsea Creek Municipal Harbor Plan and Utile Design

A ruling by the state’s top environmental official could clear the way for large-scale redevelopment of the Chelsea waterfront – including a new relief valve for industrial firms being squeezed out of Boston, Somerville and Everett by housing and life science projects.

This month’s state approval of the city of Chelsea’s municipal harbor plan allows more non-marine industrial uses for properties along Chelsea Creek, and building heights up to 80 feet on InterPark’s 21-acre airport parking lot at 111 Eastern Ave.

City officials envision a mixed-use development replacing the preflight lot, and are seeking to attract more light industrial projects that could pay for coastal resiliency projects and new waterfront parks. The city has not sought to rezone the area to include residential development.

“Chelsea’s approach is pretty smart,” said John Walkey, director of waterfront and climate initiatives for environmental justice group GreenRoots. “It keeps some industrial uses there, it keeps jobs for local people and tax revenues, and when the inevitable happens and it floods, you’re not having to evacuate residents from those properties.”

The marine industrial economy still dominates portions of the Chelsea shoreline, including the Eastern Salt Terminal and seven oil storage tank farms that supply Logan International Airport, home heating oil distributors and gas stations throughout the region.

From Marine Economy to Clean Tech

The municipal harbor plan approved April 1 gives the city of Chelsea more flexibility to approve non-water-dependent projects and higher densities. The decision by Massachusetts Secretary of Energy and Environmental Affairs Kathleen Theoharides applies to 25 parcels on the west side of Chelsea Creek, stretching from the Andrew McCardle Bridge on Meridian Street to the Revere line.

The marine industrial economy still dominates portions of the Chelsea shoreline, including the Eastern Salt Terminal and seven oil storage tank farms that supply Logan International Airport, home heating oil distributors and gas stations throughout the region.

Chelsea officials anticipate changes in future demand that could spur the acquisition of parking lots and other underutilized properties, and generate revenues that would be used for waterfront parks and climate change defenses.

Marine industry dominates most of the Chelsea shoreline, including the Eastern Salt Terminal (right). Photo courtesy of Chelsea Creek Municipal Harbor Plan and Utile Design.

One example is located at 295 Eastern Ave., a 19-acre former oil tank farm that was decommissioned in 1999. The property is currently occupied by a heating oil and propane distributor.

Boston-based GFI Partners proposes demolishing three small buildings on the site, developing a 114,000-square-foot warehouse, and creating 3 acres of new waterfront public access including trails and lookout areas.

The property was eyed by the parent company of Cape Wind for a diesel-fueled power plant in 2006, prompting GreenRoots to organize a successful campaign opposing the project because of its proximity to a nearby elementary school. The organization is looking more favorably upon the GFI warehouse proposal, according to a comment letter submitted to EOEEA on March 18, but asks that the project emphasize electric vehicles to minimize air pollution.

Another large development site with an uncertain future is located at the northeastern corner of the waterfront. The current owner, YIHE Forbes LLC, received approval in 2019 for nearly 600 housing units at the 18-acre former Forbes Lithograph Manufacturing property on Forbes Street. But the firm hasn’t moved forward on the project, and the property was recently listed for sale by Keller Williams Realty Boston-Metro. The listing is no longer active, Keller Williams’s Ken McClure said this week.

Parking Revenues Could Support Projects

A mixed-use redevelopment is envisioned in the city’s harbor plan for the InterPark property. The state’s recent decision allows building heights up to 80 feet across the entire 21-acre site, compared with the current zoning which ranges from a maximum of 55 feet along the waterfront to 255 feet along Eastern Avenue.

InterPark did not respond to a request for comment about its future plans for the property. Alex Train, director of the city’s Department of Housing and Community Development, said officials have had discussions with InterPark about a major development.

“We are presently looking to engage in collaborative planning with the property owner to eventually oversee a light industrial or commercial project with robust public access and high levels of living wages and job density,” Train said in a phone interview.

Steve Adams

On the upland side of Eastern Avenue, city officials are seeking to attract a mix of commercial and light industrial uses such as clean technology, Train said.

To pay for public benefits ranging from recreation to resiliency, Chelsea officials propose creation of a waterfront mitigation fund. Developers would contribute to the fund in exchange for zoning relief, and the money would be used to support water-dependent industrial uses.

Boston-based Conservation Law Foundation criticized the fund setup as described in the municipal harbor plan, citing lack of specifics about who would decide how it’s managed and spent. CLF singled out the city’s description of potential plans for the InterPark property, including replacement of the surface parking with a garage and dedicating a portion of parking revenues to the waterfront mitigation fund.

“There is no explanation or supporting logic for this approach or why it serves the public’s interests in a way that is comparable to or greater than MassDEP’s waterways regulations,” CLF Director of Environmental Planning Deanna Moran wrote in a 2021 comment letter.

In the wake of this month’s approval, the city of Chelsea will apply for a $150,000 grant from the state’s municipal preparedness vulnerability program to pay for planning and design for resilience projects along Eastern Avenue, Train said. Preliminary estimates place the cost of the work at $70 million to $90 million.

|

|