Two Boston office towers and a newly-completed Kendall Square research center lead the list of nine Massachusetts properties identified as non-core assets by the Trump administration, a prelude to their potential sale.

The John F. Kennedy Federal Building in Government Center and the Thomas P. O’Neill Jr. Federal Building in West End are among the prominent assets listed by the General Services Administration as non-core assets Tuesday before being suddenly pulled off the market a day later. The GSA, often called “the federal government’s landlord” is a federal agency that owns and manages most of the government’s offices and many of its real estate assets.

Elon Musk’s Department of Government Efficiency has been seeking to sell federally-owned real estate and cancel agencies’ leases in its bid to ostensibly cut federal spending.

While Musk and other senior Trump administration officials have unilaterally sought to slash federal agency headcounts in recent days, the White House appeared to walk back its highest-profile efforts Tuesday after a federal judge ruled they were likely illegal. But Congress could still pass a budget this year that cuts federal spending and headcounts in line with what the administration sought to do on its own over the last six weeks.

It’s also unclear if federal agencies would continue to lease space in any of the Massachusetts properties after a potential sale to a private owner, and how much more that might cost the government.

Designed by the modernist architect Walter Gropius, the Kennedy Building tower was completed in 1960 and includes 853,000 square feet of office space, including local offices for the state’s two U.S. senators, Elizabeth Warren and Ed Markey.

Its current assessment is $264 million.

The O’Neill Building was completed in 1986 and totals nearly 750,000 square feet and is assessed at $217 million.

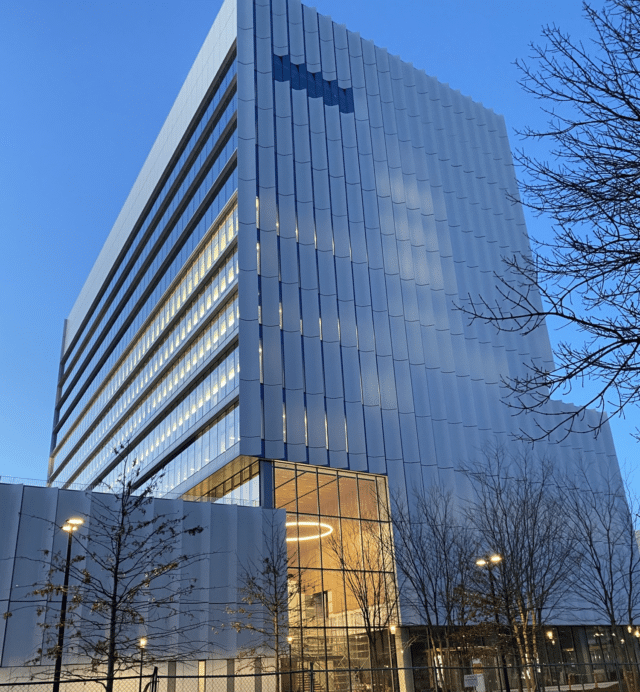

The new Volpe Transportation Systems Center in Cambridge’s Kendall Square was only completed in 2023 as a new state-of-the-art research center, following acquisition of the surrounding sought-after property in the tech hub by Massachusetts Institute of Technology for a large mixed-use redevelopment.

“Decades of funding deficiencies have resulted in many of these buildings becoming functionally obsolete and unsuitable for use by our federal workforce,” the GSA said in a statement. “We can no longer hope that funding will emerge to resolve these longstanding issues.”

The 384,000-square-foot IRS Center in Andover, the 138,000-square-foot Frederick C. Murphy building in Waltham and the 80,000-square-foot Philip J. Philbin federal office building in Fitchburg are the next largest Massachusetts properties identified as non-core assets. The list also includes the Silvio Conte Federal Building in Pittsfield, the U.S. Custom House in New Bedford and a Social Security Administration office in Fall River.

The complete list of 440 properties totals nearly 80 million square feet. The GSA estimates the properties are worth $8.3 billion.

In a statement, the GSA said the dispositions would take place “in an orderly fashion” and reduce spending on underutilized or aging facilities, including $430 million in operating cost savings.

According to data compiled by researchers at commercial real estate finance consultancy Trepp, the federal government’s largest office footprint is located in the Washington, D.C. area with nearly 36 million square feet at 438 properties.

Newton-based Office Properties Income Trust has a large federal office portfolio that is at risk from lease cancellations, executives disclosed last month. Federal agencies account for 17 percent of the REIT’s operating income.

The new Volpe Transportation Systems Center in Cambridge’s Kendall Square. Photo courtesy of the U.S. Department of Transportation