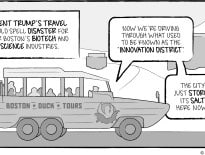

These first few weeks of the Trump Administration have been such a wild ride, one hardly knows where to begin analyzing what the flood of executive orders’ effects may be on our local politics and economy. Due to the limitations of this space, we’ll focus on just one – the recently reissued immigration/travel ban.

Signed Monday, March 6, the new ban is reverse-engineered to address many of the issues that made the first one subject to litigation. It protects green-card holders, those currently holding visas and drops Iran from the list of countries subject to the ban. As of this writing it remains to be seen whether legal challenges will be brought against this new order and on what grounds.

(We’re just gonna go out on a limb here and assume legal challenges will occur. Success of those challenges seem less likely than under the previous version, but we shall see.)

The original ban was the subject of, among many other think-pieces, a Forbes article tweeted by our own Steve Adams with this insightful commentary: “We were having a newsroom discussion last fall about what could tank the Greater Boston CRE/residential market; one factor we didn’t consider was shooting the life science industry in the head.”*

Blunt, but apt. The travel bans in either form could have a tremendous impact on the life science industry in the United States. And the life science industry is a tremendously important part of Greater Boston’s economic health. From the extraordinarily tight market in Kendall Square to spec development in the suburbs to our many colleges and universities, a hit to the robust, growing and healthy life science industry would affect Boston’s economy in ways we can’t even begin to imagine.

Immigrants are major contributors to biotech (and society at large) at all levels, from researchers to CEOs. Scientific breakthroughs rely on freely flowing information; restricting scientists from access to their peers and peers’ research – as has already happened at the EPA – will limit growth of the industry on all levels. We so far still have the internet to help bridge that in-person gap – but thanks to threats to net neutrality, the future of that is also in question.

Similar to our fair commonwealth’s health insurance situation, we assumed we would be inoculated from the worst of this administration’s misguided deeds (barring a worldwide crisis). But what happens in DC doesn’t stay there. It may well be that Greater Boston is in a better place, economically, geographically and politically, than much of the county – “better,” of course, being entirely subjective, but this is the hub of the universe, after all – but we are not isolated. We are not special. And as the country goes, so go we all.

* In case you were curious, newsroom speculation on what could tank the CRE/residential RE market included: crashing the world economy; rising sea levels; Chinese currency speculation; restrictions by that country’s government on American investment in real estate; and bear attacks caused by habitat destruction.

|

|