Developer Edens is adding 475 apartments, a 130-room hotel and 12-screen AMC Theatre as part of a $295 million expansion and redevelopment of Boston’s South Bay Center.

Evolve or die is the choice for an aging generation of shopping malls struggling to compete against e-commerce, outdoor lifestyle centers and reinvigorated Main Street shopping districts.

On the South Shore, a Utah developer plans to demolish the 46-year-old Hanover Mall and replace it with an outdoor shopping center called Hanover Crossing.

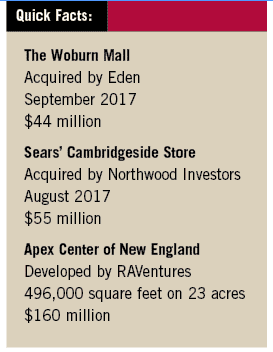

Speculation about the future of the Woburn Mall culminated this month with its $44 million acquisition by Edens. The South Carolina developer is leading the $295 million redevelopment of Boston’s South Bay Center into a mixed-use center including 475 apartments and a 130-room hotel.

Edens declined to discuss its plans for the property, but Woburn Mayor Scott Galvin said the company wants to add multifamily housing as part of a major redevelopment.

Retail specialists say the 23-acre property is ready for its next chapter, given its prime location with an access ramp to I-95/Route 128 near the I-93 cloverleaf.

“You don’t get a better intersection than that, and the key demographics that you look for,” said John Ferris, first vice president of retail for CBRE/New England. “They’ll look to fully de-mall it and add food, fitness and entertainment.”

Anchored by Market Basket and T.J. Maxx, the 41-year-old mall was last renovated in 2006 and contains a mix of storefronts with exterior entrances and an inline section. This month’s sale price was $18 million less than the previous owner, Bethesda, Maryland-based MEPT, paid for it in 2012.

Incentive to reinvent malls is likely to intensify. The financial performance gap between top-tier and class B mall properties continues to widen, CBRE research indicates. Net operating income at regional and super-regional malls was nearly identical at $5 per square foot as recently as 2010. As of June, regional malls trailed their larger counterparts by nearly $3 per square foot.

The reason: smaller malls rely heavily on slow-growing categories such as department stores and apparel. Larger properties have had success adding more restaurants, movie theaters, bowling alleys and new entertainment concepts.

“In short, the traditional mall model that was developed nearly 70 years ago is heavily dependent on categories that are … no longer meeting today’s consumer demands,” CBRE head of retail research Melina Cordero wrote.

That points to the need for new business models with a different merchandise mix. But landlords’ ability to make those changes are hindered by the length of expiring leases and anchor tenants’ veto power over major changes to the property, the report concluded.

“It’s a revolution that’s going on, and a lot of thought has been put into how to make this work,” said Robert Buckley, an attorney at Riemer & Braunstein who represents major retail landlords in land-use permitting. “You’re going to see both large regional malls as well as the second-tier malls redeveloping themselves as entertainment, recreation and experiential gathering places.”

The Sears Question

The exodus of traditional anchors such as Sears and Kmart – with more than 300 closings announced this year – could be an opportunity for mall landlords.

Sears recently sold its Cambridgeside store for $55 million to Denver-based Northwood Investors, leasing back the space through September 2019. In 2015, it leased space within its stores at Burlington Mall and Braintree’s South Shore Plaza to Irish retailer Primark.

In some cases, the departure of anchors has revitalized centers. After J.C. Penney closed its Natick Mall store, landlord General Growth Properties struck a deal with Wegmans for a 125,000-square-foot supermarket scheduled to open next spring.

“The older department stores have eaten up a lot of gross leasable area, and landlords in some cases are anxious to get that back,” CBRE’s Ferris said.

Rochester, New York-based Wegmans’ growth in Greater Boston triggered a more dramatic remake of Medford’s Meadow Glen Mall. Boston-based New England Development demolished the inline space last year and is nearing completion of a 120,000-square-foot Wegmans scheduled to open Nov. 5.

And Simon Property Group’s North Shore Mall is adding a new “Dining District” including Tony C’s, The Bancroft and up to three additional restaurants in a renovation expected to be completed next spring.

Is Entertainment The Answer?

Developers are watching the $160 million Apex Center of New England in Marlborough take shape as a potential new business model. The 496,000-square-foot complex owned by Westford-based RAVentures forgoes traditional tenants in favor of indoor kart racing, virtual reality arcades, a trampoline park and quick-service restaurants.

“That shows a little bit of the desperation of the retail end of the business,” said Peter Montesanto, a senior vice president at Colliers International in Boston. “We’re starting to figure out other concepts and go away from straight retail to more interactive stores. The good retailers will survive and prosper. The ones that are average are just not going to be able to hang on.”

The Apex Center strategy is nothing revolutionary, Riemer & Braunstein’s Buckley noted. Jordan’s Furniture opened its first IMAX theater at one of its stores in 2002, before Amazon emerged as a major threat to brick-and-mortar stores.

Suburban communities are waking up to the vulnerability of outdated malls, which are often one of their largest sources of tax revenues, and willing to consider alternate uses, Buckley said.

“In my type of work, that’s rare,” he said. “Usually the response is, ‘You want to do WHAT?’”

This article has been updated to correct the spelling of Reimer & Braunstein.

|

|