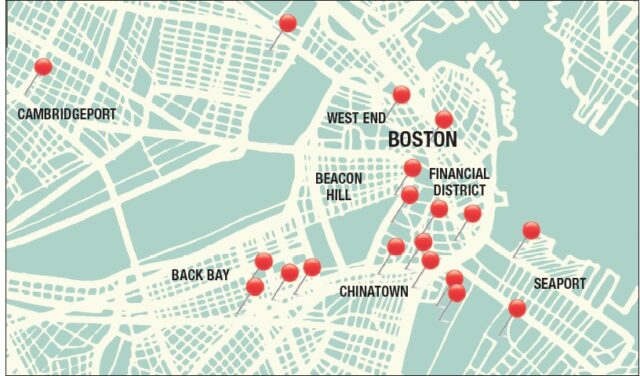

WeWork has carved out a pervasive presence in the local office market occupying over 1.7 million square feet at 19 properties in downtown Boston and Cambridge.

As the specter of bankruptcy hovers over the coworking giant, the potential closure of its trendy shared workspace hubs would free up new availabilities in office submarkets that currently have a shortage of sizeable space blocks. But a WeWork departure coupled with a broader economic downturn could have a more dramatic effect on the market down the road, real estate researchers predict.

“The downtown market is tight and if they were to close a couple of locations, we have the demand for space [from other companies],” said Elizabeth Berthelette, research director at brokerage Newmark Knight Frank in Boston. “We’ve been hearing rumblings that landlords are taking a step back if they’re in early negotiations with them. The biggest impact is what won’t be moving forward.”

WeWork is the dominant coworking player in Boston, comprising 3.2 percent of tenancy across the 72 million-square-foot office market, and it maintained its aggressive growth strategy during the third quarter. It inked an 87,000-square-foot lease at Manulife’s 200 Berkeley St. in Back Bay, another 106,000 square feet at 75 Arlington St. and 117,000 square feet at 100 Summer St, a tower which was acquired last week by Rockpoint Group for $806 million.

“I don’t see the trend toward flexible office space going away,” said Nancy Muscatello, managing consultant for commercial real estate researchers CoStar in Boston. “But the business model of WeWork gives some landlords pause. The arbitrage of signing a lease at the peak of the market and subleasing it out to people who would normally be working from home or a coffee shop: that model is a little more risky, especially at this point in the cycle.”

WeWork operates 19 locations in Boston and Cambridge, including 10 downtown.

WeWork currently has its biggest presence in Boston’s Financial District, occupying several high-visibility properties including 33 Arch St. and 1 Beacon St. It has its largest single job hub at Fortis Property Group’s One Lincoln, occupying 250,000 square feet.

But a pair of potential deals at 230 Congress St. and 14 Beacon St. recently fell through, according to a local real estate source, amid increasing leeriness among landlords.

Over $41B in Rent at Risk

New York-based WeWork is reportedly in negotiations on a $4 billion bailout from SoftBank and J.P. Morgan following the failure its long-awaited IPO which originally sought to raise as much as $47 billion.

WeWork is the dominant coworking player in Boston, comprising 3.2 percent of tenancy across the 72 million-square-foot office market. Image courtesy of WeWork

Because WeWork usually leases individual properties through special purpose entities, only a small portion of its rent is guaranteed. As of June 30, only $5.6 billion of its lease payments were backed by corporate guarantees or letters of credit, according to WeWork’s IPO prospectus. Another $41 billion in rent payments could be at risk in the event of a bankruptcy.

Tenants in WeWork’s enterprise workspace model, which provides dedicated larger spaces to corporations such as ezCater and Puma, might opt to remain in their existing locations and sign direct leases with landlords, researchers predict.

And WeWork would likely try to renegotiate terms with landlords before closing locations, said Peter Conway, a market analyst for CoStar in Boston. That could appeal to landlords as an alternative to converting the open-format, amenities-rich WeWork spaces back into traditional office space.

“A lot of their buildings are class A, top-of-the-market rents, so they could use their leverage to renegotiate,” Conway said. “It’s very expensive to re-build out a suite for a general office user.”

Eyes on Market Cycle Timing

Boston has recorded over 1 million square feet of positive office space absorption since January, including Foundation Medicine’s 580,000-square-foot lease at 400 Summer St. in the Seaport District. And rents on some Back Bay trophy properties are topping $100 per square foot on a gross basis for the first time ever, said Aaron Jodka, managing director of client services for Colliers International in Boston.

But there are recent signs that the unusually long commercial real estate growth cycle is close to exhausted, after driving vacancies in Boston’s central business district below 8 percent. During the third quarter, both Boston and Cambridge recorded over 150,000 square feet of negative absorption, according to Colliers data.

“The only time we’ve seen that in the past 20 years was in a recession or coming out of a recession,” Jodka said. “It’s safe to say we’ve reached the peak.”

Steve Adams

Currently, WeWork’s local offices are spread across a wide range of landlords, with Fortis Property Group’s One Lincoln tower having the largest single WeWork location at 250,000 square feet.

A decline in demand from traditional office tenants coupled with declining membership in WeWork locations could deal a double-whammy to the local market. And another 7 million square feet of new Boston office space is scheduled to deliver between 2021 and 2023, depending upon how many developers build on speculation, according to Colliers research.

While an economic downturn typically means corporate belt-tightening on real estate costs, the increasing acceptance of the coworking model could change the equation, said Jodie Poirier, managing director at CBRE Boston. Many Fortune 100-level companies now seek to locate about 25 percent of their office space in flexible workspaces, which offer cost savings and ability to grow and shrink faster than a traditional office lease.

“Flexibility across the portfolio is here to stay,” Poirier said. “The lack of capital outlay can help keep this an attractive product in a recession.”

|

|