IQHQ has partnered with Boston-based developer John Rosenthal of Meredith Management to build the 22-story second half of the Fenway Center air-rights project as office-lab space. Image courtesy of Gensler and SGA

Life science R&D development used to be tightly concentrated in Cambridge’s Kendall Square, where BioMed Realty and Alexandria Real Estate Equities jockeyed for prime lab sites in the backyard of Massachusetts Institute of Technology.

After East Cambridge solidified its role as global life science leader and its lab complexes reached capacity, Boston-based King Street Properties explored new frontiers such as Alewife, and new growth clusters emerged in areas like Allston and Watertown.

Record-setting venture capital investment in Massachusetts life science companies is likely to accelerate the industry’s space needs. VC’s invested $5.8 billion in the Bay State biopharma industry in 2020, according to a new report by Cambridge-based industry group MassBio. Massachusetts companies raked in 41 percent of all VC investment nationally.

It’s no surprise that the field of Greater Boston lab developers is widening, including new firms led by former executives at industry pioneers and others backed by established real estate investment firms.

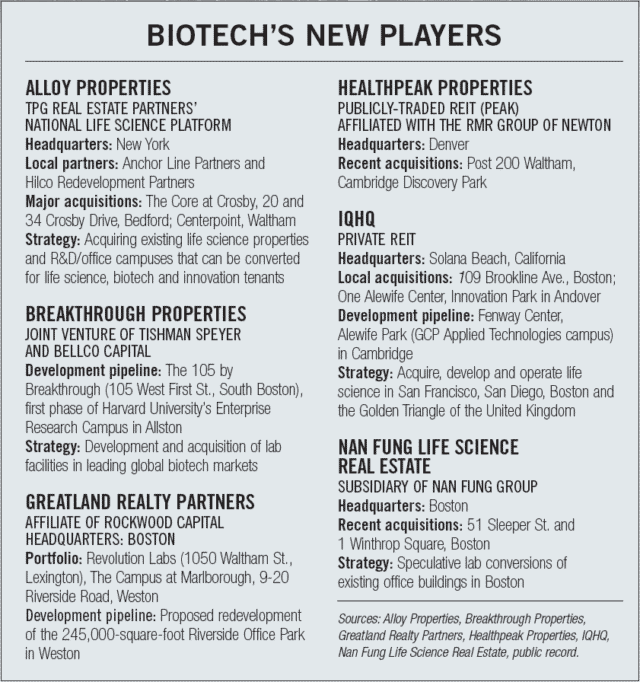

Alloy Properties is a life science platform formed in early 2020 by TPG Real Estate Partners, a San Francisco private equity firm with $6 billion in assets under management.

“In the life science space, there aren’t a lot of national firms,” said Jacob Muller, a managing director at TPG Real Estate Partners. “Rather than try to buy one of the existing firms, we thought we would build one within TPG.”

Alloy has acquired close to $1 billion of real estate totaling 2.2 million square feet since early 2020, with its largest presence in Greater Boston. Its two new office campuses in Waltham and Bedford include life science tenants such as Repligen and Abcam, and Alloy is investing in building upgrades to attract more biotechs as other tenants’ leases expire.

Alloy has acquired close to $1 billion of real estate totaling 2.2 million square feet since early 2020, with its largest presence in Greater Boston. Its two new office campuses in Waltham and Bedford include life science tenants such as Repligen and Abcam, and Alloy is investing in building upgrades to attract more biotechs as other tenants’ leases expire.

“People may not have viewed them as life science properties, but there were some strong life science tenants and lab space already and we said, ‘We can take it from 25 to 100 percent,’” Muller said. “We’re not only putting in the infrastructure, but building out spec lab suites to cater to smaller tenants that might not have the time or expertise. We want to be prepared for tenants of all sizes.”

Another well-capitalized newcomer making waves is IQHQ, a private REIT led by BioMed founder and Alexandria co-founder Alan Gold. The San Diego area firm has raised $2.5 billion in a pair of funding rounds since 2019 and made big-ticket acquisitions in Boston, Cambridge and Andover last year.

Plans include redevelopment of the 26-acre GCP Applied Technologies campus in Alewife and partnership with Meredith Management on a 720,000-square-foot air rights development over the Massachusetts Turnpike in the Fenway. IQHQ has already begun permitting in Cambridge for three new R&D buildings at the GCP property, adding 365,000 square feet of new development.

Construction of the Fenway project is scheduled to begin this spring, IQHQ said this week.

Breakthrough Properties, a joint venture of Tishman Speyer and Bellco Capital, is planning the 263,000-square-foot 105 by Breakthrough in South Boston’s A Street corridor. Image courtesy of Stantec

Spec Suites, Suburban Repositioning

Responding to early- and mid-stage life science companies’ urgent timelines for expansion, some developers are acquiring existing office buildings and adding lab infrastructure on speculation to build R&D suites. Nan Fung Life Science, backed by a Hong Kong-based real estate developer, is pursuing that strategy at 51 Sleeper St. in the Seaport District and 1 Winthrop Square in the Financial District.

A stagnant suburban office market also offers opportunities for life science conversions along the Route 128 belt.

Boston-based Greatland Realty Partners, led by a pair of former executives for Oxford Properties Group and Boston Properties, has acquired three suburban office properties with an eye toward life science growth. It’s proposing to rezone the former Liberty Mutual campus in Weston for life science uses.

Pushback in Boston, Open Arms in Somerville

Life science developers’ breakneck activity in the COVID era has gotten a mixed reception in Greater Boston communities.

Town meetings in Lexington and Burlington approved new zoning bylaws in the past year designed to make existing commercial districts more attractive to life science projects.

Somerville sought to attract more commercial space in its Union Square redevelopment plan and broaden the city’s job base, and master developer US2 is kicking off a 194,000-square-foot lab building in the first phase of the project.

At the same time, other developers are moving forward with life science projects on parcels surrounding the urban renewal zone, including Boston-based Leggat McCall’s 101 South St. lab building in the first phase of a 1.1 million-square-foot development.

Somerville City Councilor Ben Ewan-Campen said the projects fulfill the city’s goals of expanding its local employment base.

“For a long time, the narrative in Somerville was developers only want to build housing here,” Ewan-Campen said. “The city council was often fighting to limit the amount of housing that would be built, specifically to encourage commercial development to bring in jobs. What we’re seeing now is the market has shifted dramatically.”

But in Boston, the lab boom has prompted pushback in some quarters. In February, City Councilors Edward Flynn and Michael Flaherty sponsored a hearing to discuss the lack of a required community review for some lab conversions such as 51 Sleeper St.

Steve Adams

“Residents should have a say in what gets built in their community, especially if a lab can potentially impact public health and safety in the area,” Flynn said.

Flaherty raised concerns about the continuing influx of life science projects, including lab buildings with rooftop mechanicals that rise 35 feet above the building roofs.

“We’ve also seen developers get cute and put in a letter of intent… and they never mention the possibility of a lab space,” Flaherty said.

|

|