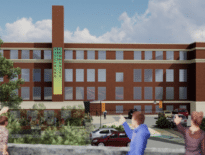

City Realty’s 1515 Hancock in Quincy Center is targeted to a wide range of potential tenants with creative deal structures and buildouts. Photo courtesy of City Realty

It is easy to get pessimistic while looking around at the state of the commercial real estate market. The headlines are filled with macro trends pointing downwards, providing a grim picture of the world of retail and office.

Save for a few high-profile companies signing large new leases in some of Boston’s newer class A buildings, there has not been a lot of good news to point to for properties in some of Massachusetts’ other urban communities or Boston’s smaller class B and C buildings.

However, at City Realty, we have seen firsthand that there are still opportunities available in the office market and new tenants in the market to fill those well publicized vacancies. Our strategy has focused on identifying quality existing buildings in strong underlying locations that have been hit hard by vacancies and the larger volatility in the office market. Then, through property improvements, marketing and creative leasing, stabilize the property and return it to positive cash flows.

One prime example is our purchase of 1515 Hancock in Quincy Center. Acquired in the summer of 2022, this 140,000-square-foot office building had been hit hard by recent lease expirations, leading to almost 60 percent vacancy at purchase. Despite the impaired state of the asset, we knew that if we could acquire it at the right price and manage it well, there remained a significant amount of value to be added.

Quincy Center’s Unique Advantages

First of all, we identified Quincy Center as a key driver of the value for the property. The neighborhood’s unique combination of transit access (the MBTA’s Red Line and commuter rail), highway access (Interstate 93) and urban amenities provided the best of all worlds to potential tenants. We felt confident that we could sell the appeal of such a location not only to the thriving, existing business community who want to stay in Quincy but also to tenants and employees across the state who are looking for a new home for their business.

With a wave of businesses leaving downtown Boston to reduce expenses, we believed there was a strong opportunity for buildings that offered a competitively priced space in an amenitized urban location just a couple stops further on the Red Line.

We also knew that investing in Quincy would mean coming into a community under Mayor Thomas Koch that has been laser-focused on activating its commercial districts through all the avenues available. They’ve rezoned key stretches of Quincy Center and streamlined their permitting process and made large parcels of city owned land available to encourage private development.

Also, the city itself has invested in common realm and infrastructure improvements in the immediate area, such as the revitalization of Ross Way and the building of new public parking garages. We saw clearly that if we did our part in improving the property, the surrounding area would do its part in helping the asset gain value.

Neighborhood Landmark Reinvented

The next step was to look at the property itself. Originally built in 1930 as the sole location of Remick’s department store, the limestone Art Deco structure featuring a notable clock tower saw numerous additions before finally being converted into retail and offices back in 1986. The current atrium building has street frontage on three sides and large windows all the way around, making the spaces bright and vibrant. Although the building had a few aging suites and a lobby that still reflected the dated design of its original conversion, the building was a long way away from needing a full renovation.

We saw a great potential for targeted, thoughtful injections of improvements in order to modernize the interior for a new generation of tenants. After a full rebrand of the building, we completed a redesign of the lobby; building in new congregation areas including a new central tiered seating structure. We also updated and subdivided some of the vacant suites to create modern, move-in-ready spaces.

Sean Rose

At the same time we were making the physical spaces more flexible, we were also providing a full-service approach to the building’s management and marketing. We wanted to ensure that any tenant, new or existing, could expect a professionally managed building that would suit their needs. With available vacancies ranging from 200 to 13,000 square feet, we were able to find a solution for tenants of any size within the building.

With a vibrant urban location, we widened our outreach to a full spectrum of business types; from traditional retail reliant on walk-in foot traffic to client facing businesses requiring a welcoming environment, to back-office services looking for a simple commute. Finally, we recognized right away that just as every business is unique, every tenancy would have to be unique. We remained adaptable; getting creative on deal structures and buildouts that worked best to get the tenant onboarded with an eye always on building long-term value through long-term relationships.

The commercial office market has certainly changed irrevocably. No longer can operators expect commercial properties to be a low maintenance proposition; lightly managing dated, aging assets from afar while relying on regular appreciation and a deep supply of new tenants to add value.

It takes disciplined, thoughtful capital improvements, relationship-based property management, and high effort, boots-on-the-ground marketing to stabilize vacancies. While it may take time to adapt to the new normal and achieve an asset’s goals, there remains a strong future for investors who can identify underlying value and execute on opportunities.

Sean Rose is an acquisitions associate at City Realty.

|

|