The remains of a pier in Boston’s North End poke above the water in Boston Harbor. Housing developers and marinas are seeking to head off a sweeping overhaul of Massachusetts’ coastal development rules. Photo by Steve Adams | Banker & Tradesman Staff

The biggest changes in decades to Massachusetts’ coastal development and stormwater regulations seek to push projects away from the waterfront and minimize the growing threat of inland flooding.

The Healey administration’s proposed overhaul of the state’s wetlands and stormwater regulations faces a backlash from industry groups predicting dire economic consequences for homeowners, developers and the state’s marine economy.

Owners of marinas from Cape Ann to Provincetown predict that strict enforcement of the new rules could put them out of business.

“These are businesses that have been adjusting to water level rise and storms,” said Randall Lyons, executive director of the Massachusetts Marine Trades Association. “They know how to handle a lot of these issues.”

Homebuilders and commercial developers say the regulations would drive up housing prices, discourage mill-to-residential conversions and make more affordable housing projects impossible to finance.

“It would make certain projects completely unfeasible, and housing projects already are at the limit of penciling out with interest rates so high,” said Jeffrey Brem, immediate past president of the Home Builders & Remodelers Association of Massachusetts and president of a Westford engineering firm.

First announced in December 2023 by Gov. Maura Healey, the new resilience regulations target the growing threats of coastal and inland flooding. They encourage “nature-based solutions” rather than fighting rising seas in the coming decades.

A final decision is expected in early 2025. The state Department of Environmental Protection initially announced that it would issue the final decision by the end of 2024, but has received hundreds of comments from a wide array of industry groups. A final decision is now due in early 2025, MassDEP spokesperson Fabienne Alexis said.

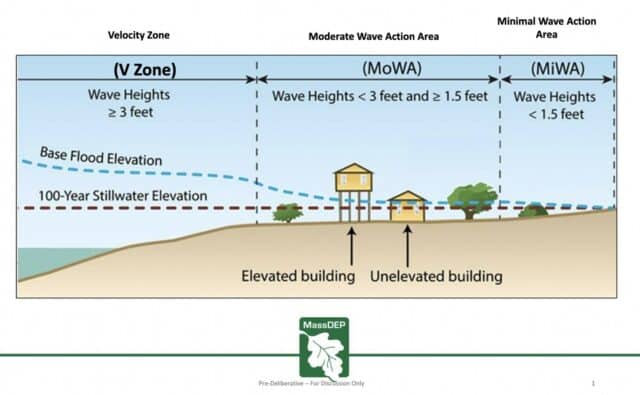

A slide from a MassDEP presentation about the Healey administration’s proposed updates to state stormwater and coastal development rules shows the different coastal zones. Image courtesy of MassDEP

‘Velocity Zone’ Construction Ban

The proposed resilience regulations affect an estimated $55 billion worth of real estate located in coastal floodplains in 78 cities and towns. They would ban new development in a tier of flood-vulnerable waterfront properties, and set tougher standards for rebuilding structures.

New construction would be prohibited in so-called “velocity zones” – a category of high-risk properties subject to wave heights over 3 feet in coastal storms.

Boston-based Conservation Law Foundation supports the changes because they reflect recent research on rising sea levels and extreme weather.

“These are places that we should not be building on,” said Ali Hiple, a CLF senior policy analyst. “It’s the places that are getting hit by storms and coastal flooding. Anything that goes there is at extreme risk and would need severe floodproofing, or having to rebuild that structure if it gets destroyed.”

Construction in the velocity zones also can intensify flood impacts on neighboring properties, Hiple added.

At least one proposed waterfront development in Boston faces permitting challenges if the new regulations are adopted.

The $90 million Neponset Wharf project received approval from the Boston Planning & Development Agency in 2022. The project would have replaced boat storage warehouses and parking on Dorchester’s Port Norfolk peninsula with 120 housing units, office and retail space.

A spokesperson for developer CPC Ericsson said this summer that the proposed new velocity zone regulations delayed closing on a construction loan.

Waves from a March 2018 nor’easter slam into the seawall along Swampscott’s King’s Beach. Even away from the coastline, industry groups say new regulations would harm housing production. iStock photo

Higher Stormwater Standards for Housing Projects

Away from the coastline, the costs of new stormwater regulations alone could have a significant dampening effect on residential development, said Brem.

Housing subdivisions would have to install more robust stormwater systems to handle the higher precipitation models included in the new regulations. The cost would be $18,500 per home lot in a 26-lot residential subdivision, according to an analysis by Bolton-based Comprehensive Environmental Inc. cited by the homebuilders’ group.

The tougher standards could make it harder to redevelop buildings such as mill-to-housing conversions located near waterways, said Anastasia Daou, vice president of policy and public affairs at commercial developers’ group NAIOP Massachusetts.

“There’s been good policy in the commonwealth to encourage redevelopment of those old mill buildings and we see that legacy throughout the state. These regulations will make it much more difficult,” Daou said.

An analysis by Danvers-based engineering firm Hancock Associates lists four recent projects including affordable housing that would have been scaled back or shelved entirely due to financial reasons if the new regulations were already in effect.

Housing developments with up to four units would be exempt from the new standards, according to the DEP.

Steve Adams

Marinas Face Uncertain Future

Owners of marinas and boatyards are wary of new barriers to rebuilding structures after future storms and upgrading their current facilities.

In a comment letter to DEP, Ann Lagasse, owner of Ocean Havens LLC, said plans for new buildings and additions are at risk because of the proposed restrictions on building in velocity zones. The Charlestown-based company owns six marinas in Boston and Provincetown and leases the East Boston Shipyard and Marina from Massport.

Shipyard owners will face financial difficulties financing their capital improvements without further clarity about the need to relocate buildings and elevate structures above projected future sea levels, the maritime trade association’s Lyons predicts.

The marine trades association argues the regulations should provide more flexibility for “rolling capital projects” to spare members excessive financial burdens.

“These are family-run businesses that have already been adapting for centuries, and it could put many of our members out of business, frankly,” Lyons said.