The Massachusetts Convention Center Authority will drop its immediate plans for development of 6.5 acres near the Boston Convention and Exhibition Center, opting for a broader look at its strategy and the changing market conditions in commercial real estate.

The authority received bids from Cronin Group and Boston Global Investors for developments including a large segment of life science space on the D and E Street parcels, but halted its plans to pick a development team last year amid a change of leadership.

Interim Executive Director Gloria Larson said she will ask the MCCA board Thursday to halt the D and E Street parcels’ disposition and begin a new market study of all the MCCA’s properties.

“I believe we must seek a fresh understanding of today’s market conditions to ensure the wisest path forward for generations to come,” Larson said in a statement released today. “In addition, after researching the process to date, I could not conclusively determine that all bidders had access to equivalent information or insights. The Board, the community, our stakeholders, and the public have every right to expect a procurement that is thoughtful, fair, and robust.”

Larson told the Boston Globe in an interview that a law firm hired to examine the RFP process discovered that the agency shared some documents with an attorney for Cronin Development but not BGI, both before the issuance of the RFP and afterward, including each team’s financial offer.

Larson succeeded former MCCA Executive Director David Gibbons, who resigned in November amid criticism of the selection process and the agency’s diversity track record.

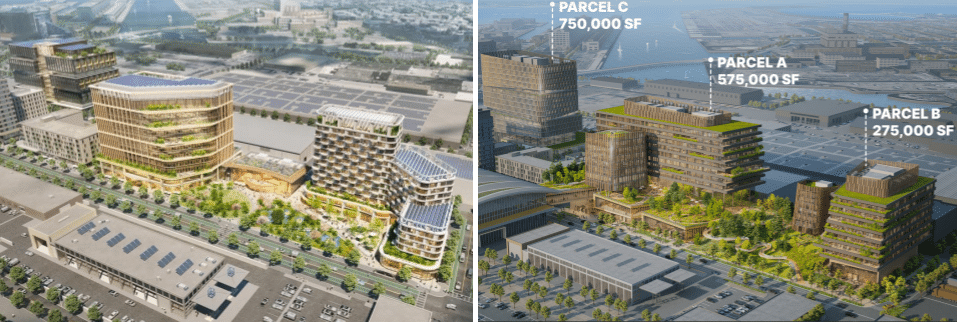

The agency had been set to vote in November on the selection of Cronin Group, best known for its St. Regis Boston Seaport condominium tower, which proposed 1.6 million square feet of commercial space. Boston Global Investors, the original master developer of the Seaport Square project, proposed a 1.1 million-square-foot project.

The two developers were the only firms to respond to a pair of requests for proposals in 2022 and 2023, which offered up vacant parcels and parking lots near the convention center.

The commercial real estate market has changed dramatically since 2022, when the agency first put out the request for proposals. Demand for life science space has shrunk amid declines in venture capital funding, while the hotel market has bounced back from its COVID-era doldrums.

Messages were left with Cronin Group and BGI seeking comment.

Rival development proposals by BGI (left) and Cronin Group (right) would have added housing, lab space and a range of community amenities on land originally taken by eminent domain for the Boston Convention and Exhibition Center. Images courtesy of CBT (left) and Sasaki (right)

|

|