Hobbs Brook Management tore down an aging office building at 275 Wyman St. in Waltham to make way for Cimpress’s new 300,000-square-foot headquarters, which contains collaborative and price workspaces, impromptu meeting spaces and game room.

Vacancies and sublease space are up along the Route 128/Mass Pike office market, yet rents are rising steadily.

At first it seems like the law of supply-and-demand has been suspended, but the explanation lies in the booming development and repositioning climate. Tenants are trading up to newly built or renovated spaces and willing to pay a premium for state-of-the-art facilities in a suburban market where the average age of an office building is 35 years.

“When somebody builds a new building and charges a higher rent, the second-tier buildings get dragged up in a rising market,” said Duncan Gratton, an executive managing director at Cushman & Wakefield. “There’s good demand out here and there’s not a lot of good quality space.”

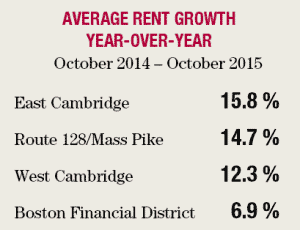

Asking rents in the Route 128/Mass Pike corridor, traditionally the Bay State’s strongest suburban office market, spiked nearly 15 percent in the 12 months ending Oct. 30, according to JLL’s Office Insight report. Class A properties hit their highest levels since 2001 at $33.45 per square foot.

The rent gains take place even as new development has added over 250,000 square feet of class A office space to the 20.6-million-square-foot market this year, helping drive up vacancies from 13.1 percent to 15.2 percent since Jan. 1.

Route 128/Mass Pike has seen the second-highest growth in office rents over the past year, trailing only biotech hotbed Kendall Square while easily outpacing Boston’s Financial District and Back Bay.

Developers are taking note of the positive reception and putting more projects in the pipeline. The market continues to see a strong preleased construction scene, with such recent projects as the new 280,000-square-foot TripAdvisor headquarters in Needham, and current construction of the new Clarks shoes offices and Wolverine Worldwide offices in Waltham.

“It’s driven the overall quality of the supply up, and a result the rents as well,” said Lisa Strope, New England research manager for JLL.

TripAdvisor paid $33 per foot when it signed a 16-year lease for its state-of-the-art headquarters in mid-2013. Since then, average asking rents for class A space in the submarket have increased nearly 20 percent, from $27.93 to $33.45 per square foot.

Developers Become Rehab Addicts

Developers Become Rehab Addicts

Gut rehabs of older office and industrial properties along 128, often combined with housing and retail, are attracting intense interest among developers for value-add projects as single-use office parks look increasingly dated.

“Upgrading the general quality of the supply is really bringing up that market as a whole,” JLL’s Strope said. “There’s still really strong demand for the suburbs with a lot of companies coming out of Cambridge looking for bigger footprints that are not available in other markets.”

Boston Properties is building a new headquarters for footwear manufacturer Wolverine Worldwide at 500 Totten Pond Road in Waltham, which is scheduled to be completed next year. Wolverine will relocate from Lexington to 150,000 square feet in the 230,000-square-foot 10 CityPoint building, which also includes ground-floor restaurant space.

Boston Properties is in negotiations for the remaining office space at 10 CityPoint. In a quarterly report, the REIT said rents for its Waltham space are 25 percent higher than 18 months ago, driven by expansion of tech and life science tenants within the market.

Boston Properties also is redeveloping the 115,000-square-foot former Polaroid building at 1265 Main St. for the new Clarks North America headquarters, in the first $18 million phase of a joint venture. The office building is next to a new retail plaza anchored by Market Basket.

Waltham-based Hobbs Brook Management put the finishing touches last week on 275 Wyman St. in Waltham, which is the new home for 1,000 employees of marketing material designers Cimpress, formerly known as Vistaprint. Hobbs Brook demolished an 80,000-square-foot office building completed in the 1960s to make way for the fully leased build-to-suit project.

The Margulies Perruzzi Architects-designed building is clad in a glass curtain wall that allows natural light deep within floor plates. The 300,000-square-foot offices contain a mix of collaborative and private “library” workspaces, impromptu meeting spaces on each floor, game rooms and a fitness center.

Next up: 610 Lincoln St. North, where Hobbs Brook just completed a gut renovation totaling $15 million including a new facade, windows and elevators to the 86,169-square-foot building dating back to 1970. It’s marketing rents in the mid to high $30s, reflecting the appeal of 21st-century workplace designs, said Patricia Holland, assistant manager of construction, real estate and leasing for Hobbs Brook Management.

“These tenants are looking for more collaborative areas, open floor plates and they’re looking for great amenities,” Holland said.

In Needham, Normandy Real Estate Partners is bringing the live-work-play development scheme to the 185-acre Needham Crossing business park. Normandy is in local permitting for a $300 million mixed-use project including offices, a hotel and 390 apartments.

Suburban repositioning projects continue to be a key element of Boston-based Davis Cos.’ acquisition strategy. Davis Cos. paid $52.5 million in October for 1025-1075 Main St. in Waltham, a former BayBank office property built in 1983. Davis Cos. plans a significant renovation including new lobby, fitness center, food services and amenities, President Jonathan Davis said.

In an era where urban living and workspaces are touted as the key to attracting young talent, Greater Boston’s limited supply of developable commercial land supports the resiliency of core suburban office markets.

“The interesting thing is land is very difficult to find inside 128, and we’ve seen many examples of older industrial buildings knocked down or upgraded to office use, and that trend is going to continue,” said Joe Fallon, New England market lead for Cushman & Wakefield. “There’s good demand, and the supply side is challenging.”

|

|