Asian homebuyers have been a strong and growing force in the Greater Boston real estate market for decades, and a report from the Asian Real Estate Association says their impact is only going to grow in the years to come.

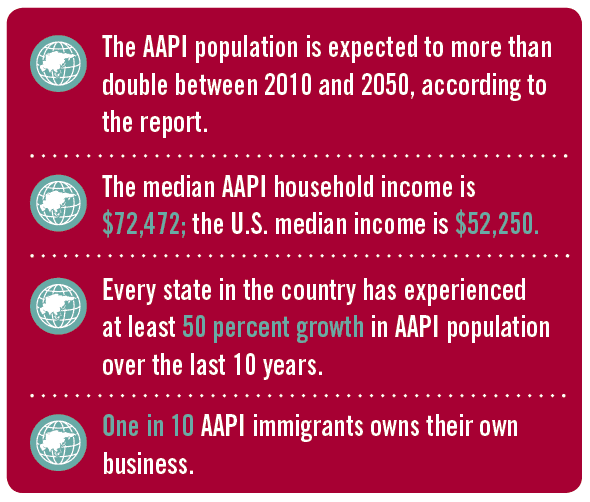

The Asian American/Pacific Islander (AAPI) population is expected to more than double between 2010 and 2050, according to the report. Every state in the country has experienced at least 50 percent growth in AAPI population over the last 10 years.

The report said China and India have replaced Mexico as the largest source of U.S. immigrants. Chinese immigrants make up the bulk of the AAPI population in America, followed by the Philippines, India and Vietnam.

Greer Tan Swiston has been selling real estate in and around Newton for the past decade. She is the daughter of Chinese immigrants, speaks fluent Mandarin and has traveled to China to lecture about the American homebuying process. She said most of the AAPI buyers in her market are from China and India.

“The Chinese market is interesting. They didn’t allow private citizens to own property for many years, but 15 to 20 years ago they opened it up to everyone,” Swiston said. “But over there, they only own buildings, not the land. That’s one of the reasons American real estate is so popular over there. Here, you actually own a little piece of the country.”

According to the report, the median AAPI household income is $72,472, which is 39 percent higher than the U.S. median income of $52,250. Indian income is on the high end of that at $100,547, while Hmong and Bangladeshis are on the low end.

AAPI immigrants are also more likely to have a savings account than the typical American and one in five also own stock. Swiston said the difference is cultural.

“I’m American born and raised, but Chinese culture is bred into me,” she said. “Your average Asian-American sees investments in a different order than an American. Americans invest in the stock market, then a home. Chinese people tend to invest in investment properties, then you start thinking about mutual funds and things like that.”

One in 10 AAPI immigrants owns their own business, but that can complicate financing, said loan originator Dick Lee, who is also the president of the Boston chapter of the Asian Real Estate Association of America (AREAA). Those buyers often take legal deductions through their business, which can make it look like they earn less than they do. He said an understanding of the culture and the origination process is key.

“If you’re an Asian-American homebuyer buying a house for $550,000 in West Roxbury and you put 40 percent down, your tax returns may not reflect your income,” Lee said. “Is that a bad loan? It doesn’t show their ability to repay. They’re penalized even though they’re operating within the tax code. I have products now where lenders will do that deal.”

Lee, who grew up in America, said he finds that outright racism is rare, though he still encounters the expectation of a stereotypical “submissive” Asian. His AAPI buyers are the same as every other buyer, he said; the mortgage process is complicated for everyone, and presents a learning curve for most people.

Swiston advised against making any assumptions or generalizations about Asian buyers. Some place a lot of importance on the position of the home relative to moving water or intersecting streets, and other things related to feng shui principles, and others don’t. She said it’s important to talk to AAPI buyers what they want and want to avoid, just like anyone else.

“If you’re a good agent, you’re sensitive to whatever your client wants,” Swiston said. “The number four sounds a lot like the word ‘death’ in many Asian languages. It’s not a superstition, it’s just that who wants to have an address that sounds like death?”

Lee said some AAPI buyers believe in feng shui to varying degrees and will avoid homes near a cemetery, or homes where the front door is opposite the bottom of the staircase. He said education for their children is at the top of most AAPI buyers’ wish list.

“They’re looking for properties in Boston and Greater Boston and an upper-middle class communities in good school system like Lexington, Newton and Wellesley,” Lee said.

The AREAA statistics bear that out. Nearly 50 percent of AAPI have a bachelor’s degree as opposed to just 28 percent of the general population. AAPI buyers are also more likely to have an advanced degree.

Swiston said most of her AAPI clients are buying homes in Newton either because their children live nearby and they don’t want to stay in a hotel when they visit, or they are families looking for an excellent school district. She’s seen a significant increase in the number of AAPI buyers over the last few years. She thinks there are a couple of reasons for that.

“You can attribute it to the threat of monetary instability in China,” Swiston said. “Given that’s the fastest-growing ethnic group, it explains the huge influx of buyers. It seems to have plateaued a little bit. It hasn’t gone down, despite the fact that we’ve seen some economic woes in Asia.”

Swiston has some anecdotal evidence that the AAPI homebuying population is here to stay.

“I see agents whose English is poor and only cater to specific buyers [that share their first language],” Swiston said. “That tells me the business is strong enough in the Asian sector, that they can survive with such a limited clientele. It’s an indicator of where things are at.”