A new report from Apartment List researchers shows the dramatic disparity between housing production in Greater Boston and other parts of the country often touted as the region’s chief competition for residents and talent.

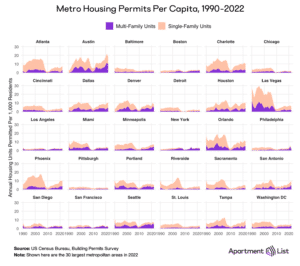

Researchers at the company analyzed building permit data from the Census Bureau for the nation’s 50 largest metro areas for the number of units OK’d per resident living there from 1990 to 2022.

Because the report used Census Bureau definitions for metro areas, its data on Greater Boston includes Southeastern New Hampshire’s Strafford and Rockingham counties in addition to Essex, Middlesex, Norfolk, Plymouth and Suffolk counties in Massachusetts.

Towns and cities in this large area OK’d an average of about 14,200 homes per year between 2003 and 2007, with a peak in 2006 of roughly 17,000. From 2012, when the Massachusetts housing sector finally began to shrug off the Great Recession, to 2022 the average was about the same, with only around 12,000 units OK’d in 2012 and 2013 and a more sustained average of 15,000 per year permitted from 2017 to 2022. Before the Great Recession, production was roughly evenly split between single-family and multifamily buildings. Afterwards, the ratio was closer to 2 to 1 in favor of multifamily production.

Per-person, that’s worked out to an average of 2.79 units of all types, per person per year, permitted in Eastern Massachusetts and Southeastern New Hampshire between 2017 and 2022, with just shy of 3 units OK’d per person last year.

Over that time period, that’s consistently put Boston between 33rd and 36th in the nation for housing production per person. Sun Belt communities like Austin, Texas, Nashville, Tennessee and Raleigh, North Carolina consistently landed the top spots from 2017 to 2022, Apartment List’s report said, with as many as 11.2 multifamily units and 10.4 single-family units permitted per person in Austin in 2021 alone.

Housing economists, advocates and real estate industry leaders have long blamed Boston’s high home prices and rents relative to the rest of the country on a lack of supply. Apartment List’s own research put the average rent for a two-bedroom apartment in the Boston market – a smaller region than the seven-county area covered in its housing production report – in February at $2,066, and Austin’s at $1,780. The former was up 4.7 percent year-over-year, while the latter was up only 1.8 percent, the report said.

“Our region is one of the most economically productive in the country, yet Boston builds far fewer homes than many comparable sized (and smaller) cities that are much more affordable than us. If we have any dream of making Boston affordable for all, we must #BuildMoreHomes,” Abundant Housing-MA executive director Jesse Kanson-Benanav tweeted in response to the survey.

The researchers behind Apartment List’s survey drew similar conclusions.

“The U.S. is currently in the throes of an ongoing housing affordability crisis, which has only grown more acute in the face of disruption caused by the pandemic. Increasing the nation’s housing supply is crucial to relieving the pressure of this crisis. While permitting activity for new multifamily housing units is currently stronger than it has been in decades, single-family construction continues to lag, keeping homeownership out of reach for many younger Americans looking for a starter home. And while many Sun Belt markets are doing a decent job of building enough new housing to keep pace with growth, the nation’s most expensive markets are continuing to severely underbuild,” wrote the company’s senior housing economist Chris Salviati and research associate Rob Warnock.

|

|