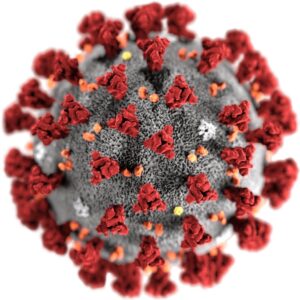

An illustration of the new coronavirus that causes the disease COVID-19. Image courtesy of the Centers for Disease Control.

Massachusetts small businesses affected by the coronavirus can now apply for disaster assistance loans through the U.S. Small Business Administration.

The low-interest federal disaster loans provide working capital to Massachusetts small businesses experiencing substantial economic injury, as a result of the coronavirus (COVID-19), according to a statement from the SBA.

“SBA is strongly committed to providing the most effective and customer-focused response possible to assist Massachusetts small businesses with federal disaster loans,” SBA Administrator Jovita Carranza said in a statement. “We will be swift in our efforts to help these small businesses recover from the financial impacts of the Coronavirus (COVID-19).”

Small businesses, private non-profit organizations, small agricultural cooperatives and small aquaculture enterprises that have been financially impacted by the coronavirus since Jan. 31 could qualify for Economic Injury Disaster Loans of up to $2 million to help meet financial obligations and operating expenses which could have been met had the disaster not occurred, Carranza said.

SBA acted under its own authority to declare a disaster following a request received from Gov. Charlie Baker on March 17, the SBA said, as provided by the Coronavirus Preparedness and Response Supplemental Appropriations Act that was recently signed by President Donald Trump.

The disaster declaration makes SBA assistance available in Massachusetts; the contiguous counties of Hartford, Litchfield, Tolland and Windham in Connecticut; Cheshire, Hillsborough and Rockingham in New Hampshire; Columbia, Dutchess and Rensselaer in New York; Bristol, Newport and Providence in Rhode Island; and Bennington and Windham in Vermont.

“These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact,” Carranza said. “Disaster loans can provide vital economic assistance to small businesses to help overcome the temporary loss of revenue they are experiencing.”

Eligibility for Economic Injury Disaster Loans is based on the financial impact of the Coronavirus (COVID-19). The interest rate is 3.75 percent for small businesses. The interest rate for private non-profit organizations is 2.75 percent. SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years and are available to entities without the financial ability to offset the adverse impact without hardship.

“The SBA Massachusetts District Office and our partners are available to assist small businesses with applying for disaster assistance and providing recovery technical assistance,” Massachusetts District Director Bob Nelson said in the statement. “We are committed to providing the latest guidance to our lending and community partners.”

The deadline to apply for one of these loans is Dec. 18, 2020.