The second round of loan applications for the government’s small business relief program has been slowed by computer issues at the Small Business Administration.

Lenders complained Monday that they couldn’t get their applications into the SBA system known as ETran that processes and approves loans. The agency said it notified lenders Sunday that it was limiting the number of applications any lender could submit at once.

The SBA began accepting applications at 10:30 a.m. for $310 billion in funding. The program’s initial $349 billion was exhausted in less than two weeks after more than 1.7 million loans were approved. That first round was also slowed by computer issues at the SBA.

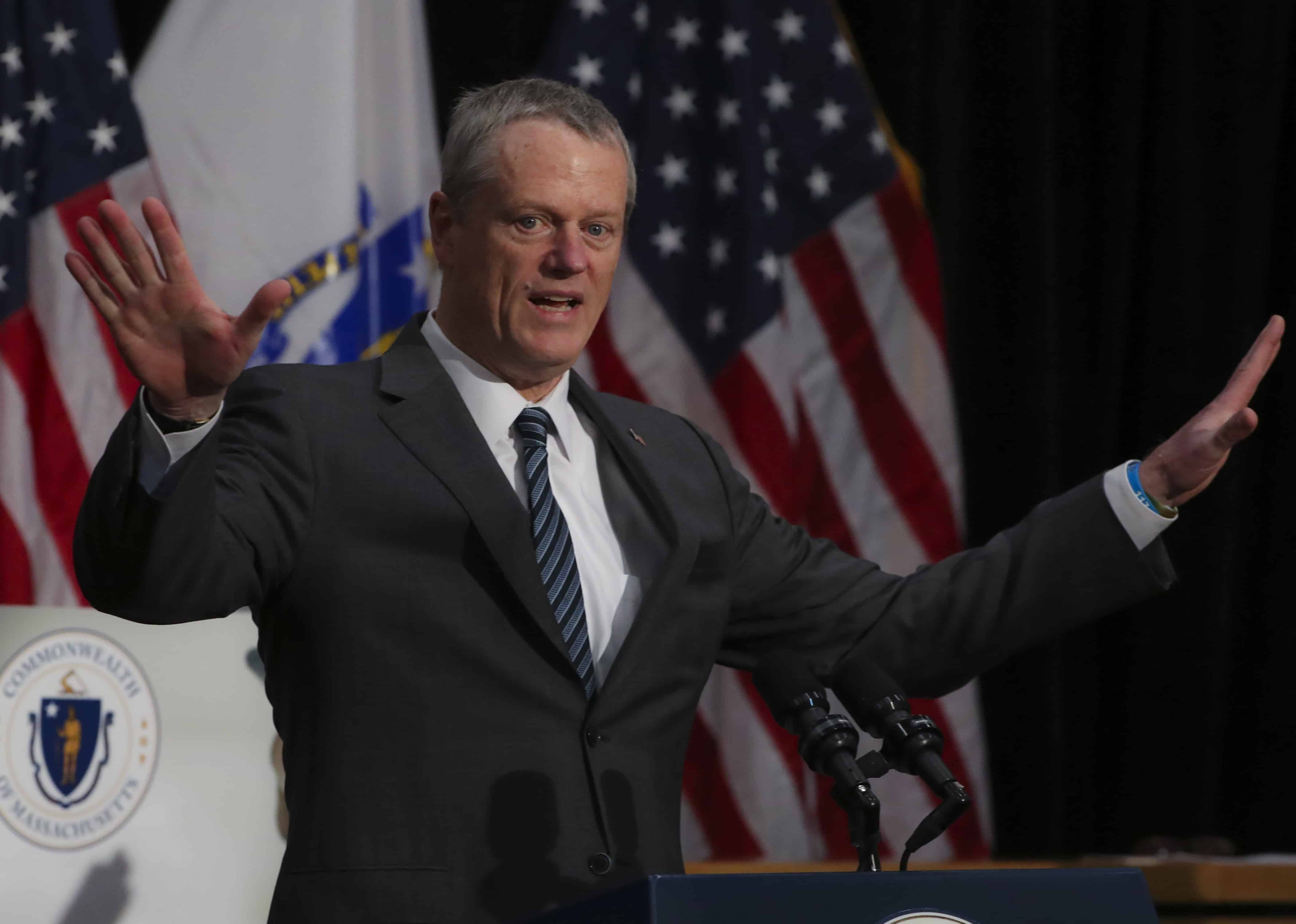

“Yesterday was a fiasco,” said Joseph Baptista Jr, president and CEO of Taunton-based Mechanics Cooperative Bank.

Baptista told Banker & Tradesman that problems with the SBA system yesterday meant five lenders were able to submit only six applications throughout the day.

Lenders at 5 a.m. this morning still could not submit applications, Baptista said, though the system seemed to improve later in the morning.

Mechanics Cooperative Bank had about 80 applications to process Monday, including ones submitted but not completed before the first round of funding ran out on April 16 and applications received last week.

Big Banks Privileged

Baptista said the bank continues to take calls from customers and non-customers looking to apply for PPP loans. After putting a temporary hold on non-customer applications shortly after the first round of PPP loans began, Baptista said, the bank began accepting those again before the first round closed.

“We really feel we’ve got a good process here to close more loans to get more money into the hands of small business owners,” Baptista said. “The frustration is with the guidance that changes on a daily basis and the system.”

Baptista said SBA personnel in the Massachusetts and Rhode Island district offices have been helpful throughout the process. His frustration is with the SBA office and Treasury Department in Washington.

“We’re asked to be the facilitator between the government and the small business owner, and it feels like we’re being held to a different standard than what the Treasury and the SBA are held to with regards to this program.”

One change allowed banks to submit applications in batches of 15,000, later reduced to 5,000. The batch processing favored large financial institutions over community banks, Baptista said, adding that he suspected the batch submissions slowed down the system for others.

11th-Hour changes

Banks across the U.S. also experienced problems.

Banks had thousands of applications ready to go Monday. Richard Hunt, president of the trade group Consumer Bankers Association, said the SBA’s announcement on application limits was too last-minute – bankers had already sent large batches of applications to the agency, not knowing that a new procedure was being planned.

“We learned at the 11th hour that SBA had changed its process. They could have told us well ahead of time,” Hunt said. He said the agency’s computers weren’t able to accept even the reduced number of applications per hour that it had planned.

The ETran system normally handles under 60,000 applications in a year and wasn’t built to handle the volume of applications it has been receiving this month.

The fresh round of funding was expected to go quickly because banks already had thousands of applications in hand and were accepting more as they waited for Congress to approve the additional money. If the new funds do get depleted, it’s feared that many companies will be shut out unless lawmakers are willing to approve a third round.

The loans offer forgiveness for the money owners spend on workers’ pay. Millions of workers lost their jobs as companies such as restaurants, retailers, gyms and entertainment venues were forced to close to curb the spread of the virus.

On Monday, bankers around the country were having trouble getting into the SBA’s system, said Paul Merski, a vice president at the Independent Community Bankers of America.

“Some have been trying all day since it opened,” Merski said. “It’s not different from what happened in the original launch.”

Material from the Associated Press was used in this report.