State Street Corp. is vacating two of its four Quincy office buildings. Braintree-based developer Campanelli converted a former State Street building at 2 Heritage Drive in North Quincy into multitenant office space before selling it to Grander Capital Partners in 2016. Image courtesy of CBRE

Boston’s South Shore office market is usually well-insulated from boom-and-bust cycles, a reflection of its financial service industry cluster that seldom makes drastic changes in real estate footprints.

However, State Street Corp.’s recent decision to sublease two of its four Quincy office buildings totaling nearly 390,000 square feet shakes up a suburban submarket that’s been the heart of the financial service provider’s back office presence in Massachusetts. CBRE/New England is marketing the sublease spaces at 200 Newport Ave. and 1200 Crown Colony Drive.

Attempts to find big tenants to fill the two buildings take place as Dorchester starts to emerge as competition to North Quincy, with Nordblom Co. marketing nearly 700,000 square feet of office, lab and manufacturing space at The Beat, its redevelopment of the former Boston Globe headquarters.

“People can be even closer to Boston at The Beat so it’s a little bit of competition, but tenants are still looking at the Red Line,” said Stephen Woelfel Jr., a senior vice president at Colliers International in Boston. “There’s been decent activity over the past three or four years with tenants priced out of Boston.”

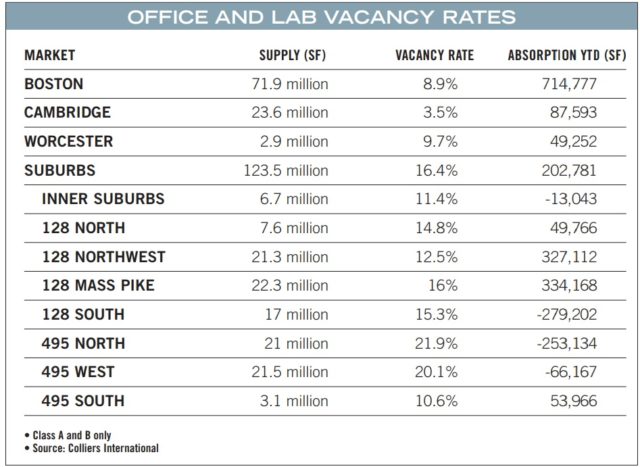

Double-Digit Suburban Vacancy Rates

Boston and Cambridge office leasing has surged in recent years, with vacancy rates falling into single digits even amid historic levels of new development. At the same time, all seven of the Route 128 and 495 office submarkets tracked by Colliers International have double-digit vacancy rates ranging from 11.6 to 21.5 percent. The Route 128 South market ended the second quarter with a 15.9 percent vacancy rate, according to Colliers’ Greater Boston Market Viewpoint report released last week.

The uptick reflects large companies’ continuing preference for downtown offices, even as many class A suburban properties offer rents less than half of their downtown competitors.

“The southern market has an identity crisis to some degree,” said David Begelfer, principal at CRE Strategic Advisers and a commercial real estate consultant. “That has not been the go-to place for lab or tech tenants, and it really hasn’t attracted the specific type of users to build a cluster.”

But the availability of the two State Street spaces could offer an option for large corporate tenants seeking a transit-friendly location, particularly the Newport Avenue location next to the North Quincy MBTA station. With few large blocks in downtown Boston available, Quincy could reemerge as an option, Begelfer said.

“Right now, you’re looking for a specific kind of user who needs a lot of space, and is looking for good value,” he said. “Boston is pricey and getting filled up and that market is on the train. The question is: how far out do you go?”

A local business leader said the State Street Corp. properties have potential to be converted into multitenant office buildings, similar to two buildings in North Quincy vacated by State Street in 2011.

“Every property owner would love to get one large tenant and fill it quickly, but in the South Shore or any suburban market, it’s actually nice if you can fill it up with a lot of smaller businesses and diversify the real estate,” said Peter Forman, CEO of the South Shore Chamber of Commerce.

That was the strategy used by Braintree-based developer Campanelli and TriGate Capital when they acquired two former State Street Corp. buildings known as Heritage Landing I and II in 2013. After paying $16.3 million for the properties, Campanelli increased occupancy of the two buildings to 93 percent and over 50 percent before selling them to Quincy-based Foxrock Properties and Grander Capital Partners for $63.9 million. Many of the new tenants relocated from downtown Boston and the Seaport District.

Dorchester has begun to emerge as competition for North Quincy, with Nordblom Co. marketing nearly 700,000 square feet of office, lab and manufacturing space at The Beat, its redevelopment of the former Boston Globe headquarters.

Short-Term Pain on the Train

Disruptions to MBTA Red Line service in the wake of last month’s derailment are delaying transit trip times between Braintree and Boston at least through Labor Day. South Shore commuters already have been enduring the ongoing replacement of the Quincy Center station parking garage, temporary closure of Wollaston station for renovations and a nearly 600-space temporary reduction in parking at the North Quincy station during new garage construction.

But planned upgrades to the Red Line including signal replacements and 252 new vehicles eventually will pay off, the Chamber of Commerce’s Forman said.

“The South Shore market is going to have a lot of disruption for the next couple of years because of work on the Red Line and the parking garages,” he said. “But that’s short-term pain compared to what we’re going to get when the work is done. I expect a lot more development around those stations, and the T service will actually have more capacity. In the long run, we’re going to gain.”

Dorchester: A New Rival?

In the early 1970s, class A office development leapfrogged Dorchester with construction of the State Street South office complex in North Quincy. Extension of the MBTA Red Line to Quincy in 1971 put the City of Presidents on the map as a corporate address.

Now the Quincy-Braintree market faces competition from an emerging development cluster closer to Boston, as investors acquire parcels around Dorchester’s Columbia Point.

University of Massachusetts officials in February selected Accordia Partners to redevelop the 20-acre former Bayside Expo Center property, and Accordia last month acquired the 12-acre Santander Bank property at 2 Morrissey Blvd.

The potential expansion of Dorchester’s class A office market could make it more difficult for Quincy developers to lure tenants further down the Red Line. At the same time, it could draw more attention to a submarket that’s seen little new office construction in recent years.

“I expect North Quincy will continue to benefit from rising rents and tightening markets in downtown Boston, and that 200 Newport Ave. will be able to take advantage of its unique proximity to the MBTA,” said Rob Byrne, a managing director at Cushman & Wakefield.

With more tenants demanding live-work-play elements, the new owner of Reebok’s former Canton campus sold a 140,000-square-foot outbuilding to Trillium Brewing Co. for a production facility, brewpub and restaurant. But the office park still has 185,000 more square feet available. Image courtesy of Les Vants Aerial Photos

Creation of a Destination on Royall Street

Single-use office parks still dominate the South Shore market, but this month’s decision by Citizens’ Bank to consolidate three local offices in a 100,000-square-foot build-to-suit office building at University Station in Westwood points to the appeal of mixed-use developments. Meketa Investments also leased 50,000 square feet of office space at University Station.

The 2.1-million-square-foot development contains an open-air shopping center, a 350-unit apartment complex and future building sites approved for an office building and a hotel.

“It took some time, but University Station is a great success and Citizens’ and Meketa’s commitments are positive signs for that market,” said Nat Kessler, a senior vice president at CBRE/New England.

In Canton, the new owner of the former Reebok campus is seeking multiple tenants to fill the 518,000 square office building, which was one of the South Shore’s trophy headquarters properties when it opened two decades ago.

“To attract most tenants nowadays, you have to have some level of a live-work-play element,” said Tyler Hilson, an assistant vice president at Perry Brokerage. “People are willing to commute by car to work, but they don’t want to commute during the day to go to lunch or run an errand. Anytime a developer can address those options and limit transportation use during the day, they’re going to have successful projects.”

Steve Adams

Spear Street Capital paid $88 million for the Reebok campus last year and sold a 140,000-square-foot outbuilding to Trillium Brewing Co. for a production facility, brewpub and restaurant. The office park overlooking Route 128 has another 185,000 square feet available at 250 Royall St., which was recently vacated by Computershare when it leased a smaller space at 150 Royall St.

The updates will benefit leasing prospects for the entire office park, said Cushman & Wakefield’s Byrne.

“That will make Royall Street a destination address, really for the first time in its existence,” Byrne said. “It’s a great address with great corporate neighbors, but you had no reason to go to Royall Street unless you were an employee at one of the big companies.”