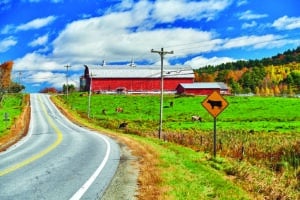

Walden Mutual hopes to attract depositors passionate about locally grown and raised food, and lend to farmers and processors in the same sector across the Northeast.

The U.S. will soon see a new mutual bank launch for the first time in nearly 50 years now that bank regulators have approved a New Hampshire-based de novo bank.

Walden Mutual Bank said in a statement yesterday that it had received final approval from the FDIC and the New Hampshire Banking Department. The bank plans to open its Concord office in a few weeks.

“After about a year and a half of work, this is a big milestone for our team, and now a historic moment for us all!” Walden Mutual Bank said in the statement.

Walden Mutual plans to focus its lending on the local and organic agriculture industry in New England and New York. The last mutual de novo formed in Tennessee in 1973, and New Hampshire has not seen a new mutual bank form in 100 years.

The bank is led by its CEO and founder, Charley Cummings, who in 2013 had founded Tewksbury-based Walden Local Meat, a retailer and distributor of locally raised meat and other farm products in the Northeast.

The bank’s leadership team also includes Jackie Charron, Walden Mutual’s executive vice president and chief operating officer. Charron spent 36 years at Holyoke-based PeoplesBank, most recently as chief risk officer and senior vice president of IT and project management.

Walden Mutual’s products include a deposit account that will come with a credit that accountholders can spend at local farms, farmers markets and related businesses.

|

|