From the Back Bay and South Boston to the commuter suburbs on Route 128 and I-495, home prices in the Boston area and across Massachusetts are smashing one record after another.

But what goes up must come down, including the seemingly invincible Greater Boston real estate market.

Fears that a growing number of buyers were being priced out of the party were seemingly eased with the 6.8 percent increase in homes sales in July after months of declines. Yet putting much stock in one month’s numbers – and a rather modest increase at that – is risky business.

July’s numbers aside, home sales in Massachusetts were down or flat for the past 10 months, according to The Warren Group, publisher of Banker & Tradesman.

A disturbing trend has emerged, both here and across the country, of a slowdown in sales that are coming amid relentless price increases that are testing the limits of what even relatively well-off buyers can afford.

For the first seven months of 2018, sales across Massachusetts are running below last year’s levels, according to The Warren Group. And sales in Boston and its suburbs have posted serious declines that are well below the .8 percent drop seen statewide.

This combination of rising prices and falling sales is not unprecedented; a similar pattern emerged before the real estate market hit the skids in 2007 and 2008.

Home prices went on to set new records in 2006, even after sales had peaked the year before in 2005.

These trends are very much linked. As prices go ever higher, the pool of potential buyers shrinks.

Scott Van Voorhis

Change is Coming

Just take the latest numbers from core of the Greater Boston market.

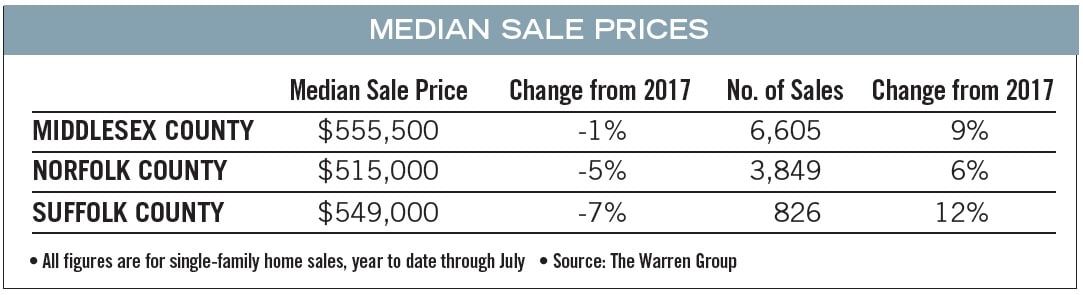

Suffolk County, which is dominated by Boston but also includes Chelsea, Revere and Winthrop, has rung up the biggest increase in single-family home prices so far this year as well as one of the biggest declines in sales.

Median home prices in Boston and its environs have nearly reached $550,000, jumping 12 percent. Sales, by contrast, have sunk 7 percent so far this year, Warren Group stats show.

It’s the same story in Boston’s western and southern suburbs.

The median price in Middlesex County, which stretches from Cambridge and Newton out to Natick and Framingham, jumped nearly 9 percent, to $555,500, while sales fell 1.1 percent.

And in Norfolk, which ranges from Quincy on the South Shore to Needham and on out to Foxboro and Plainville, the median price rose to $515,000, a 6.2 percent increase, even as sales dropped 4.6 percent.

Does this mean a real estate market downturn, or heaven forbid, full-scale crash, is just around the corner?

I doubt it. Barring some catastrophic international or economic disaster – which seems unlikely even with President Crazytown at the helm – trends like these take some time to work out.

We could be looking at several months of sluggish sales before we see an impact on prices, with a slowdown in appreciation likely before any decline sets in.

One reason home prices are likely to be extremely sticky on the way down is that the long run we’ve seen in Greater Boston is being driven more than just by a strong economy.

Rather, the market is also suffering from the effects of decades of underbuilding when it comes to new single-family homes.

Especially in the tonier ’burbs, the only building we are seeing now involves developers tearing down modest Capes, ranches and Colonials from the ’50s and ’60s and replacing them with $1.5 million McMansions.

One result is that even as buyers are priced out of the market, the drop in demand may not have all that much impact given the extreme shortage of new homes.

And it is a trend that, if anything, is only intensifying amid local NIMBY opposition to new construction and restrictive zoning rules.

So it will take something more than just buyers getting priced out to significantly bring down prices, or at least bring them down in a hurry.

The wild card is the economy. If the stock market and the GDP and employment numbers keep charging along, we are talking about a slow and hopefully soft landing.

But if a recession hits, all bets are off. A real downturn would kick into high gear some of the trends we are seeing now. And buyers, instead of desperately trying to stretch their finances in order to get into a house, will find themselves bargain hunting.

As with all things cyclical, the change will come – the only question is when.

Scott Van Voorhis is Banker & Tradesman’s columnist; opinions expressed are his own. He may be reached at sbvanvoorhis@hotmail.com.

|

|