State data released in August claims Massachusetts is nearly halfway to its 2035 housing production goal. But a new analysis suggests that pace will be short-lived.

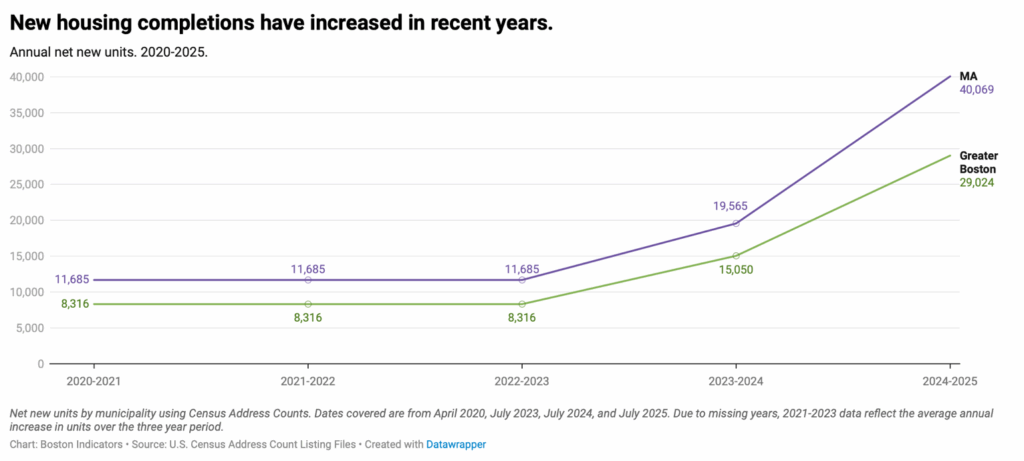

Massachusetts added 40,069 new homes between July 2024 and July 2025, according to a report released Tuesday by the Boston Indicators think-tank at The Boston Foundation.

That’s more than double the number delivered between July 2023 and July 2024, and a little less than four times the number delivered between July 2022 and July 2023.

In Greater Boston, 29,024 homes came online between July 2024 and July 2025, the researchers found, versus 15,050 between July 2023 and July 2024 and 8,316 between July 2022 and July 2023.

“It’s even outstripping the pace of what we would need to produce in order to meet the state’s housing goals that they’ve set for production from 2025 to 2035,” said Boston Indicators fellow Aja Kennedy, one of the report’s authors.

The report used a relatively new data source, the Census Address Count, to estimate numbers of new homes entering the market instead of extrapolating from numbers of housing units permitted.

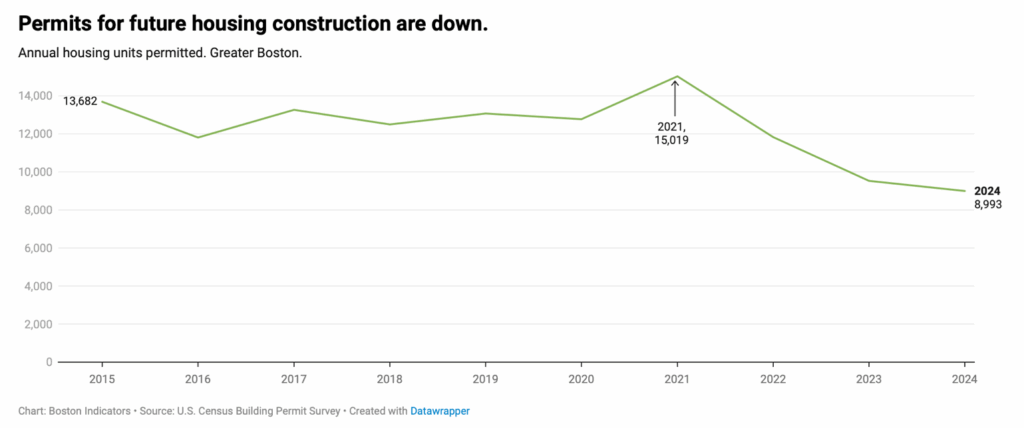

But the report also found a troubling sign that the current pace of production is set to fall dramatically, casting doubt on whether Massachusetts can meet its new, 220,000-home production target by 2035.

Numbers of new housing permits peaked at 16,019 in Greater Boston in 2021, and have since fell to 8,993 in 2024 – nearly 31 percent less than the average of the last decade. thanks to a much more difficult financing environment and a ratcheting up of affordability requirements in Boston, Cambridge and Somerville.

Greater Boston this year has even far behind the pace of housing approvals seen in prior years. Only 5,456 new homes were permitted between January and July of this year, compared to 7,138 in the same period in 2025 and an average of 8,148 for the same period between 2015 and 2019.

Housing units typically take between one and three years to go from permit to completion, depending on the size of a project.

A shortfall in production can lead to jumps in rents.

“It throws a little bit of water on the excitement about the amount of production that we’ve had in the past couple of years,” Kennedy said. “I think we have to take those housing production numbers with a grain of salt and still think critically about how the process of building new housing can be more streamlined and make it easier for developers to be able to build.”

Image courtesy of Boston Indicators

Image courtesy of Boston Indicators