Consumer delinquencies in closed-end loans fell slightly in the second quarter, driven by a drop in home equity loan delinquencies, the American Bankers Association said this week.

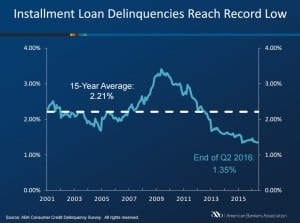

According to the ABA’s most recent Consumer Delinquency Credit Bulletin, delinquencies, defined as a late payment overdue by 30 days or more, fell in three of 11 individual loan categories compared with the previous quarter. The composite ratio tracks delinquencies in eight closed-end installment loan categories, and it fell three basis points to a record low of 1.35 percent of all accounts. The ABA also said this is the third year that delinquency rates were below the 15-year average of 2.21 percent.

“Consumers have become more confident over the past two years and for good reason – their financial picture is improving and their paychecks have finally started to rise as we near full-employment levels,” James Chessen, the ABA’s chief economist, said in a statement. “Quarter after quarter, consumers continue to build a stronger balance sheet as they earn more, save more and keep debt levels low relative to income.”

Home equity loan delinquencies fell 4 basis points to 2.70 percent of all accounts, below the 15-year average of 2.85 percent. Home equity line delinquencies ticked up 6 basis points to 1.21 percent of all accounts, just above their 15-year average of 1.15 percent. Property improvement loan delinquencies rose 2 basis points to 0.91 percent of all accounts.

“Small ups and downs are expected, but improvement is still very much in the cards for home-related delinquencies,” Chessen said. “Rising home prices have restored equity, providing even more incentive for borrowers to stay current with their payments.”

Mobile home delinquencies saw the biggest drop in the second quarter, falling from 3.41 percent to 3.17 percent.

Bank card delinquencies edged up 1 basis point to 2.48 percent of all accounts in the second quarter, but remained below their 15-year average of 3.70 percent. Direct auto loan delinquencies increased 1 basis point to 0.82 percent, and indirect auto loan delinquencies increased 11 basis points to 1.56 percent.

|

|