Commercial real estate lending is a primary focus for a majority of financial institutions looking to grow their loan portfolios, according to a new poll out of the North Carolina-based financial information firm Sageworks.

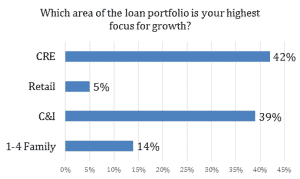

Sageworks conducted the poll during a risk management summit last month. Among 142 individuals polled, mainly credit risk executives from banks and credit unions, 42 percent said that commercial real estate was their primary area of focus in growing their loan portfolio, followed by 39 percent who indicated that commercial and industrial was their top focus. Another 14 percent said one- to four-family loans were their priority for growth. Just 5 percent said they were focusing on retail lending to achieve growth.

“Banks are really trying to compete in the commercial space, especially with CRE. With interest rates low and interest margin low as well, banks lend in areas that make them money, like CRE,” Senior Risk Management Consultant Robert Ashbaugh said in a statement. “These results are interesting – commercial borrowers are getting the attention, but banks still need retail deposits. They may start focusing on niche lending like hotels, indirect lending or specialty lending.”