In the early 1990s and parts of the 2000s, it was not unusual for Dan Rosman, principal at Rockland-based DTR Corp., to secure traditional financing on distressed properties that he was looking to fix up. The banks were looking to lend and had more autonomy to do so.

After the financial crisis struck and the Dodd-Frank Act was implemented, that sort of lending from the traditional banks dried up. Nowadays, Rosman secures financing from companies like Stage Point Capital, an alternative direct lender that can grant loans in 24 to 48 hours.

Their rates are not as good as the traditional banks; they offer lower loan-to-value ratios to make sure borrowers have more skin in the game and tougher terms. But firms like Stage Point and other non-bank lenders are filling gaps that traditional lenders no longer venture into.

Stage Point operates by providing short-term financing; the company can approve loans quickly, which is key for contractors looking to purchase distressed properties at upcoming auctions. The contractor then rehabs the property, pays off the loan it got from Stage Point and ideally sells the property at a profit.

“There is an incredible shortage of housing,” said Whitney Quillen, co-founder and CEO of Stage Point Capital. “Banks are out there, but they are not financing properties that need fixing up. … Banks will lend to you if you have W-2 or W-4, but they won’t lend to borrowers who are self-employed.”

Stage Point has since 2014 lent more than $40 million to 120 local investors, many of whom are contractors, to help them renovate over 250 single and multifamily homes in Rhode Island and Southeastern Massachusetts.

Other companies are also finding profit in this lending niche.

Quincy-based Grand Coast Capital Group operates similarly to Stage Point, focusing part of its business on short-term rehab loans to builders looking to purchase and improve properties, and then sell them within 12 months. The company has originated more than 650 loans in 41 states, with 20 percent of its investment portfolio in Massachusetts.

In general, house flips and foreclosure sales are on the rise, suggesting that more financing is becoming available.

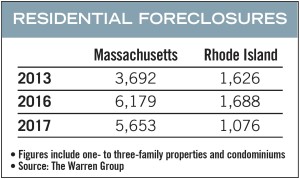

Foreclosure sales of single-family homes in Rhode Island rose from 1,626 in 2013 to 1,688 in 2016, before falling to 1,076 in 2017, according to analysis from The Warren Group, publisher of Banker & Tradesman. In Massachusetts, foreclosure sales increased from 3,692 in 2013 to 6,179 in 2016, then falling to 5,653 in 2017, according to the analysis.

Foreclosure sales of single-family homes in Rhode Island rose from 1,626 in 2013 to 1,688 in 2016, before falling to 1,076 in 2017, according to analysis from The Warren Group, publisher of Banker & Tradesman. In Massachusetts, foreclosure sales increased from 3,692 in 2013 to 6,179 in 2016, then falling to 5,653 in 2017, according to the analysis.

Attom Data Solutions reports that 207,088 single-family homes and condominiums were flipped nationwide in 2017, up 1 percent from 2016 and an 11-year high.

Quillen and his brother Bart, Stage Point’s COO, are hugely transforming traditional small banking and private community business practices, said Victor Park, principal and founder of Alternative Assets, a hedge fund capital raising firm.

“The web disintermediated local brick and mortar savings and loan [institutions],” he said. “In 2008, the government changed all of the regulatory standards. … That has created this whole huge void in this sort of lending practice. We are seeing hedge funds and to some extent private equity step in and make those loans.”

Bram Berkowitz

Community Visibility

The void is not, as one might expect, in Boston. Stage Point Capital operates in more blue-collar communities such as Brockton, Plymouth, Attleboro and Providence.

These markets are attractive, according to Quillen, because while home prices are low, the rental market is doing well.

“When the market is hot, people want to chase it and when things fall apart, that is when everyone leaves,” said Quillen. “It is the complete opposite of what people should be doing. You want to buy assets in distressed times.”

Quillen prides Stage Points’ “boots on the ground” approach, knowing all the local plumbers and subcontractors in the area. Finding good borrowers was more difficult than he first thought, but once Stage Point got the business, they didn’t lose it, he said.

The company has found success in the Portuguese- and Spanish-speaking communities, as well as with nonprofit organizations that are working to rebuild neighborhoods.

William Fegley, managing director of Helping Hands Community Partners Inc., an organization in Providence that renovates old properties and sells them below market rate, has secured financing from Stage Point Capital for at least 10 properties.

“The way we acquire properties requires us to make a hard commitment upfront,” said Fegley. “There is not a lot of time for messing around, and any time we don’t get a deal, we are in a position where we might not be able to continue with our mission.”

Timing is really what separates a company like Stage Point Capital from a bank, said Rosman of DTR Corp.

“Time is money and a lot of these people, when they sell a distressed property, they want it gone in 30 days or less,” he said. “Banks close in 60 days.”

While these companies may be operating in an area previously under the purview of banks, they are not traditional lenders. The business model depends on converting or flipping old homes, which, like any type of real estate, can dry up.

Quillen acknowledged he is getting slightly nervous because the market has been good for a while and if rents don’t go up with home prices, that is an issue for the company’s model. The company is currently pulling back by turning down more borrowers and by making borrowers take more equity.

But Quillen believes Stage Point will be in Rhode Island and Southeastern Massachusetts for the long haul, and Park thinks this kind of lending will only get more prevalent in the future.

“I think hedge funds will step in the alternative lending space and displace community banks,” he said.

|

|