Unconventional designs of a mixed-use project maximized floor-to-floor heights and enabled the office spaces to include expansive outdoor decks on the second and third floors. Image courtesy of Brick

In today’s world of non-linear market forces and economic ambiguity, one thing is clear: everyone expects more.

For developers, it means a project’s path to success is more challenging than ever before. Lenders, agencies, community stakeholders, tenants, and end users aren’t satisfied with the notion of an attractive, functional building. Each player needs to see deeper project value in the form of tangible economic, social, political and environmental outcomes. Creating value and delivering a great project beyond these expectations without sacrificing the developer’s vision or the pro forma requires stakeholder-savvy designers that think like developers.

To design with this end in mind, first ask: what’s the best possible outcome for the client? How do they measure ROI?

A commercial developer planning to “build, stabilize and exit” might focus on maximizing floor area ratio (FAR) and speed-to-market, while minimizing up-front costs. They might favor design options that streamline approvals – including a mix of uses or community benefits, for example – and also attract high-value tenants with tall floor-to-floor heights or lab-ready layouts. A long-term owner/operator keeps an eye on net operating income (NOI) and will see the value in high-efficiency systems and easy maintenance, or versatile floor plates with well-placed core services that allow for multiple tenant layouts over time. Smart designers find ways to exceed both short- and long-term project expectations while balancing timing, costs and constraints.

At the same time, designers can’t ignore the data. Addressing comparable metrics such as FAR, floor-to-building-skin ratio, floor plate depth, parking and costs versus benefits across each design scheme creates objective choices for the client and allows for informed dialogue with the entire project team. When done right, this method will check the “yes” boxes for the project budget, pro forma, neighborhood, site constraints, municipal codes and public approvals processes, too. The alchemy of facts, creativity, and consensus results in a project that every stakeholder – from client to community member – can endorse.

Lastly, designers must embrace the unexpected. Sometimes one simple design move changes everything. For a 64,000-square-foot mixed-use project, Brick and our client took an unusual design approach to a local planning code resulting in one of the most valuable buildings in its locale, and the country. The project sold in 2018 soon after its completion for just over $2,156 per rentable square foot.

Zoning Height Limit Creates a Challenge

Located on a tight urban infill site next to transit and a lively downtown core, the development was originally conceived as a 3-story office building with two levels of underground parking. But with a prescribed height limit of 38 feet, creating three floors of class A office space with decent floor-to-floor heights posed a challenge.

Abigail Hammett

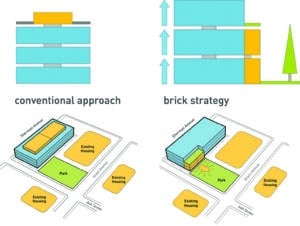

The planning code offered a height bonus if the project included a mixed-use component. Since the floor area ratio doesn’t change and office space was worth nearly twice that of housing, the conventional approach around town assumed that the extra height would be used to squeeze in a couple of large residential units atop the office spac. But this scenario didn’t improve the floor-to-floor height challenge and created new issues with vertical circulation, residential unit quality and housing affordability. This approach met the status quo, but did it create the best value? The team thought not.

Instead, Brick created value for the city, the future tenants and the neighborhood by situating the residential component next to the office building on the same lot facing a public park. Relocating residential units from the upper story to the park meant that we now had 50 feet to work with for three floors of office space, and it was a game-changer. The result was best-in-class floor-to-floor heights with tall windows flooding the spaces with natural light and smart circulation – all leading to a 12-year lease with a Fortune 500 tenant. Stepping the building back on the third floor created expansive outdoor decks facing the park for the second- and third-floor offices. Four townhomes, now with private entrances and a view of the park, are more space-efficient and command premium rents that augment the project’s NOI.

Unsurprisingly, the project – since certified LEED Silver – sailed through the city approval process. Even better, the development’s total investment of $36 million generated an amazing sale of $138 million after stabilization. It makes a difference to partner with an architect who also thinks like a developer.

Abigail Hammett is an associate principal at architecture firm Brick.