Check fraud has jumped 20 percent this year in Massachusetts. And customer education and fraud-prevention technology seem like the only fixes. iStock photo illustration

Check fraud has skyrocketed and Massachusetts banks are trying to stop the bleeding in their customers’ accounts by educating clients and investing in prevention tech.

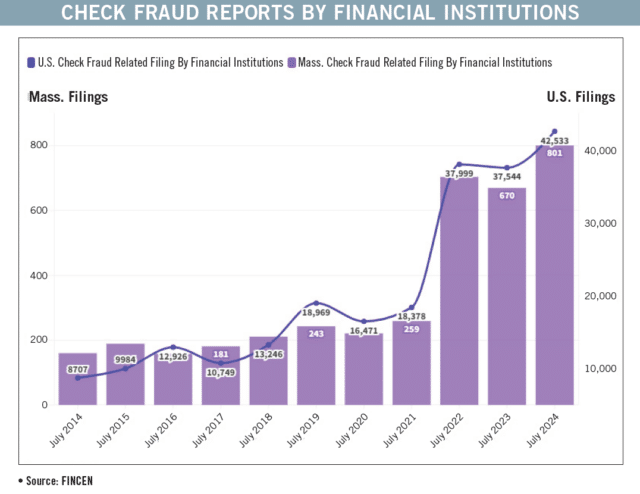

According to data from the U.S. Treasury Department’s Financial Crimes Enforcement Network, over 42,000 suspicious activity reports related to check fraud were filed in the month of July. Reports coming from Massachusetts institutions totaled 801.

Reports nationwide regarding check fraud first soared from 18,378 in July 2021 to 37,999 in July 2022. Over the same time period, reports in Massachusetts nearly tripled, from 259 to 709.

It’s now the third year in a row of outsized numbers of check fraud cases but July’s FinCEN reports showed a nearly 20 percent increase in check fraud cases in Massachusetts year-on-year.

While the advent of digital and mobile banking has mostly eliminated the use of checks among retail bank customers, they are still used by many. Billions of checks are processed annually according to the Federal Reserve.

With checks still being used for some transactions, criminals are able to take advantage. Sometimes checks are stolen directly from personal mailboxes and drop boxes where mail is collected to be picked up, said Kathleen Murphy, president and CEO at the Massachusetts Bankers Association.

Another method goes by the name of “check washing,” a type of fraud where criminals steal signed checks and use chemicals to remove or alter the ink so they can rewrite the check.

In a high-tech era of banking, it’s “unsophisticated fraud that’s causing these losses,” Murphy said.

Check fraud can also particularly affect small businesses more than the average personal banker. These business accounts are more likely to use physical checks compared to digital payment tools.

“It’s an ongoing challenge,” Scott Kwarta, chief risk and operating officer at The Co-Operative Bank of Cape Cod said. “A lot of it is customer awareness, as well as what we’re doing on the bank side to help to identify and prevent that. I would say with the recent uptick that we have seen over the last six months, we sort of ramped up some of our efforts in customer communication.”

Illustration by Sam Minton and Bill Samatis

The Cost of Check Fraud

Of course, there is a financial impact when a case of check fraud occurs. If the fraudulent check is processed, the owner of the bank account initially faces the crime’s financial brunt but that is typically passed on to the financial institution after the transaction is investigated.

Banks can utilize a service called Positive Pay to help limit fraud and protect customers. The Co-Operative Bank of Cape Cod offers this service free to its customers, bearing the cost of the software out of its regular budget.

“That’s a service we offer free to our customers,” Kwarta said. “So that’s an expense to the bank on an annual expense for that software, in addition to the resources that we have in operations and managing through that process for our customers. And then, as I mentioned, there’s the cost of other alert systems that we have to identify suspicious activity and then resources behind that.”

Unfortunately for financial institutions, check fraud is so common that it almost considered a cost of doing business.

“Every bank experience losses on the fraud side, whether it’s check fraud or other types of fraud,” Kwarta said. “It is, to a certain extent, part of doing business but our goal is to mitigate and minimize those losses as much as possible, and also to help minimize any of our customer potential losses.”

But that cost can be steep, especially in a time when banks everywhere are struggling with compressed profit margins.

“The exposure is pretty high, because we were seeing some counterfeit checks that were several hundred thousand dollars. If one of those checks wasn’t caught and identified and returned within the proper window time, the bank could be sitting with [a] several-hundred-thousand-dollar loss just due to one fraud,” Kwarta said.

Loss Prevention

While losses are to be expected, they can be prevented. If customers pay close attention to their accounts, they can spot check fraud before it is too late. Banks can also utilize fraud protection tools and can train tellers in ways to detect a fraudulent check.

“Customer awareness is very important,” Kwarta said. “If the customer is going into their accounts every day, looking at their transactions to say ‘Is there anything hitting that looks suspicious?’ and reaching out to us. That’s a huge help in us being able to identify it, because in the banking system, there’s certain windows of opportunity return fraudulent checks.” ”

Sam Minton

The good news, he said, is that customers of The Cooperative Bank at Cape Cod “haven’t lost anything.”

“We took on some of the losses, they weren’t significant. But, you know, we also beefed up some of our efforts,” Kwarta said.

To avoid becoming the victim of check fraud, experts say consumers should avoid using paper checks but when forced to do so, should drop it off in a mailbox inside the post office as close to the collection time as possible.

Using a permanent marker like a Sharpie instead of an ordinary pen is also another method to help prevent check fraud as it can inhibit the ability for the check to be “washed.”

Businesses should also look into moving their payments from physical checks to electronic payments systems like an ACH, or automated clearing house transfer.