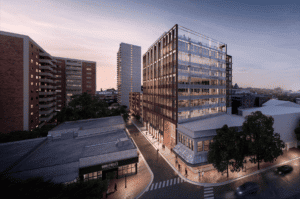

Planned life science developments are expanding into Massachusetts Gateway Cities, like Boston-based Quaker Lane Capital and Turnbridge Equities’ 11 Dartmouth St. building in Malden, providing a new source of jobs and tax revenues. Image courtesy of Gensler

Massachusetts state government bet big on the life sciences industry in 2008 with a $1 billion investment over the next decade. The result of this risky wager? An industry that has been on a record-breaking tear of raising funds, hiring people, building labs and solving medical challenges.

As we approach the close of the second act – a five-year extension worth hundreds of millions of dollars – MassBio’s latest “Industry Snapshot” paints a picture of a cluster built to remain the global life sciences leader.

With more than 106,000 people now working in the industry, continued strong venture capital investment in Massachusetts companies (over $5 billion in the first six months of 2022), and a life sciences real estate portfolio totaling 55.9 million square feet, Massachusetts has positioned itself to weather a transition from the heady months of 2021 to the headwinds of 2022 to what comes next better than most other clusters and industries.

A Foundation of Talent, Science and Lab Space

To properly consider where we go from here, we must look at some of the foundational pieces that this successful ecosystem here is built on: talent and science and, more recently, space. Our workforce has long been the calling card for Massachusetts. Hiring challenges exist, but CBRE recently renewed their labeling of Greater Boston as the number one life science cluster based on jobs, local wages, cost of living and other factors. The density of emerging companies in Boston and Cambridge working on the world’s most difficult medical challenges is second to none, and that’s why the biggest biopharma players are here too.

On lab and biomanufacturing space, let’s go to the data: beyond the current 55.9 million-square-foot inventory, there are 14.9 million square of lab space and 1.7 million square feet of cGMP space currently under construction. These projects are part of a pipeline that could be anywhere from 26 million and 59 million square feet by 2025. All told, we are looking at a market that is heading away from the currently unhealthy vacancy rates and toward a regionalization that exposes new communities and populations to the benefits of the innovation economy with a supply that can meet the demand.

Instead of a situation where a company is leasing more space than it needs because its leadership is concerned about a lack of expansion options down the road, the continued construction boom positions Massachusetts to benefit in the long term from company expansions, firms looking to relocate and new startups backed by strong clinical data and plentiful venture capital funding.

Communities Certified for Lab-Friendly Sites

And MassBio is helping to keep the movement beyond Kendall Square and the Seaport going by guiding cities and towns through the process of becoming BioReady – our organization’s designation for municipalities that have streamlined permitting, biotech-ready zoning and good infrastructure – and making their municipalities more appealing to developers. Some of our newest BioReady communities include Danvers, Foxborough and Lynn. We’re also seeing exciting developments in the state’s Gateway Cities, with recently proposed life sciences developments in Brockton, Everett and Revere.

When the industry moves beyond its traditional confines, it opens itself up to a new pool of talent that is untapped, more diverse and underrepresented in the life sciences. MassBio has been leading the charge in supporting our members as they address hiring challenges and lagging workforce diversity. Some ways this can be accomplished is by locating jobs in the places where marginalized populations live, updating job descriptions and hiring practices to make careers accessible and aligning training curriculums with what employers need and with the lives of non-traditional students.

Joe Boncore

A company that has biomanufacturing facilities that are accessible by public transportation or without gridlock can offer on-the-job training as part of a credentialing program at a local community college. A city or town that hosts a life sciences campus has new tax revenue and ready-made customers for their restaurants and shops.

As we ponder the life sciences industry’s third act here in Massachusetts, we must remain vigilant in our efforts to mitigate competition from other states, larger policy challenges like the cost of housing and failing infrastructure and a workforce that wants to work from or closer to home. State government has been far more than a cheerleader for the life sciences this last decade and a half. Going forward this public-private partnership could be the difference in staying on top or ceding our leadership position.

Joe Boncore is CEO of the Massachusetts Biotechnology Council.

|

|