With the Federal Reserve cutting its benchmark interest rate in September, the lower interest rates appear to have driven some increased market activity in Greater Boston.

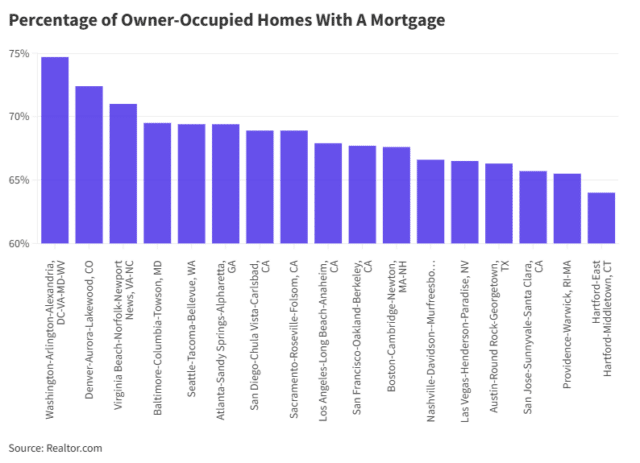

According to a new study from Realtor.com, markets with a high percentage of owner-occupied homes with a mortgage stand to see the most changes in their real estate market. While Boston failed to crack the top 10 of owner-occupied homes with a mortgage, it did land 19th among metros analyzed in the study (67.6 percent).

“Having a mortgage with a low interest rate is a fantastic benefit to existing homeowners, but sometimes being in a great position can limit your options. Although mortgage rates have eased, market rates continue to exceed current rates for most homeowners keeping them locked in ‘golden handcuffs,'” Danielle Hale, chief economist at Realtor.com, said in a statement. “In markets like Washington D.C. and Denver, Colorado, where almost 75 percent of owner-occupied homes have a mortgage, changes in market rates are likely to factor into buying and selling decisions for more homeowners. As mortgage rates decline, real estate sales activity is expected to pick up in these areas.”

As interest rates drop, it will be beneficial on both the buyer and seller side. Buyers who have been potentially priced out of the market can return to house hunting while sellers can feel more confident that they can find their next home and not feel “locked in” to their homes with an attractively low mortgage interest rate.

In September, activity in Boston picked up in Greater Boston when it saw the fifth-largest increase in new listings year-over-year (24.4 percent) among the dozens of metro areas nation-wide analyzed by Realtor.com.

Sellers, especially those who are locked into a low rate, have been waiting for market conditions to change. Now that we’re seeing mortgage rates down to their lowest levels in two years, there are signs of movement, with more sellers putting homes on the market even in what’s typically a real estate shoulder season,” Hale said. “We expect mortgage rates to hold around 6 percent through the end of the year, which is a significant difference from their 7.8 percent high in October 2023.”

Graphic by Sam Minton | Banker & Tradesman Staff