Well-heeled buyers looking to escape COVID-19 flocked to Cape Cod from Boston, New York and Connecticut, driving up prices.

As spring turned to summer in Massachusetts and the harshest public health measures to stay at home eased, an unusual thing happened: Homebuyers flooded the market.

In a time when any stranger – and more than a few friends and family members – could be carrying a deadly virus, and the statewide unemployment rate hit 17 percent, a surge of buyer interest has swamped many of the region’s housing markets.

“The buyer pool is so much bigger than the inventory can handle,” said Sue Drumm, a Longmeadow-based Coldwell Banker agent and 2020 president of the Realtors Association of the Pioneer Valley. “It’s not unusual to have 18 or 20 offers on a property.”

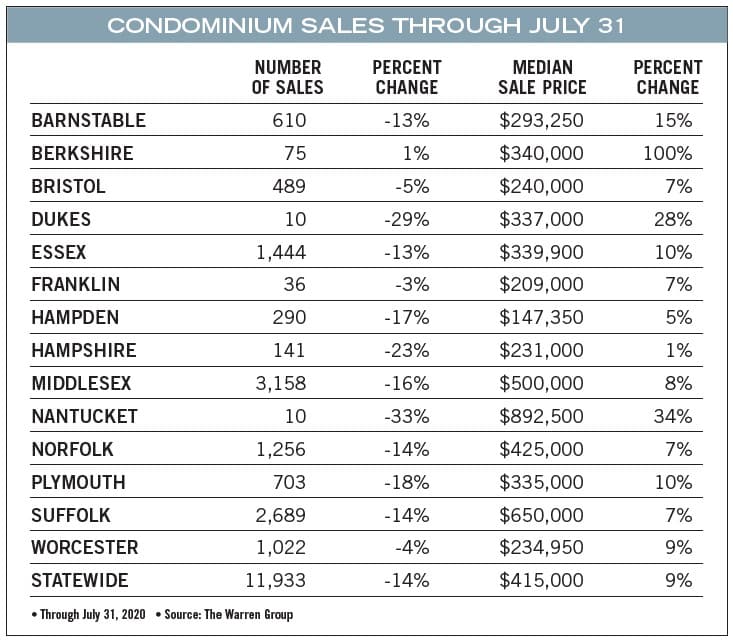

Statewide, 11,769 single-family homes and 4,277 condominiums changed hands in June and July according to The Warren Group, publisher of Banker & Tradesman, in what real estate agents across the state have said was an extraordinarily delayed spring market. Year-to-date sales through July 31 – the most recent data available – show the impact of a spring largely spent hunkering down: a 9.9 percent drop in single-family sales and a 13.6 percent drop in condominium sales.

But as buyers seeking more elbow room were lured onto the field by record-low mortgage interest rates, which bottomed out in early August at 2.88 percent for a 30-year, fixed-rate mortgage according to Freddie Mac, still more sellers stayed on the sidelines in all of the state’s major markets. The effect: The year-to-date median statewide single-family sale price rose 6.3 percent through July 31, to $425,000, while the same figure for condominiums hit $415,000, a 9.2 percent jump, The Warren Group reported.

As of July 31, the Massachusetts Association of Realtors reported single-family inventory had fallen by almost 52.1 percent year-over-year, with only 1.6 months of supply remaining on the market, a 20 percent drop from the same time last year.

Rearranged Priorities

Whether buyers were hunting for condos or single-family homes, agents told Banker & Tradesman the COVID-19 pandemic helped spur decisions to move.

“People have become very intimate with their homes [and] the deficiencies their homes bring,” Boston-based Compass broker Charles George said of his middle-market clients.

Many of his Millennial buyers either have or plan to soon have growing families, driving many to the suburbs, where more homes typically come with yard space or more square footage at a similar price point.

“I think a natural instinct is to buy a larger home with yard space when you have kids,” he said. “That space can be found in the city, but it depends on where you’re looking.”

Some buyers, too, may have had their priorities rejiggered by the pandemic.

“Right now, people are prioritizing quality and price over location,” said Brookline-based RE/MAX Unlimited Realtor Jason Gell.

Indeed, Greater Boston’s suburbs saw some of the biggest drops in numbers of homes sold as buyers snapped up what inventory was available. The number of homes sold in Newton through July 31 dropped 30 percent year-over-year, according to The Warren Group, to 271. In Billerica, the drop was 31 percent, to 179. And in Norton, 40 percent fewer homes were sold, with only 71 changing hands.

“A pot that was boiling turned into steam,” said Gell.

No Condo Collapse

As the COVID-19 pandemic washed over the region, suggestions circulated that buyers would flee cities like Boston and Somerville and their closely packed condos for less dense single-family neighborhoods suburbs.

Instead, units continued to trade briskly, with the Greater Boston Association of Realtors reporting condos in the region’s urban core were put under agreement in an average of 33 days in July, compared to 40 in July 2019 and 35 days in June.

And the median sale prices for condos in the area’s urban neighborhoods rose an average of 8 percent through July 31, according to The Warren Group’s data, while the number of units sold year-to-date dropped an average of 16 percent.

Still, the heart of Boston’s non-luxury condominium market saw much more modest price increases and smaller drops in the numbers of units sold than in many suburban towns, The Warren Group reported. Dorchester saw the number of condos sold shrink by only 6 percent, while the median sale price rose a modest 4 percent. And South Boston saw its median condo sale price drop by 1 percent, while the number of units sold dropped by 21 percent, to 363.

“The Boston area came out of the lockdown attitude a lot later than the suburbs did,” said Carol Conway Bulman, president of Jack Conway, Realtor. “I had a meeting with my city managers [recently and], gosh, I bet half the Dorchester office is just putting their toe in the water again.”

George, the Compass broker, said his middle-market, condo-buying clients haven’t changed their wish lists much. Convenience to jobs in the city of Boston still matters to them, as does an area’s walkability and proximity to restaurants, he said, even if many are looking for an extra bedroom or yard space.

“A lot of them are preparing for when this COVID piece shifts to a, you could say, ‘normal’ lifestyle,” he said. “I think people are still thinking how they would live their lives pre-COVID.”

Luxury Buyers Sought Elbow Room

At the highest end of the market, many – including many out-of-state residents – used their money to buy their way out of proximity to the pandemic.

Cape Cod agents set successive records for numbers of homes sold and dollar volume of sales made in a single month in June and July, said Cape Cod and Islands Association of Realtors spokesperson Craig Orsi, with $457 million worth of sales closed in July alone. That month, 67 percent more homes sold on Cape Cod than were sold in July 2019, The Warren Group reported.

“Buyers are saying ‘I’ll buy whatever I can get my hands on right now. It’s important for my health and my emotional wellbeing and my family’s,’” said CCIAOR 2020 President Greg Kiely, noting the region had kept its COVID-19 caseload manageable.

While the urban condo market in Greater Boston did not see a collapse, waves of older Millennials looked to the suburbs for space to grow their families, agents said.

The ability to be remote from their jobs and their children’s schools helped set sales records in more distant parts of the Cape, like Chatham and Orleans, he added. Both saw 20 percent year-over-year jumps in the number of homes sold so far this year, to 125 and 65 respectively, according to The Warren Group.

Kiely, a brokerage manager for Sotheby’s International Realty in Osterville, said the region’s relatively weak housing market heading into the pandemic likely played a role in attracting so many buyers, helped along by low interest rates.

“That allows people to perceive really strong value in Cape Cod real estate if they’re coming out of Boston or Fairfield County [in Connecticut] or New York,” he said.

While fall enrollment in local schools – traditionally measured at Oct. 1 – will show how many of these new buyers may stick around, Kiely said, it’s likely not all Cape buyers are planning to become permanent residents.

“What we’re surmising is that people are buying more modest homes out here,” he said. “They’re holding on to their primary, $3 million residence.”

Indeed, the markets high-end MetroWest suburbs like Weston and Wayland have been “feverish,” said Gibson Sotheby’s International Realtor Amy Mizner, who is based in Weston.

“For their own mental sanity, [people] need outside space,” she said, noting that pools, patios and home offices or the space to add all three became hot commodities.

Where Are the Sellers?

Hanging over every housing market in Massachusetts this summer, however, was an even smaller pool of sellers than normally seen in markets long used to dealing with less than six months’ worth of inventory available for sale.

“It’s a real problem. The market’s at a stalemate,” said Anthony Lamacchia, owner of Waltham’s Lamacchia Realty.

A big reason, Lamacchia said, is the lack of supply. Many buyers looking for their next home can’t find something they like, or are worried they won’t be able to, so they’re staying put. But the fear of COVID-19 is also weighing on sellers’ minds, he said, regardless of how good real estate agents have become at safeguarding buyers and sellers during the transaction.

Other sellers are still dealing with the pandemic’s effects.

James Sanna

“It’s COVID,” Mizner said. “People who are much older are waiting to go into assisted living homes. And younger Baby Boomers, their last child had left and [now] they’re deferring college entrance for a year … or kids are coming back from urban markets to live with them.”

Demand could cool in the fall, Lamacchia said, as buyers who are currently renters give up and sign leases, and if the traditional fall increase in condo and single-family inventory arrives, some normalcy could return.

However, it’s still been a rough summer for buyers’ agents trying to coach clients through multiple failed offers.

“It wears on you and it wears on your Realtor,” he said. “This is the toughest year I’ve been through as a Realtor – and I’ve been through ’08.”

|

|