When Citi admitted it was pulling its retail operations out of the Massachusetts market early next year, it was careful to say it wasn’t abandoning mortgage lending in the Bay State.

Citi will continue to service Massachusetts loans in its portfolio, it will continue to close on loans still in the pipeline, and it will still originate residential mortgage loans through its direct-to-consumer and digital channels, a spokesperson told Banker & Tradesman by email when the news first broke. Citi did not respond to requests for further information about this strategy or the reasoning behind the decision.

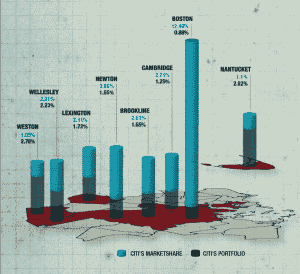

Since 2010, Citibank and CitiMortgage made the highest number of its loans in Boston, Cambridge, Newton, Lexington, Wellesley, Brookline and Springfield. Those 554 loans represented 27.6 percent of Citi’s total mortgage origination portfolio in Massachusetts over the last five years, according to data compiled by The Warren Group, publisher of Banker & Tradesman.

Four of those municipalities also represented areas where Citi was strongest in the town-wide market: Wellesley, Lexington, Brookline, and Newton were in the top 25 best locations for Citi’s market share statewide. Citi made loans in 273 municipalities in Massachusetts overall; Cambridge ranked at No. 36 for Citi, Springfield ranked No. 62 and Boston at No. 65.

Citi also had strong market share over that time in Nantucket and Weston. Its 22 loans in Nantucket represented 2. 82 percent market share and its fifth-best locale, though only 1.1 percent of the bank’s total portfolio in Massachusetts. Citi had 21 loans in Weston, representing 2.78 percent market share (sixth-best) and 1.05 percent of the total portfolio.

With Citi’s flight from the market, those towns – where Citi had the best market share and focused most of its attention – may represent the biggest opportunity for competitors to elbow in on its business. Can the fourth-largest bank in America expect to maintain that level – or any level – of mortgage lending solely through digital channels? Opinions are mixed.

“I’ve been in the business for 15 years. Seven to 10 years ago, everybody wanted to meet in person. Then everybody wanted to talk on the phone,” said Shant Banosian, the Waltham branch manager of Guaranteed Rate. “Now most people don’t even want to talk. They want email, they want text, and consumers are very big into being able to send you stuff securely. They want to upload directly to their site without having to email any personal documents.”

Others had a different perspective. David Lazowski, an area manager for Fairway Independent Mortgage, said that while some customers may initially connect digitally, they often want to work face-to-face with an actual human at some point in the process. He also estimated that about 52 percent of his own transactions begin with a referral from the realtor community.

“It’s not as simple as opening up a credit card online. For most people, it’s the largest purchase that they make, it’s the largest asset they work with online,” he said. “In today’s day and age of originating mortgages, it’s not an easy proposition. It requires hand-holding, guidance and excellent communication throughout the process.”

Moving In On Vacated Turf

Citi’s departure from the Massachusetts market may represent an opportunity for community banks.

This year was Citi’s best where mortgage volume is concerned – although it’s also the best year for the housing market overall in nearly a decade. The national behemoth originated 534 residential purchase mortgages for one- to three-family homes and condominiums across the Bay State. It originated 523 such mortgages last year, in comparison with the 208 mortgages originated in 2010, just two years after its entrée into Massachusetts. Over the past five years, Citi has originated 1,995 of those mortgages in the state.

“Any time a bank or mortgage company picks up and closes its doors, those customers have to go somewhere,” said Jay Tuli, senior vice president for corporate development and retail banking at Leader Bank. “For all the incumbents, it can sometimes be a windfall. With Citibank, they have several locations and depending on what ends up happening, that could become an opportunity for another bank.”

Tuli cited a string of instances in which the Arlington-based Leader Bank benefitted because mortgage companies – and the occasional bank – pulled its residential lending operations out of some portion of Leader’s footprint. Those included JMAC Lending, First Mariner Bank, Summit Mortgage and Dynamic Capital. Moreover, Leader Bank was able to capture not just market share, but also offices and sometimes staff.

Though Citi did much of its mortgage business in Wellesley Bank’s backyard, Thomas Fontaine, the bank’s president and CEO, said he never really saw Citi as much of a competitor in the mortgage space.

“We compete against everybody, but I don’t see them as being one of our major competitors,” he said. “I’m more excited about the deposit relationships that we can attract for those Citi customers.”

He added that he was more interested in scooping up those deposit customers who might be disenchanted at the idea of being serviced by Citi out of New York.

Tuli drew a distinction between purchase mortgages and refinances – with a purchase, borrowers probably want to sit down with a person, but with a refi, they might well conduct that whole transaction online. Where the purchase market is concerned, he said, “They’re basically not going to have a focus on Massachusetts. … No one in Massachusetts is going to think about Citi.”

|

|