Many community banks and credit unions are turning to C&I to solve a core strategic problem: loan books with too much concentration in commercial real estate for regulators’ tastes. iStock illustration

The commercial and industrial lending market has seen a relative lack of demand, but with interest rate cuts, more activity could be on the horizon.

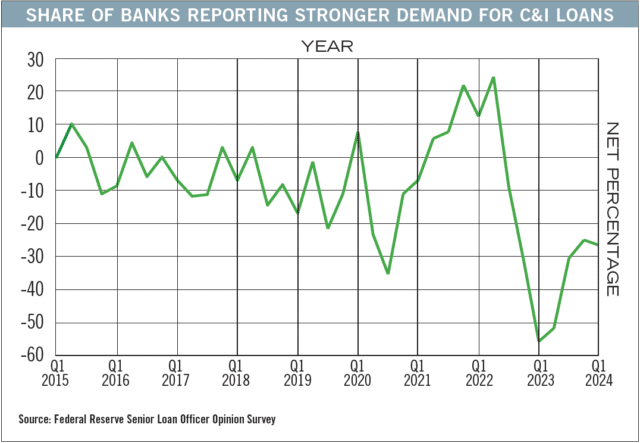

According to data from the Federal Reserve Bank of St. Louis, the net percentage of banks reporting stronger demand for commercial and industrial loans from large and middle-market firms nation-wide has been at or below 0 percent since the fourth quarter of 2022.

Bank executives interviewed for this story said high interest rates over the last two years have helped drive that lack of demand. Consolidation in the wider business community has also reduced the number of firms that need loans in the first place, said Jim Hickson, senior managing director for middle market lending at Berkshire Bank.

“Although every region is different in Massachusetts, the commercial and industrial lending market is very competitive right now,” he said. “There has been a wave of consolidations, as well as merger and acquisition activity, that has resulted in fewer C&I lending opportunities for banks in general. Consolidations in all traditional C&I sectors combined with a rise in service-related industries are driving these changes in the market.”

Search for ‘Sticky’ Deposits

Cambridge Savings Bank Chief Commercial Banking Officer Ian Brandon said that the slowdown hasn’t led to the market being less competitive.

“In conjunction with the fact that when you’re dealing with a C&I loan, you’re really controlling the entire relationship, from the lending component, following through all of the depository relationships – and it could extend further into treasury management so forth,” he said. “They’re certainly coveted.”

In addition, the deposits that banks gain through C&I lending relationships tend to be “sticky,” he said – that is, they’re much slower to leave one bank for an account at a competitor.

This stickiness can make it hard to find new opportunities, said Andreas Kapetanopoulos, NBT Bank regional president for Connecticut. It usually takes dissatisfaction with a particular institution to see a C&I customer switch to a new lender which leaves little opportunity for new origination.

“When it comes to commercial real estate, there is the need for the project to get financed so the banks and the sponsors get together to see what we can put together. With C&I you have long-term relationships whether it’s manufacturers, contractors, other industries and then the commercial side, but there’s long relationships with banks,” he said. “So typically, maybe there’s a dissatisfaction between the borrower and their current lender. There may be a specific need, they may have outgrown the lender’s capacity.”

Graphic by Bill Samatis | Special to Banker & Tradesman

Interest Rates’ Impact

The sluggish demand for C&I lending reported by the St. Louis Fed comes at a time when many community banks and credit unions are turning to C&I to solve a core strategic problem: loan books with too much concentration in commercial real estate for regulators’ tastes.

“We’re seeing a lot of financial institutions wanting to get into C&I currently is [due to] the fact that many institutions here in Massachusetts are so overly weighted in terms of commercial real estate over the past couple years so it’s a way to diversify the portfolio with C&I, the type of relationship that’s there,” said Robert Cashman, president and CEO of Chelsea-based Metro Credit Union.

But with recent interest rate cuts, demand could begin to pick up. The Federal Reserve’s 50-basis-point cut in its benchmark short-term interest rate earlier this month – and senior central bankers’ predictions of more cuts to come over the next few quarters – could serve as a sign to investors that more cuts are on the way and signal to businesses that now is the time to look at growth.

Sam Minton

“As we continue to hopefully see rates drop, it should certainly help businesses continue to move forward with some of their growth plans that they may have put on hold as a result of money moving from what was effectively free for the last 10 years to a point that was certainly not free,” Brandon said. “So, as we hopefully see that the cost of funds start to drop, that should drive additional growth.”

In KeyBank’s latest annual survey of CEOs and CFOs at middle-market companies, 78 percent of respondents said that their outlook on the economy was “very good” to “excellent,” the highest total in years. In addition, 52 percent of the roughly 700 respondents said they are looking at merger & acquisition opportunities in the next 12 to 18 months.

While interest rates play a role in the positive sentiment, Matthew Hummel, KeyBank market president for Connecticut and Massachusetts said that some companies have deferred investments in the last couple years and will be looking to reverse that.

“Equipment wears out, trucks need to be replaced. I think what’s bringing the demand is it’s just people have to defer an investment, [and now] they can’t wait any longer,” he said.