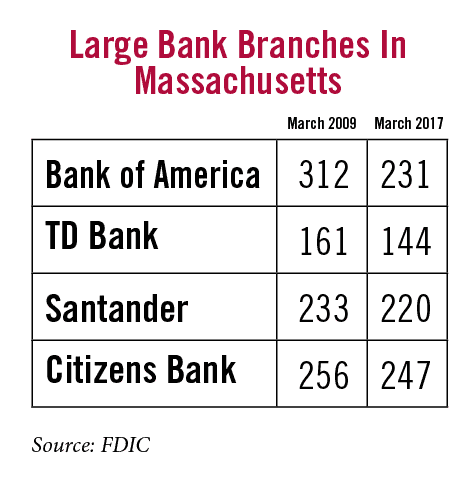

Bank of America has closed more than 70 branch locations in Massachusetts in the past eight years, according to Federal Deposit Insurance Corporation data. During the same time, TD Bank has closed 17 branches; Santander has closed 13 and Citizens has closed nine.

But as large banks have reduced their footprint locally and nationally since the number of bank branches in Massachusetts and the U.S. peaked in 2009, community banks are seizing on the opportunity to increase their physical presence in Massachusetts.

Berkshire Bank has made seven acquisitions since 2005, adding 14 branches in Massachusetts and more than 50 overall since 2009. The most recent acquisition of Commerce Bank, which is still in the works, would give the bank more than $12 billion in assets and make it the largest state-chartered bank in Massachusetts.

Building off a string of recent acquisitions, East Boston Savings Bank earlier this year purchased the failing Meetinghouse Bank, giving it new branches in Dorchester and Roslindale and positioning the bank to move into the Dedham and Milton markets.

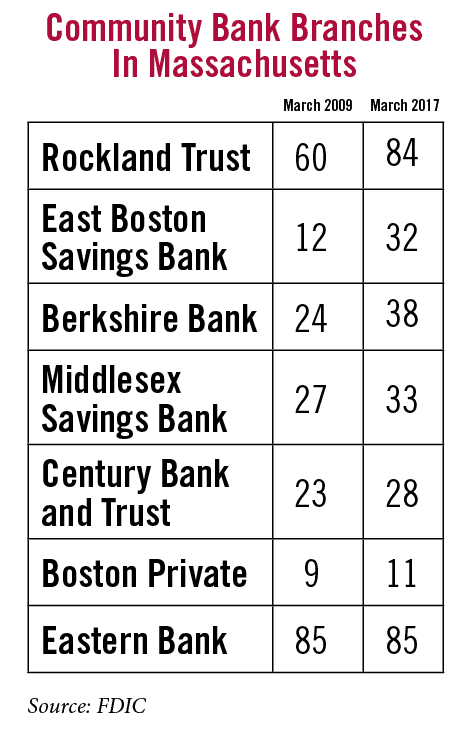

Richard Gavegnano, chairman, president and CEO of Meridian Bancorp, the holding company of EBSB, said the bank has increased its balance sheet 18 percent a year compounded annually since 2007, while increasing its loan portfolio 24 percent. Since 2009, EBSB has grown its branches from 12 to 32.

“For most everybody, if you want to expand your geographic reach, branches are still a terribly important way of doing it,” said Suzanne Moot, a Boston-based banking analyst. “Particularly to the extent at which big banks are increasing the rate they are closing offices, community banks are going to see that as an opportunity.”

The top seven community banks based in Massachusetts have all increased their number of branches between March 2009 and March 2017, according to FDIC data.

Eastern Bank is the only one of the seven largest community banks that maintained the same number of branches in Massachusetts during that time, but it also opened seven new branches in New Hampshire.

The Opportunity

There was a bank branch boom between 1994 and 2009 in the United States, according to FDIC data, that saw the number of branches jump from 81,297 to 99,550.

But most of that boom was attributed to larger banks pushing into new geographies and saturating popular metropolitan areas, said Bob Meara, a banking analyst for Celent, a Boston-based financial services research and consulting firm.

“They never made the same investment in branches,” he said of community banks. “The contraction we are now witnessing and will continue to witness over the next decade will continue to be at the hands of big banks.”

“They never made the same investment in branches,” he said of community banks. “The contraction we are now witnessing and will continue to witness over the next decade will continue to be at the hands of big banks.”

Now community banks, spurred by larger banks shuttering branches, are following the path of those larger banks and increasing their branch locations to add consumers and increase their lending portfolios.

As BofA cut branches nationwide, Berkshire Bank saw an opening and in 2013 acquired 20 of the Charlotte-based company’s retail branches in New York.

According to Tami Gunsch, executive vice president of retail banking at Berkshire Bank, the company was able to pick up more than 90 percent of former BofA customers in those locations.

Acquisitions are easier to grow than de novo branch locations because the deals come with established customers, deposits and loans, she said.

The acquisition of Commerce Bank will provide Berkshire with a physical presence in the Worcester market, uniting its established presences in Springfield and Boston.

Gavegnano said he believes the lucrative Boston and Greater Boston markets are ready for a rejuvenation.

Gavegnano is looking for areas where larger banks are cutting back or where there is a smaller community bank presence, an opportunity for EBSB to swoop in and offer consumers a more personalized experience.

“You walk in and everyone knows your name,” he said. “We are embedded into the community and we have ability to be more nimble [than larger banks] in reacting to customers’ needs in the market. All customers can call me, the CEO and president, and I will answer.”

A Trend With Legs

It’s hard to know in the long term how long this trend will continue.

“For the first time in very, very long time, maybe forever, the future role of the branch is uncertain,” said Moot, who added that anecdotally, she thinks the number of transactions occurring at branches are down in recent years. “It’s not clear how many [branches] we will need.”

Meara said while retail banking is still important to big banks, they are heavily investing in digital technologies.

“Our clients increasingly prefer to do their everyday banking via their mobile device or online,” BofA Spokesperson Trevor Koenig wrote in an email. “As more clients do their traditional banking outside of financial centers, financial centers are increasingly used to address more substantial client needs, like planning for retirement, securing a loan or establishing a banking relationship for their small business.”

“Our clients increasingly prefer to do their everyday banking via their mobile device or online,” BofA Spokesperson Trevor Koenig wrote in an email. “As more clients do their traditional banking outside of financial centers, financial centers are increasingly used to address more substantial client needs, like planning for retirement, securing a loan or establishing a banking relationship for their small business.”

Even community banks have begun to look beyond the traditional branch model.

Gunsch said Berkshire has consolidated 20 branches since 2011, while opening 11 de novo branches built at lower cost or in a more desirable location.

Berkshire’s new Boston office, which opened in February, is powered by new Interactive Teller Machine technology, where live tellers assist customers from a remote location through video chat and touch screen.

But if the future of the branch is headed for demise, it likely won’t occur for “a ways down the road,” said Moot.

Take a recent study conducted by Diebold Nixdorf and Forrester Research conducted at the end of 2016: More than 60 percent of Millennials surveyed cited the number and location of branches as important or very important factors when choosing a bank.

Millennials, the generation banks seem to struggle to engage with the most, ranked these factors as important or very important more than any other age demographic in the study, said Renee Murphy, a senior communications specialist at Diebold Nixdorf.

|

|