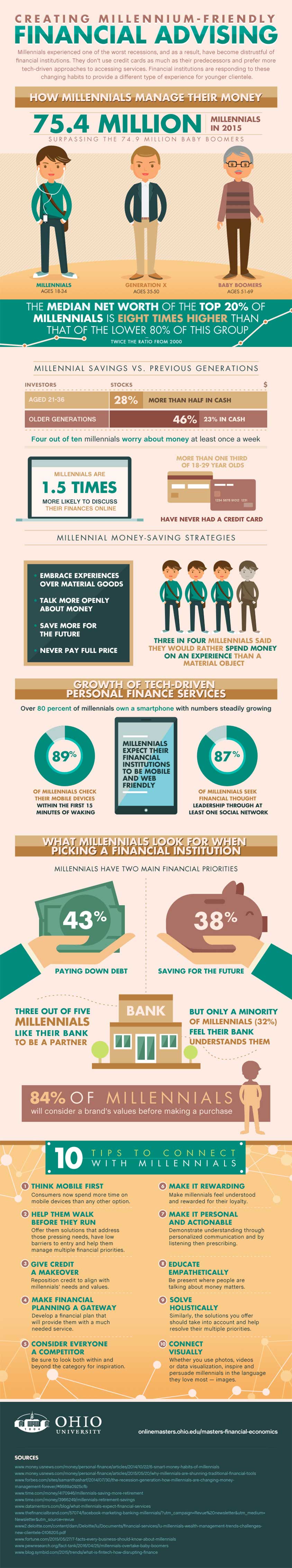

People often need financial advice that’s best suited to meet their needs, which differs from one generation to another. For this reason, you cannot expect Millennials to consume the same financial advice as Baby Boomers. Times have changed, so financial institutions and experts also need to change their approaches to cater to the needs of a younger generation.

A new study conducted by Young Invincibles found that Millennials are earning 20 percent less than Baby Boomers did at the same stage of life, despite being more educated. Though they are earning less, Millennials are actually saving more than half of their income in cash, compared to older generations who only saved 23 percent in cash.

Millennials are also different in the fact that they experienced one of the worst recessions, and as a result, have become distrustful of financial institutions. They don’t even use credit cards as much as their predecessors. In fact, a third of consumers aged between 18 to 29 years old have never had a credit card. Millennials also prefer more tech-driven approaches to accessing services. Research studies have revealed that this generation is 1.5 times more likely to discuss their finances online. At the same time, 87 percent of Millennials seek financial thought leadership through at least one social network. As a result, banks are looking for more ways to serve Millennials and help them reach their financial goals by building partnerships and creating online finance services.

When trying to appeal to this younger generation, it is important to keep in mind that Millennials have two main financial priorities; paying off their student loans, and saving for the future. On average, they spend 43 percent of their income to pay down their debts and put away 38 percent of their income as savings for the future. Three out of five Millennials would like their bank to be a financial partner as opposed to just another business profiting off of their work. At the same time, only 32 percent of this generation feel their bank understands them. This is largely due to the fact that banks and other financial providers still offer solutions to meet the needs of Baby Boomers. This means tailoring products to meet Millennial needs will create a more mutually beneficial relationship and help to attract younger customers.

For more about Millennial saving strategies and 10 tips for connecting with Millennials, check out the infographic below created by Ohio University’s online Master of Financial Economics program.