In Massachusetts’ Gateway Cities, where borrowers’ loan applications may have more blemishes than those seen in the affluent suburbs, credit unions are often in a better position than larger lenders to help those would-be homeowners realize their goals.

Indeed, credit unions have steadily increased their mortgage loan business in Massachusetts’ original Gateway Cities over the past five years, according to data from The Warren Group, publisher of Banker & Tradesman. In Worcester, for instance, credit unions as a group made 72 mortgage loans in 2012 and 147 loans last year. In Lawrence, credit unions made just six residential mortgage loans but increased that to 14 in 2016. And in Fitchburg, credit unions made 101 loans last year, compared with 62 loans in 2012.

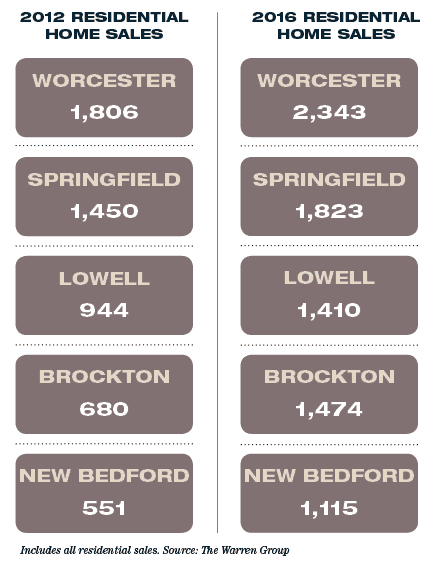

As the number of home sales rises every year, the number of loans in those communities rises as well, but credit unions lenders say their model has the strength and flexibility that is best-suited to borrowers in Gateway communities.

“I think it’s fair to say that a majority of applications that we see have some potential weakness, whether that be in limited funds for the down payment or low to moderate income levels or less than stellar credit,” said Mike Dubuque, vice president of market development at Jeanne D’Arc Credit Union in Lowell.

Connecting members with the right loan package begins the day they open an account, said Caleb Cook, vice president of marketing at Digital Federal Credit Union (DCU).

“We do a full credit report review when they open an account and we offer a free credit report every month,” he said. “Our members can see their credit scores move up and down over time. We tell people with low credit scores that there are only two things that can fix your credit: time and money.”

The credit report reveals weaknesses in the borrower’s financial picture; DCU is able to advise members on ways to improve the picture long before they apply for a mortgage.

“We can run a credit optimizer tool. It runs algorithms and tells members how they can increase their credit about 50 points by doing x, y and z,” Cook said. “To get a conventional mortgage you need at least a 660. That used to be considered really good credit, but today it’s the minimum. You can’t fix your credit overnight, but if you do the right things, it doesn’t take long.”

“We can run a credit optimizer tool. It runs algorithms and tells members how they can increase their credit about 50 points by doing x, y and z,” Cook said. “To get a conventional mortgage you need at least a 660. That used to be considered really good credit, but today it’s the minimum. You can’t fix your credit overnight, but if you do the right things, it doesn’t take long.”

For those borrowers with potential weaknesses, Jeanne D’Arc has access to the Federal Home Loan Bank of Boston’s equity builder program, as well as Fannie and Freddie’s 3 percent down programs. The credit union also teams up with local housing partnerships, like the Merrimack Valley Housing Partnership, that provide additional education and financial assistance. And credit unions, Dubuque said, often have access to lower private mortgage insurance premiums than banks or mortgage companies do.

“We take a more common sense approach to underwriting. It really permeates a culture that promotes every effort to say yes to members. We look to highlight compensating factors when one aspect of an application may pose a challenge,” Dubuque said.

As an example of that, Dubuque discussed one recent case where a mortgage loan applicant had poor credit. Jeanne D’Arc took a closer look at that member’s history and learned that the underlying issue was a years-old medical debt. Since the member had resolved the debt and increased their income, Jeanne D’Arc was able to say yes to that member.

Cook said DCU goes a step further than most institutions, which only offer 3 percent down loans to low-income borrowers, per secondary market requirements. DCU offers a 3 percent down program for buyers regardless of their income – and if the credit union can’t sell the loan, it keeps it in its portfolio.

Many Bay State condominiums, especially those in triple-deckers, don’t meet the secondary market’s criteria for the percentage of owner occupancy or the amount of money in the condo association’s reserve account. But because credit unions and community banks keep some loans in their portfolios, they can be more flexible with those mortgages, Cook said.

A continued focus on recruiting and retaining talented mortgage loan officers will help credit unions continue to offer that high level of service, Dubuque said.

DCU’s loan originators, like those in most credit unions, aren’t paid commissions on the loans they sell borrowers. That helps ensure borrowers are in the right program for them, not the originator, said Cook.

Since credit unions lack the advertising budgets of the big mortgage lenders, one of their biggest challenges is making sure borrowers know they’re in the mortgage game.

“Awareness is a challenge for credit unions as a whole,” Cook said. “We’re a full-service mortgage business. We do mortgages and have more programs than other lenders. We can sell to Fannie and Freddie and have all the conventional programs. Most credit unions leverage their portfolio and don’t necessarily have to follow the secondary market.”

|

|