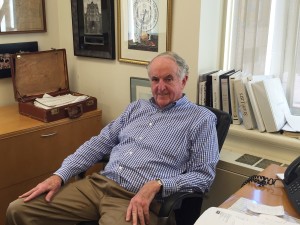

Kevin Phelan

Title: Co-Chairman, Colliers International, Boston

Age: 72

Experience: 50 years

If Kevin Phelan invites you to breakfast, you’ve arrived as a member of Boston’s power elite. The veteran commercial real estate executive founded a morning roundtable where, for nearly four decades, civic leaders have hashed out the issues facing the city. Phelan’s civic engagement played into his selection last month as winner of the 2016 James Landauer/John White Award from The Counselors of Real Estate, a Chicago-based industry group with 1,100 members globally. A former State Street Bank executive, Phelan joined Meredith & Grew in 1978 to create its capital markets group. He was named co-chairman along with Tom Hynes in 2007, a year before Meredith & Grew joined the Colliers organization.

Q: What was your first major real estate assignment?

A: I was with State Street Bank for 12 years right out of college, doing lending including real estate. My real baptism was running the leasing for State Street South down in North Quincy. They threw me down there, sort of sink or swim, and it worked out fine with the help of a lot of people. I had to lease 450,000 square feet out of 750,000. That was the crossing of my career. When I finished that with success, frankly, my heart wasn’t in it, and Tom Hynes came after me to come over here. I started out a new capital markets department, which tied in my two careers, lending and real estate. I’ve been here 39 years.

Q: What’s the most unusual transaction you participated in?

A: Creatively we were involved in raising the equity for the Mandarin Hotel. That was a good news story. A bad news story, we financed a building over at Fort Point Channel which ultimately was condemned before it fell into the channel. It was on Congress Street. Subsequently I think it was demolished and they put in a new foundation and rebuilt on the same site. If you haven’t made a bad loan, you haven’t made a loan, they say.

Q: There’s been a larger-than-normal amount of turnover in Boston commercial real estate brokerages over the past year. Is this still the fallout from the Cushman & Wakefield to Newmark Grubb Knight Frank exodus?

A: I think you’re right on. I think the amount of money that’s being waved around, with front-end signing bonuses, when all is said and done, people are going to look back and say, “I was better off where I was.” Money in pocket you can’t deny, but the hooks that go with it: term obligations, maybe not quite as friendly expense arrangements as you had before, maybe less forgiveness on playing golf twice a week in the summer as opposed to staying at your desk at the new job. I look at it with a critical and somewhat jaundiced eye. Money isn’t everything and sometimes you’ve got to have a life. And I think these new deals that people signed up for, I think it locks them down for five to seven years. But yes, it’s tempting. The Newmark thing started this, but there’s been a lot of turnover and free agency.

Q: What’s the history behind your breakfast group?

A: Thirty-nine years ago, (former Boston Mayor) Kevin White used to come speak to us. Ray Flynn’s been in. Tommy Menino was a member. (City Council President) Michelle Wu is probably our newest member. And (MBTA Chief Administrator) Brian Shortsleeve. As Mayor White once said, it’s the only group in the city that has men and women, black and white, politics, media and business at the same table and it’s off the record. I have a list of about 100 people and we cap every meeting at 32 people because there’s good interaction. You talk about the issues that are relevant to the economy, social issues affecting the city.

Q: How do you put the ideas to work?

A: That’s a good question and here’s the straight-up answer: Good ideas come out of it, but we don’t come out with white papers or conclusions. It’s more of a discussion group where people make their own decisions. I had Brian Shortsleeve from the MBTA in Monday, and Brian McGrory from the Globe is a member. Brian can’t use any of that stuff because it’s off the record. But would any ideas come out of it? Somebody might say, yeah, we ought to extend the line out to Medford or something. But that’s up to smarter or bigger people than we are. Congressman (Seth) Moulton was in two weeks ago and he was very strong on having North and South stations connected with an underground tunnel. He just felt the economy would kind of be linked together. There have been civic things that come out of it.

Q: How long have you belonged to the Counselors of Real Estate?

A: I’ve been in it for 15 years. It’s invitation-only. It sounds very vain, it’s kind of the captains of industry. It’s a trade group and you’re invited in to join and go through a process of interviews, and then they have the annual convention and meeting in Washington with a three-day session of case examples and breakout sessions, talking about issues in real estate right now. I was honored to be selected for the annual award. The category that really honors me is to be thrown into a list of past nominees like Hank Spaulding from Boston and George Lovejoy from my firm. It’s a who’s who and why I got it, I don’t know.

Q: What do you think is the most likely next asset bubble?

A: I would say the biggest risk is condominiums. Not that there are too many. The lead time on building them is a three- or four-year process and you don’t know where the economy’s going to be when you start buying these things. Right now, in Back Bay, Beacon Hill, you’re up to $2,000 or $3,000 a foot. Everybody’s making money. But I can’t tell you what the economy’s like in 2020. If I were starting an apartment I wouldn’t worry, because there’s always going to be demand for rentals and you can move your prices accordingly. We need more office space. We could probably use another hotel.

Q: What question would you like to be asked in an interview? And what’s the answer?

A: “Are you ever going to retire?” And I’d say no. What I always respond to that is, I have a job and I don’t work. I love what I do. I’m here at 5:30 every morning. I wouldn’t give up what I do for all the tea in China. I can do all my civic stuff, and this stuff pays the freight for that.

Phelan’s Top Five Thoughts to Live By:

- Do well by doing good (self-explanatory).

- The best jokes start in the mirror (don’t take yourself too seriously).

- The wallet is tied to the heart (your philanthropy should reflect your values).

- Have a job but don’t work (love what you do).

- Never miss your kid’s games (self-explanatory).