Housing-market observers should know within a few weeks whether Mother Nature has helped play a statistical trick on the real-estate industry.

Early-year data from a number of sources has shown an uptick in sold homes and new listings, suggesting that maybe potential sellers are tired of sitting on the sidelines and have decided to put their homes up for sale this spring after more than a year of holding back.

At the start of the year, The Warren Group, publisher of Banker & Tradesman, reported that Massachusetts single-family home sales in January increased by 0.2 percent, a very small increase and yet the first year-over-year sales increase since 2021.

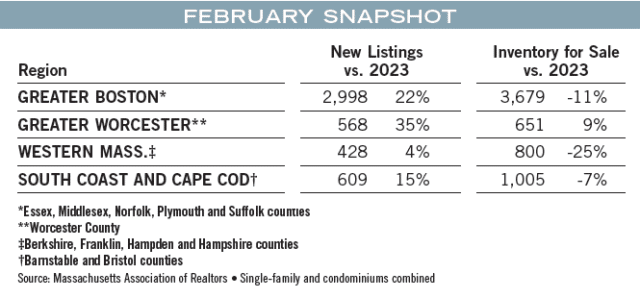

Meanwhile, the Massachusetts Association of Realtors recently reported that new single-family listings were up an impressive 23 percent in February. Redfin and Zillow have reported similar encouraging February and March data on new listings, both in the Boston metro area and across the nation, as Banker & Tradesman has reported.

Combined with anecdotal evidence, such data suggest that maybe, just maybe, the inventory picture is about to change, perhaps leading to a stronger-than-expected spring sales season in 2024.

“We’re moving a little better than we have in the recent past,” said Al Becker, president and COO of Jack Conway Realty, pointing to industry stats showing a jump in new listings heading into April.

Experts Eye Next Three Months

But other real estate observers wonder if the evidence might be a bit misleading.

They note that this past winter was milder than normal – seemingly thanks to climate change – and that the nicer weather may have prompted some sellers to put their homes up for sale earlier than expected this year.

“That may have accounted for the slight winter increase” in first-quarter sales and new-listings data, said Alison Socha, a Realtor and team leader for Leading Edge in Melrose. “We’ll have to see. We have not hit our stride yet in the spring market.”

Socha, the immediate past president of the Greater Boston Association of Realtors, said data from April, May and June will ultimately show if early-year stats were a fluke – or harbinger of things to come.

“There may well be an increase in inventory, but I don’t think it will be anything dramatic,” she said.

Even Becker, who’s a bit more optimistic about the market than other experienced agents and brokers contacted by Banker & Tradesman, said the early-year data may indeed turn out to be outdated and irrelevant to how the market unfolds this spring.

One thing is clear: the demand for homes remains high. And, arguably, demand is increasing compared to spring 2023.

“We’re seeing really great activity from buyers,” Becker said. “It’s not the same as a few years ago, before interest rates went up. But it’s still very strong. It’s certainly outpacing the supply.”

Early-year data from several sources has shown an uptick in sold homes and new listings. But some are skeptical that we could be seeing signs of the market becoming unstuck. iStock illustration

Interest Rate’s Grip Loosened?

Coldwell Banker’s Lee Joseph, the immediate past president of the Realtors Association of Central Massachusetts, agreed demand seems to have increased this year, if only because some buyers are so desperate to find a home, high interest rates be damned.

“They’re not as turned off by higher rates as they were last year,” said Joseph. “I’m seeing a lot of pent-up demand.”

And that leads to another thing that’s very clear to many in the industry: Home prices will continued to rise. The reason: The supply-and-demand equation is still seriously out of whack, thanks to the low supply of homes for sale.

“As soon as new homes come in, they go out,” said Socha. “They’re sold fast.”

So, the spring market – and the entire market for 2024 – all comes down to inventory.

One working theory is that potential sellers, many of them empty-nesters eager to downsize, are tired of sitting on the sidelines and might be more inclined to sell their homes this year, even if mortgage rates remain high and they have to purchase their new, smaller homes at higher rates. In other words: sellers want to move on.

And the desire to sell, as the theory goes, may increase if the Federal Reserve lowers its benchmark short-term interest rates later this year, prompting a corresponding fall in mortgage rates.

“There’s a pent-up desire to sell,” said Becker. “And there’s a value to selling your house now. Demand is very strong.”

Socha agreed that many empty nesters want to sell their larger homes.

“I know of some potential sellers, they say to me. ‘I’m only living in two or three rooms in my house,’” she said.

Skepticism of Sellers on Sidelines

But Joseph, who is based in Worcester, said she’s still skeptical that pent-up eagerness to sell will lead to any significant changes in overall inventory.

“They still have no place to go if they sell,” she said of empty nesters seeking to downsize. “They still need to find a new home to buy – and there’s just not that many out there.”

Joseph said there’s indeed been a 13.4 percent uptick in overall new property listings in Central Massachusetts, from 9,408 in the four-weeks ending March 25 in 2023 to 10,674 for the same period this year. Her data includes all property listings – single-family homes, condos, multi-family units, land, commercial and other properties.

But she said she’s not convinced that a recent one-month jump in listings will translate into substantially more homes for sale this spring.

“There might be a little more momentum to sell, but not by much,” she said.

The ultimate solution to the current, Catch 22-like inventory problem –sellers not wanting to sell because not enough people are selling – is to increase construction of new homes, industry leaders agree.

“We need to create more housing across the entire country – all types of housing,” said Socha.

|

|